The USD/JPY closed last week below 106.30 which is a very important level considering the rally from the 100.530 level from last week. the 106.30 was... is our bul bear zone because not only it has been a zone of high volume but it also is a structure level that has been tested strongly in the past. Having said that the USD/JPY has been in a very clean down channel for quite a while and it has been testing and breaking levels very cleanly too.

The expectation of more easing coming out of the BoJ weakend the Yen but Governor Kuroda put a stop to helicopter money (thank god) at the end of last week which stopped this rally right a a very important techncal point: 161.8% extensions from the last leg down, 61.8% of the 111.09-98.90 move and the 38.2%of the entire move to the down side (white channel).

What we see here is sellers stepping in on a technical level, buyers closing theirs longs on technicals too and fundamentally speaking the USD/JPY erasing some of the gains of the last 743 rally. We are bearish on the Yen so we are looking to buy the USD/JPY on this dip. The levels to look for next week:

- 103.230 / 61.8% / 1272% area of support

- 100.530 lows of the move

We need to take into consideration the heavy US data week ahead, which can bring the desire bullishness to this currency pair. Not only we have the the Markit PMI, new home sales and consumer confidence on Tuesday but we have the monetary policy statement and the interest rate decision, which means that the USD/JPY has 2 days to drop 288 pips to that sweet spot before the upcoming US data / US Dollar starts to drive price.

A rate hike by the fed is unlikely at this meeting and the monetary policy is likely to be maintained.

Kuroda on saturday:

“We have said we will check risks in the economy and prices and expand monetary stimulus if it’s needed to achieve our price stability target at the earliest time possible”

“If the words ‘helicopter money’ mean the direct underwriting of government debt or managing fiscal and monetary policy as one consolidated measure, that is forbidden in developed nations -- including Japan -- from the lessons of history”

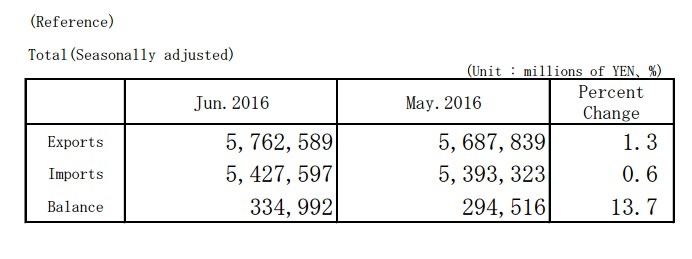

Japan´s Trade Balance