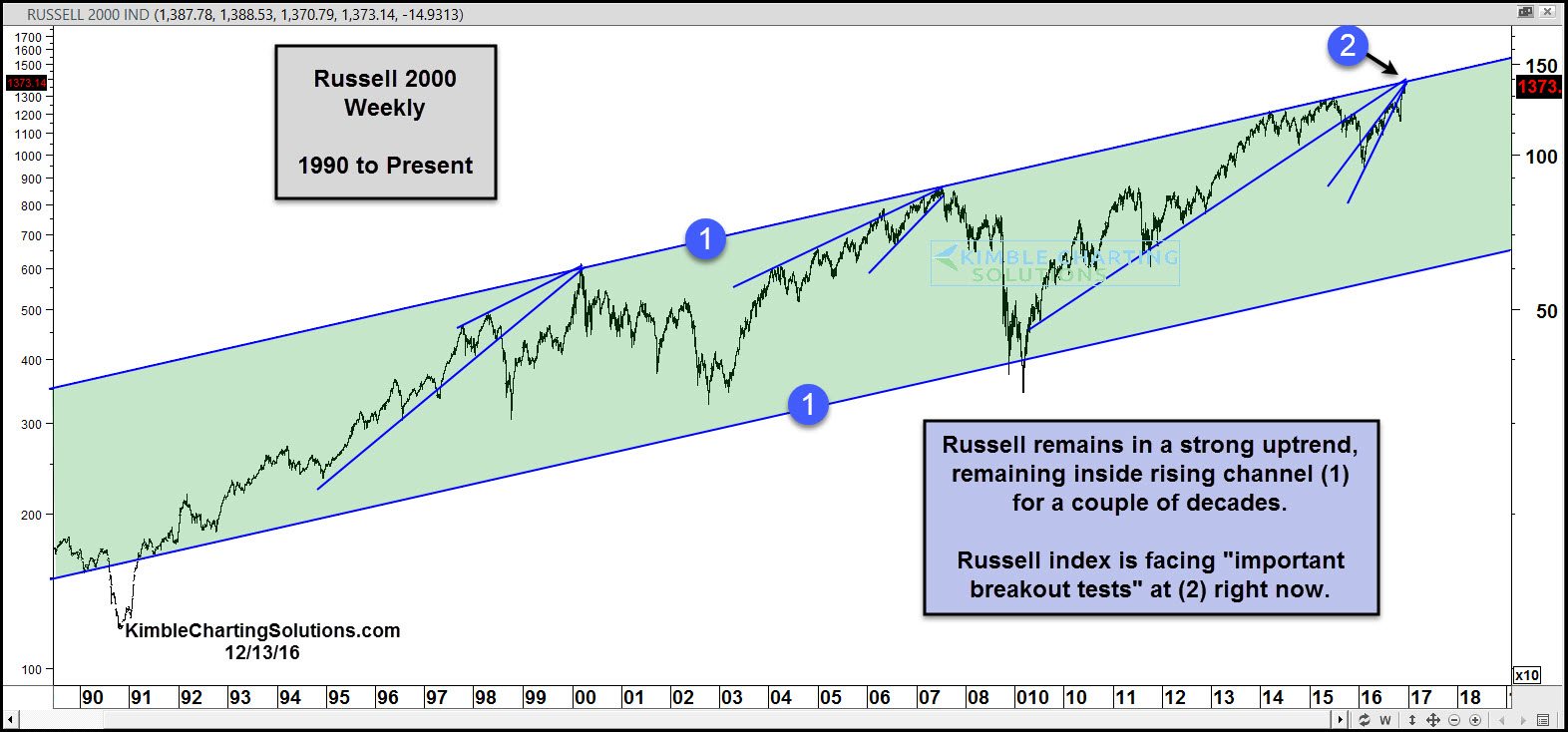

Small caps, in the long term, have done very well over the past 25 years. Below looks at the Russell 2000 since 1990.

Small caps have rallied big time inside of rising channel (1). Right now, they're trying to break above the top of the rising channel at (2).

If small caps can breakout, it would be a positive price event, which it was unable to do back in 1999 and 2007, when presented with the same opportunity.

What happens at (2) will send an important message to small- and large-caps going forward. Keep your eye on the breakout level, as this breakout test is very important for the risk-on trade in stocks.