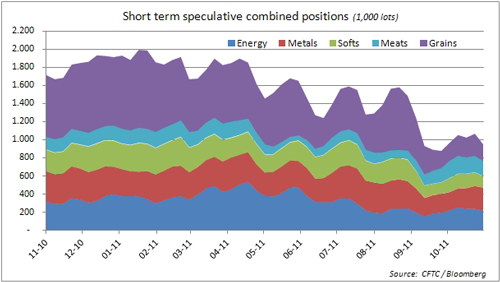

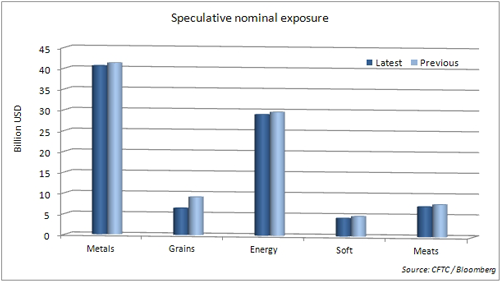

Hedge funds and large investors pulled 5 billion dollars out of commodity futures and options last week. This was the biggest reduction in seven weeks on mounting concerns that the European debt crisis will reduce economic growth and demand for raw materials. In terms of number of contracts this was an 11 percent reduction to 952,000 lots. All sectors apart from metals saw reductions.

Bullish bets on oil rose to a six-month high even before the pipeline reversal was announced which boosted WTI crude further and caused short positions versus Brent crude to be closed. Heating oil rose again ahead of winter with gasoline reduced by the same amount. Speculators increased their shorts in natural gas by one-third to the lowest level in years as the chronic bear market continues amid ample supply and the short-term forecast of milder weather.

The agriculture sector suffered another week of selling with the net long across grains and soybeans falling to 185,000 lots the lowest level since July 2010 and down from a September peak of 700,000 lots. The net position of the soybean complex turned negative for the first time in more than three years while traders continued to add to already negative wheat positions. Corn long exposures dropped by 8 percent but remains the best supported with longs now standing at 221,000 lots.

The metal sector saw a small net increase in long positions. Copper returned to a net short but was offset by increases in gold, silver and platinum.

Speculative longs in soft commodities were trimmed again with sugar longs being cut by a quarter as continued weak price action reduced confidence.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Speculative Positions Cut By 11% As Confidence Saps

Published 11/22/2011, 01:33 PM

Updated 03/19/2019, 04:00 AM

Speculative Positions Cut By 11% As Confidence Saps

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.