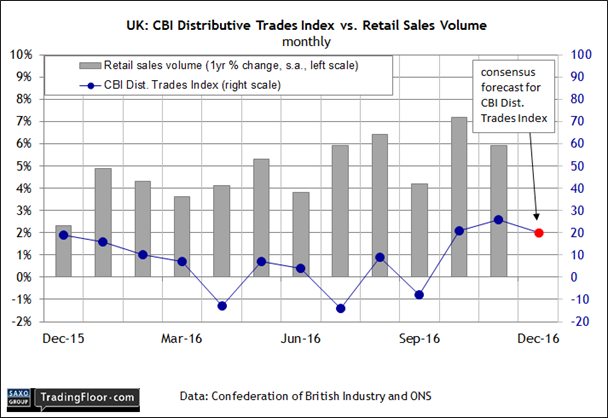

- UK CBI Distributive Trades Index is expected to ease in December

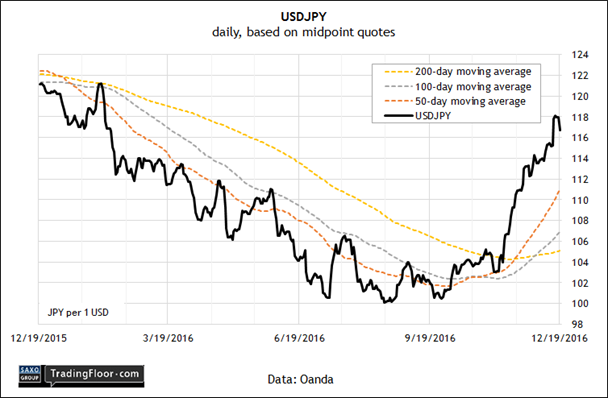

- Whether USD/JPY reaches 120 depends largely on US economic numbers

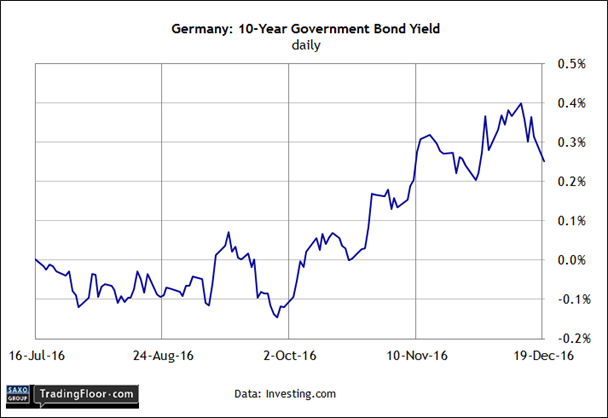

- Upbeat German economy looks to maintain pressure on the 10-year yield

Another slow day for economic news awaits on Tuesday. One exception is the December update for the UK’s CBI Distributive Trades Index, which is widely followed as a proxy for the retail sector.

Meantime, the crowd will be watching USD/JPY, which has been made a sharp U-turn lately, and Germany's upward-trending 10-year yield.

UK: CBI Distributive Trades Index (1100 GMT): Brexit blowback is still lurking, but the UK’s economy continues to defy the worst fears since the June referendum.

The latest GDP estimate from the National Institute of Economic and Social Research (NIESR), for instance, reveals that economic output was stable in November, rising at a moderate 0.4% quarterly rate.

Note, however, that while service sector growth has been strong, thanks to consumer spending, NIESR advised earlier this month that the rest of the economy contracted during the three months through November.

“Looking ahead, we expect consumption growth to slow as inflation picks up due to sterling’s depreciation, eroding real income growth,” a spokesperson for the consultancy said.

Perhaps, although last week’s hard data on retail spending betrayed few signs of weakness. Although the annual growth rate for sales eased to 5.9% in November, analysts generally cheered the result as a sign of strength.

“The retail sector has been in fine fettle since Brexit and, although [the November] figures are not as strong as October’s, there is plenty of reason to believe that shoppers will continue to spend well over the festive period,” said the chief market analyst at Xtrade.

Today’s survey update offers an early test on that outlook via the CBI Distributive Trades Index, which is closely monitored as a proxy for the retail spending.

Today’s report is expected to show the benchmark dipped to 20 this month, based on Econoday.com’s consensus forecast. But that’s still well above the levels posted earlier in the year and the outlook for a softer reading follows November's surge.

The implication: Retail spending’s year-on-year trend will remain positive in the final month of the year, albeit at a modestly lower level against the previous month.

The year ahead may still bring new headwinds for consumer spending, but today’s CBI data appears on track to provide the bulls with more support for thinking positively.

USD/JPY: The Japanese yen has staged a remarkable reversal over the past month, posting a new bout of weakness against the US dollar.

The question is whether the trend will push USD/JPY closer to the 120 mark in the weeks ahead?

A key part of the answer will likely be found in the upcoming economic numbers for the US.

If the data continues to point to growth, the news will keep pressure on the yen, in part by convincing the crowd that the Federal Reserve will continue to raise rates in 2017.

Meantime, the technical profile for USD/JPY suggests that the yen will continue to weaken.

With short moving averages climbing well above their long-dated counterparts recently, the yen will have a hard time breaking free of the trend without new evidence that the US economy is stumbling.

Otherwise, even modestly upbeat US numbers will probably keep the pressure on the yen for the foreseeable future.

Germany: 10-Year Bond Yield: Europe’s main economy appears to be picking up speed in the final quarter of the year.

The latest clue: the Ifo Business Climate Index, which climbed more than expected in December.

“The business outlook for the first half of 2017 is also slightly more optimistic,” said the president of the Ifo Institute yesterday.

The upbeat outlook still awaits confirmation in the hard data, but for the moment the mood is brighter.

In theory, a pick-up in economic activity is bad news for bonds. In fact, we’ve already seen Germany’s benchmark 10-year yield rise sharply in recent months.

But further yield increases could be limited due to ongoing anxiety about any number of Eurozone issues, including upcoming elections that may bring Eurosceptic governments to power.

Based on the revised economic outlook for Germany, however, there's a marginally stronger case for selling bonds (and thereby raising rates).

Disclosure: Originally published at Saxo Bank TradingFloor.com