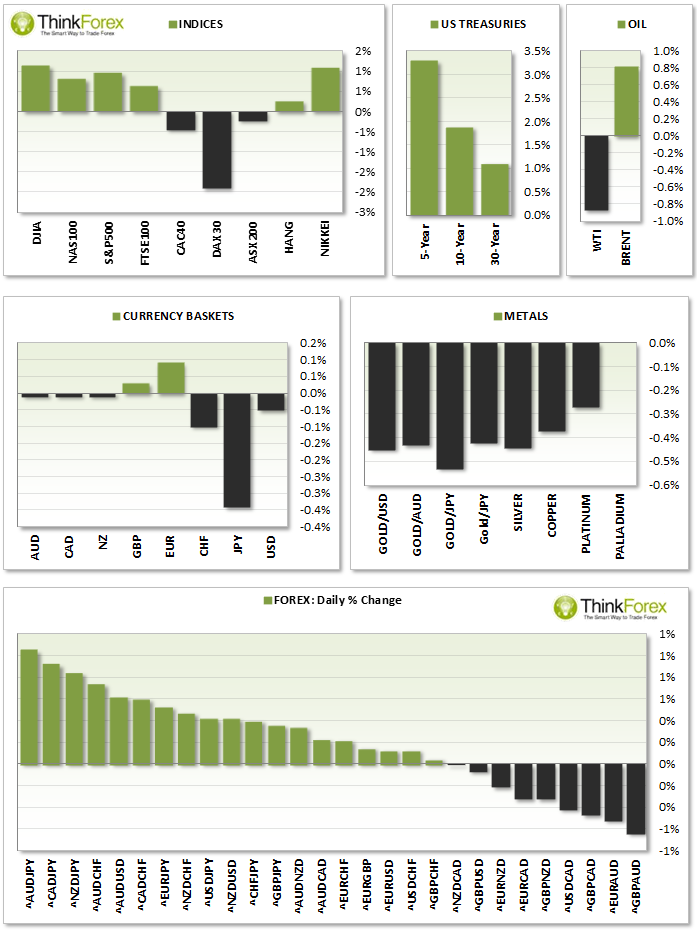

Market Snapshot:

NYLON ROUNDUP (New York - London)

Bond Yields and Equities were up and Gold edged lower from its 6-month highs as tensions from Ukraine were eased and the market is now focussing on Fed Chair Lady Yellen's speech tomorrow.

- USD: The Greenback currently trading near last week's lows around 79.30

- EUR: CPI fell short at 0.7% vs 0.8% expected Euro seemed unaffected and closed higher for a 3rd consecutive session

- GBP: Cable continues to hover above 1.65 support zone

- CHF: The Swissy remains near 2-year lows awaiting further direction from the greenback

- CAD: Technically bullish but within a sideways correction (potential pennant/triangle forming) but holding above 1.104 support

- INDICES: US Equities produced bullish engulfing candles to suggest a pivotal swing low.

- COMMODITIES: Gold produced bearish outside days to suggest a near-term swing high but is now resting on $1366 support; Copper remains below $2.98 resistance and hovers around 4-year lows.

ASIA ROUNDUP

- AUD: AUD/USD remains near yesterday's highs after closing up 0.6% and falling just shy of the 0.910 barrier. The Aussie continued to trade higher against the JPY and NZD during Asia after producing engulfing bars against all 3 pairs. During the RBS policy minutes they stated that the Aussie "remains high by historical standards" but a steady rate would be prudent.

- CNY: Remnimbi trades at 11-month low

- JPY: The Yen continues across the board following an increase in risk appetite

- NZD: Continued to look strong overall and hold above key levels of support.

- INDICES: AUS200 continued to trade higher for a 2nd consecutive day

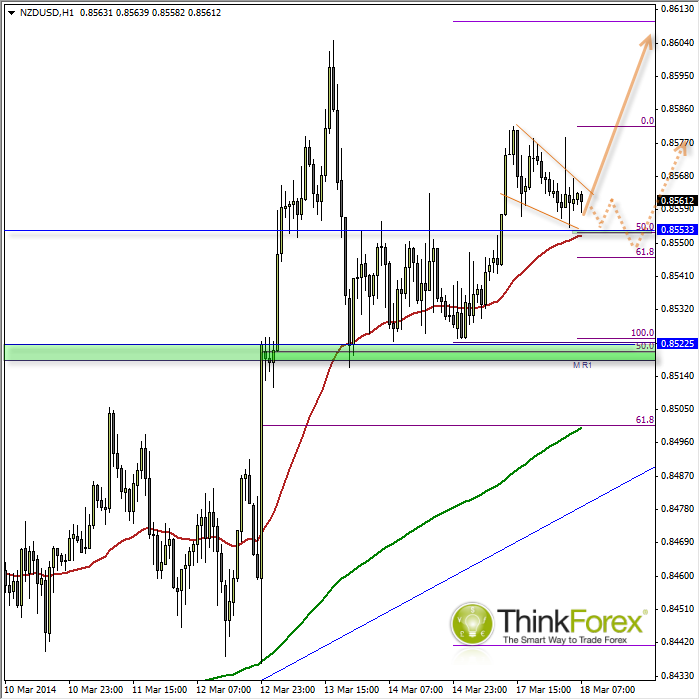

CHARTS OF THE DAY:

NZD/USD: Bullish bias remains with potenial flag formation NZD/USD" title="NZD/USD" height="700" width="700">

NZD/USD" title="NZD/USD" height="700" width="700">

This follows on from yesterday's analysis which, so far, is going our way. We held above the support zone around 0.8520 to break to the upside and have recently respected a new support level of 0.8550-53.

A break below 0.8850-53 invalidates the current bullish bias as we would then be trading back within what I call 'no man’s land'.

However as long as we hold above 0.8850-53 then bullish setups could be considered for a run up towards 0.8580 and 0.8600

NZD/CAD: Consolidating within bullish channel above support NZD/CAD" title="NZD/CAD" height="700" width="700">

NZD/CAD" title="NZD/CAD" height="700" width="700">

Price almost appears to be having a quick snooze prior to the next move. However it is hovering above an interesting confluence of support comprising of the Monthly/Weekly pivots and bullish channel.

In some ways this is very similar to the NZDUSD trade suggested yesterday - it is quite messy to look at now but when/if it does start to move, it will do so very quickly. This makes monitoring it very hard so you have one of 2 ways to approach this setup.

Use stop orders; However the downside to this approach is picking your 'breakout level' as there is nowhere clearly defined

Seek a bullish bar (closed) which firmly rejects the support level, then look to enter live at market.

If course if we see price break beneath the support confluence then this changes the directional bias all together and I would favour a retracement towards the previous support level before seeking bearish setups.

General Advice Disclaimer: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au. The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.