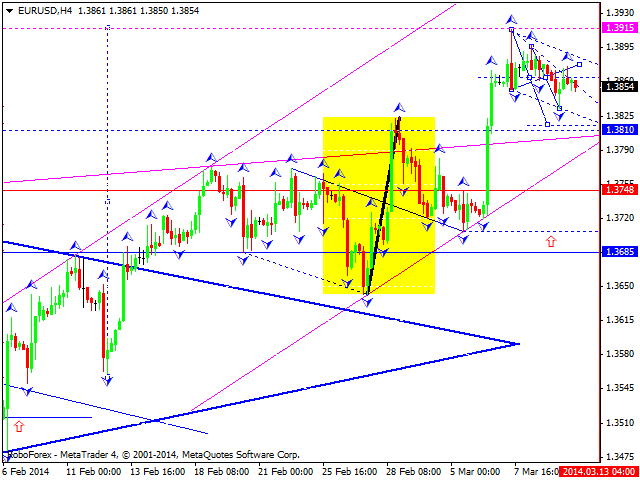

EUR/USD

The euro is being corrected. We think, today the price may reach level of 1.3820 and then form reversal pattern for new ascending movement towards level of 1.3990. EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="452" height="339">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="452" height="339">

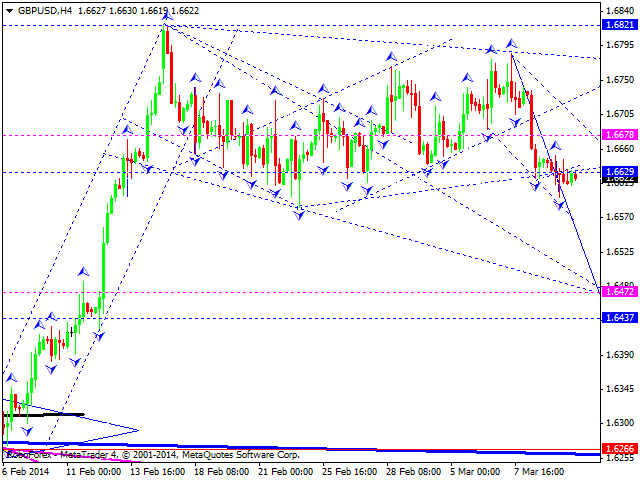

GBP/USD

The pound is moving downwards; the market has formed continuation pattern near level of 1.6630. We think, today the price may reach local level of 1.6470, return to level of 1.6630 to test it from below, and then form the fifth wave of this correction towards level of 1.6440. Later, in our opinion, instrument may continue growing up to reach level of 1.7000. GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="452" height="339">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="452" height="339">

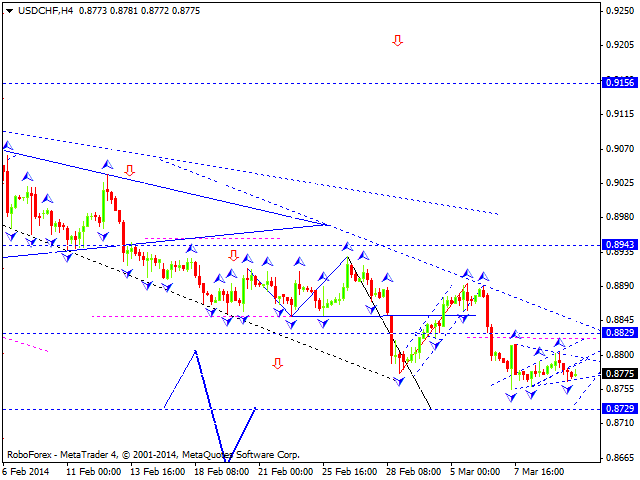

USD/CHF

The franc is still consolidating; the market hasn’t formed any reversal structures yet. We think, today the price may continue falling down towards level of at 0.8730 and then form another consolidation channel to continue forming descending structure. USD/CHF 4 Hour Chart" title="USD/CHF 4 Hour Chart" width="452" height="339">

USD/CHF 4 Hour Chart" title="USD/CHF 4 Hour Chart" width="452" height="339">

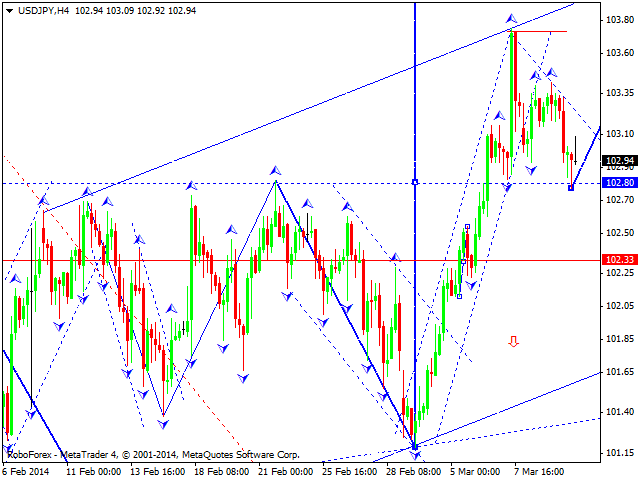

USD/JPY

The yen reached the second target of its ascending pattern. We think, today the price may form reversal pattern to continue forming ascending structure towards level of 104.40. USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="452" height="339">

