- Mixed report for Germany’s economy expected in ZEW survey data for August

- US housing starts projected to tick lower in July

- US industrial output on track to increase for the second straight month in July

Tuesday brings a moderately busy day for new economic numbers, including ZEW’s release of August sentiment data for Germany. Later, two US reports for July will dominate the headlines: housing starts and industrial production.

With the Brexit blowback appearing less severe than expected, economists are projecting a rebound in Germany's expectations data this month. Photo: iStock

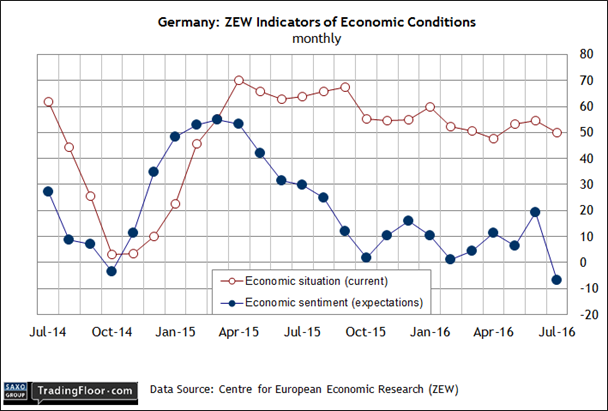

Germany: ZEW Economic Survey (0900 GMT) The Eurozone’s sluggish growth rate appears to be slowing even further, based on Now-casting.com’s revised estimate for third-quarter GDP. The consultancy projects that economic activity will slow to 0.22% in Q3 from 0.3% in Q2 (quarter-over-quarter rate). If the outlook is confirmed, the euro area’s macro trend will decelerate to the slowest pace in two years.

It’s still early for deciding how Q3 will shape up, of course. As usual, a substantial slice of the trend will be linked to Germany’s performance. On that front, today’s ZEW survey data will offer an early look at the August profile for Europe’s biggest economy.

The main focus is on the expectations data, which fell sharply in July, settling at the lowest reading in nearly four years. The ZEW’s president blamed the weakness on Brexit. “Uncertainty about the vote’s consequences for the German economy is largely responsible for the substantial decline in economic sentiment,” he said last month.

A month later, the Brexit blowback for Europe looks less severe based on a variety of indicators, which implies that today’s ZEW data for August will rebound. In fact, that’s what Econoday.com’s consensus forecast sees for the expectations index. Economists are looking for a rise to 4.0 for this month vs. minus 6.8 in July. But note that the estimate for the current situation data is projected to dip again.

The main takeaway, based on the forecasts: Brexit risk is lower than initially expected, but the downside bias for Eurozone growth is still lurking.

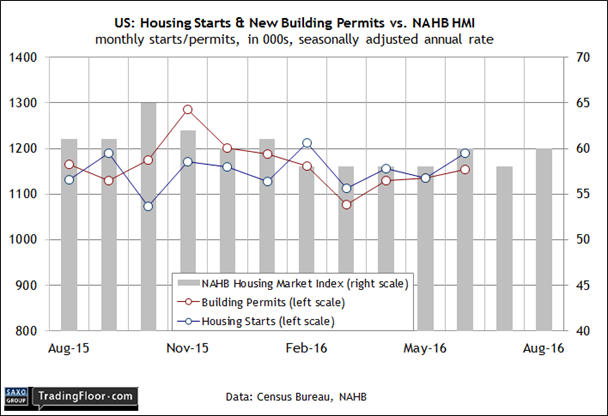

US: Housing Starts (1230 GMT) The housing market may not be delivering impressive numbers these days, but it’s doing fine in terms of maintaining a modest degree of forward momentum.

Yesterday’s update on sentiment in the home-building industry tells the story. The Housing Market Index ticked up to 60 in August, matching June’s reading for the highest level since January. “New construction and new home sales are on the rise in most areas of the country, and this is helping to boost builder sentiment,” said the chairman of the National Association of Home Builders, the group that publishes the data.

The positive spin on sentiment implies that we could see an improvement in today’s report on housing construction in July. But economists are downplaying the odds with a consensus forecast via Econoday.com that projects a slight dip to 1.180 million units (seasonally adjusted annual rate).

Note, however, that the crowd’s looking for a slightly higher number of newly issued building permits for July. If the projection for permits holds, this leading indicator for residential construction will inch up to an annualised 1.160 million units, the highest since March.

Overall, the outlook suggests more of the same: a modest expansion that’s impressive only in the sense that it's strong enough to fend off a decline.

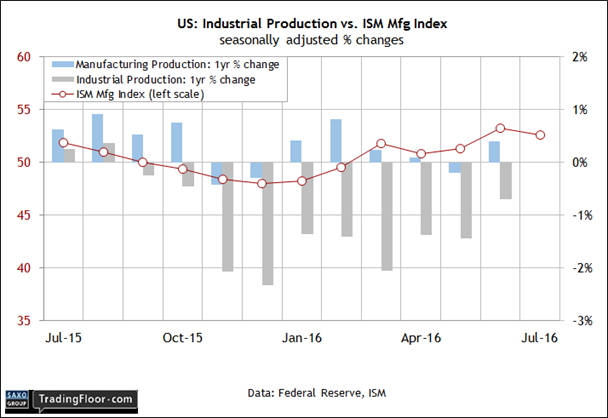

US: Industrial Production (1315 GMT) Yesterday’s disappointing August update for the New York Fed’s manufacturing index cut expectations down a notch for expecting a rebound in this sector. Instead of posting its third straight positive reading, as analysts expected, this regional benchmark fell back into negative territory.

“Overall we think manufacturing is now expanding slowly, but no boom is in prospect,” advised the chief economist at Pantheon Macroeconomics via MarketWatch.com.

Today’s monthly report on industrial activity for the US in July, however, is expected to deliver a minor milestone for the monthly comparison: the second consecutive increase in output. Another rise would mark the first time since late 2014 that this indicator has posted back-to-back gains.

Econoday.com’s consensus forecast calls for a 0.3% monthly rise in output. That translates into a projected 1.0% year-over-year decline, although that would be the smallest annual slide since last November.

In other words, industrial sector is set to show that the slump over the past year or so is easing. A bonafide recovery may be a debatable point, but if today’s data matches expectations it’ll be easier to assume that this battered corner of the US economy will post more encouraging numbers in the months ahead.

Disclosure: Originally published at Saxo Bank TradingFloor.com