Today the IMF announced it was making available to member states more immediate access to emergency lending facilities to help fend off potential liquidity crises. The IMF said the new facilities are intended to “break the chains of contagion” currently gripping EU credit markets and threatening the ability of nations like Italy and Spain to access financing.

The main facility is known as the ‘Precautionary and Liquidity Line,’ replacing the previous ‘Precautionary Credit Line,’ and will be available for maturities of as short as six months and as long as 1-2 years. The facilities will be available to member states with “relatively strong policies and fundamentals,” but seem clearly aimed at assisting countries like Italy, Spain and Hungary. Those countries will be able to borrow up to 5 times the amount of their IMF quotas for six months, which for Italy is about EUR 45 bio and for Spain around EUR 23 bio, or up to 10 times for the 1-2 year period (Italy EUR 90 bio and Spain EUR 46 bio, approximately).

While the amounts are insufficient to address the overall borrowing requirements of Italy, which needs to finance around EUR 350 bio in total during 2012, the facilities may be sufficient to quell fears surrounding smaller economies like Hungary and possibly Spain. Coupled with the impending debut of the EUR 440 bio EFSF, the facilities also represent another source of liquidity previously unavailable to troubled sovereign borrowers.

Markets responded to the IMF announcement with temporary indications of stabilization. The EUR/USD recovered slightly to back above 1.35, while equity markets reversed earlier losses and tested back into the black, suggesting a glimmer of hope in risk sentiment. But the IMF announcement came out just at the close of European government debt markets, which saw Italian and Spanish yields finish out nearer to their highs after the pullback earlier this week. Italian government bond futures, which were open for an hour longer, stabilized following the IMF announcement, but it’s too soon to gauge the bond market’s ultimate reaction.

Given the preponderance of EUR-area pessimism and the attendant heavy short EUR-positioning, we think there is the potential for a short-squeeze higher in EUR and other risk assets in the days ahead on the back of the IMF move and the upcoming Dec. 9 EU summit. While we would look for any rebound in EUR and other risk FX to be temporary, we would urge caution on short-EUR and short-risk positions overall in the short-term. Wednesday will see advance Nov. EU PMI’s along with a slew of US data (durable goods, personal income/spending, weekly jobless claims, and final Michigan sentiment), so data could also be a catalyst to a near-term risk rebound.

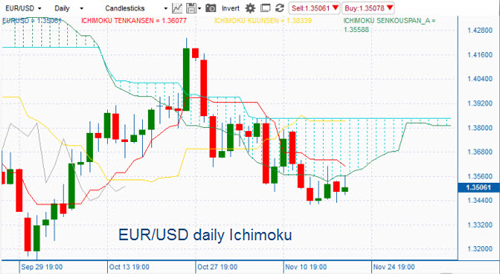

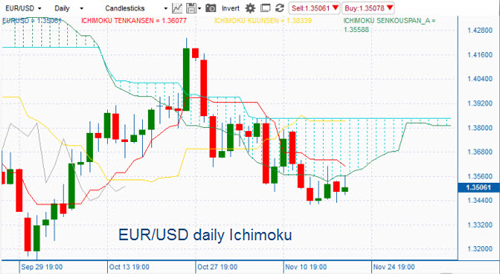

Technically, EUR/USD has formed a potential ‘descending wedge pattern,’ best seen on the 4-hour chart (see below), and this formation typically resolves with a break higher following the primary decline. The top of the wedge is currently at 1.3560/70, coincident with the bottom of the daily Ichimoku cloud and the 200-hr mov. avg. as other sources of resistance. We would also note the multiple failures so far to break below the key support levels in the 1.3400/20 area (bottom of weekly Ichimoku cloud and 76.4% retracement of 1.3145-1.4245 advance), potentially setting up a rebound while that holds. A sustained move above the 1.3560/70 area opens scope higher to the 1.3830/50 area, we think, where the Kijun line and top of the daily cloud are located.

The main facility is known as the ‘Precautionary and Liquidity Line,’ replacing the previous ‘Precautionary Credit Line,’ and will be available for maturities of as short as six months and as long as 1-2 years. The facilities will be available to member states with “relatively strong policies and fundamentals,” but seem clearly aimed at assisting countries like Italy, Spain and Hungary. Those countries will be able to borrow up to 5 times the amount of their IMF quotas for six months, which for Italy is about EUR 45 bio and for Spain around EUR 23 bio, or up to 10 times for the 1-2 year period (Italy EUR 90 bio and Spain EUR 46 bio, approximately).

While the amounts are insufficient to address the overall borrowing requirements of Italy, which needs to finance around EUR 350 bio in total during 2012, the facilities may be sufficient to quell fears surrounding smaller economies like Hungary and possibly Spain. Coupled with the impending debut of the EUR 440 bio EFSF, the facilities also represent another source of liquidity previously unavailable to troubled sovereign borrowers.

Markets responded to the IMF announcement with temporary indications of stabilization. The EUR/USD recovered slightly to back above 1.35, while equity markets reversed earlier losses and tested back into the black, suggesting a glimmer of hope in risk sentiment. But the IMF announcement came out just at the close of European government debt markets, which saw Italian and Spanish yields finish out nearer to their highs after the pullback earlier this week. Italian government bond futures, which were open for an hour longer, stabilized following the IMF announcement, but it’s too soon to gauge the bond market’s ultimate reaction.

Given the preponderance of EUR-area pessimism and the attendant heavy short EUR-positioning, we think there is the potential for a short-squeeze higher in EUR and other risk assets in the days ahead on the back of the IMF move and the upcoming Dec. 9 EU summit. While we would look for any rebound in EUR and other risk FX to be temporary, we would urge caution on short-EUR and short-risk positions overall in the short-term. Wednesday will see advance Nov. EU PMI’s along with a slew of US data (durable goods, personal income/spending, weekly jobless claims, and final Michigan sentiment), so data could also be a catalyst to a near-term risk rebound.

Technically, EUR/USD has formed a potential ‘descending wedge pattern,’ best seen on the 4-hour chart (see below), and this formation typically resolves with a break higher following the primary decline. The top of the wedge is currently at 1.3560/70, coincident with the bottom of the daily Ichimoku cloud and the 200-hr mov. avg. as other sources of resistance. We would also note the multiple failures so far to break below the key support levels in the 1.3400/20 area (bottom of weekly Ichimoku cloud and 76.4% retracement of 1.3145-1.4245 advance), potentially setting up a rebound while that holds. A sustained move above the 1.3560/70 area opens scope higher to the 1.3830/50 area, we think, where the Kijun line and top of the daily cloud are located.