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="452" height="339">

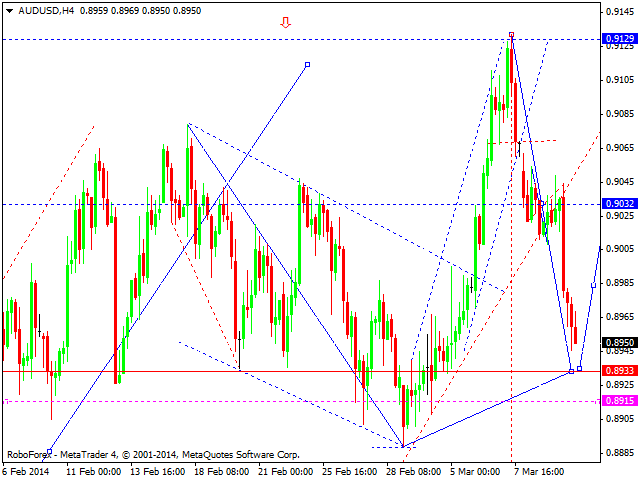

AUD/USD

Australian dollar completed its first descending wave. We think, today the price may reach level of 0.8930 and then return to level of 0.9030, thus forming head & shoulders reversal pattern with target at 0.8770. Later, in our opinion, instrument may continue falling down towards level of 0.8400. AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="452" height="339">

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="452" height="339">

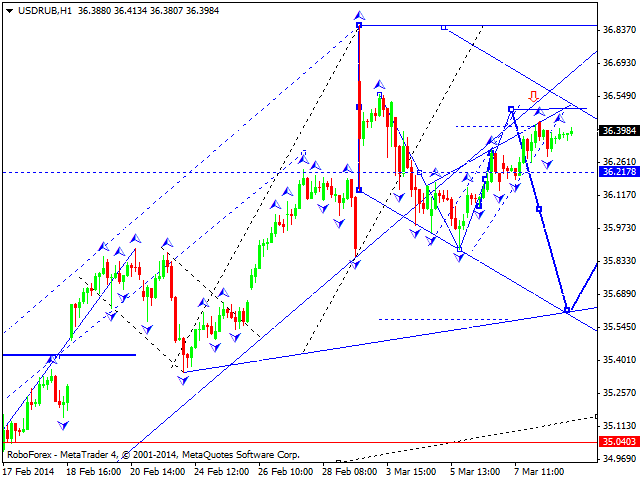

USD/RUB

The ruble continues forming ascending structure. We think, today the price may complete this wave, the fourth one, at level of 36.50 and then start forming the fifth wave with target at level of 35.60. Later, in our opinion, instrument may form reversal structure and continue growing up to reach level of 37.60. USD/RUB Hour Chart" title="USD/RUB Hour Chart" width="452" height="339">

USD/RUB Hour Chart" title="USD/RUB Hour Chart" width="452" height="339">

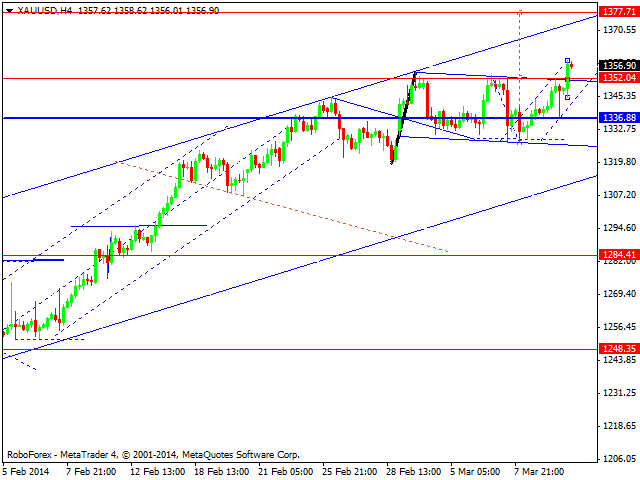

XAU/USD

Gold has broken its consolidation channel upwards; this pattern may be considered as continuation one near level of 1336. Target of this pattern is at level of 1490. Instrument is going to form new correction.

XAU/USD Hour Chart" title="XAU/USD Hour Chart" width="452" height="339">

XAU/USD Hour Chart" title="XAU/USD Hour Chart" width="452" height="339">