Trading Themes: The US dollar edged higher over a quiet data week boosted by comments Boston Fed President Rosengren, who is generally seen as being part of the Dovish Fed spectrum, noting that the market is under-pricing the US rate path this year. USD was leant further support on Friday as the latest Retail Sales data printed strongly above expectations followed by an equally impressive Michigan Confidence survey. Traders now look ahead to April CPI due on Tuesday with bulls hoping for further positive support.

EUR: Final EuroZone inflation data for April is the key domestic data focus this week.

GBP: BOE sound the alarms over Brexit, keeping pressure on Sterling. CPI data dues this week alongside earnings and employment data also.

JPY: Japanese Fin Min Aso warns again of possible intervention if JPY strength persists.

CHF: A lack of EUR downside keeps the pressure off the SNB for now.

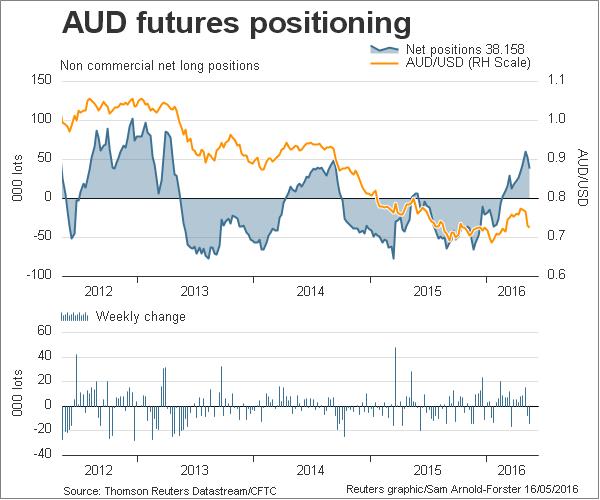

AUD: AUD remains under pressure following RBA rate cut and now weighed upon further by weak China data. Domestic unemployment rate due later this week.

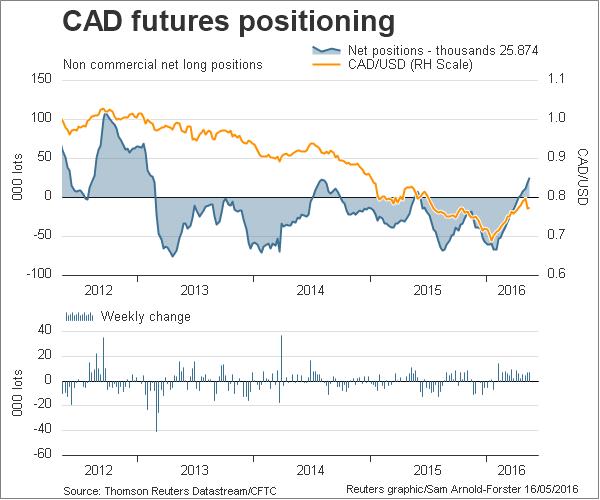

CAD: Boosted by stronger Oil prices. Traders now look ahead to CPI data on Friday.

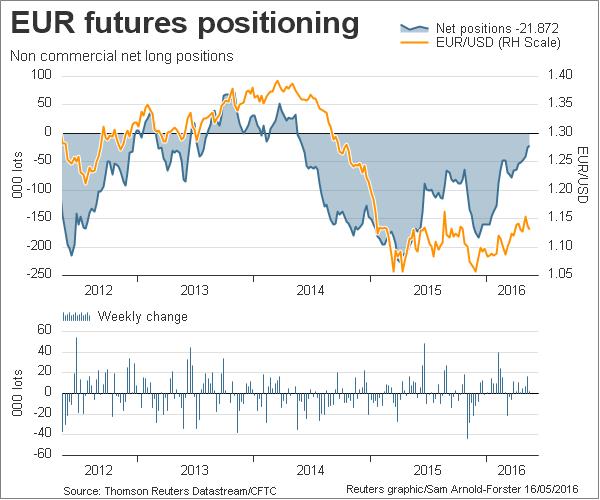

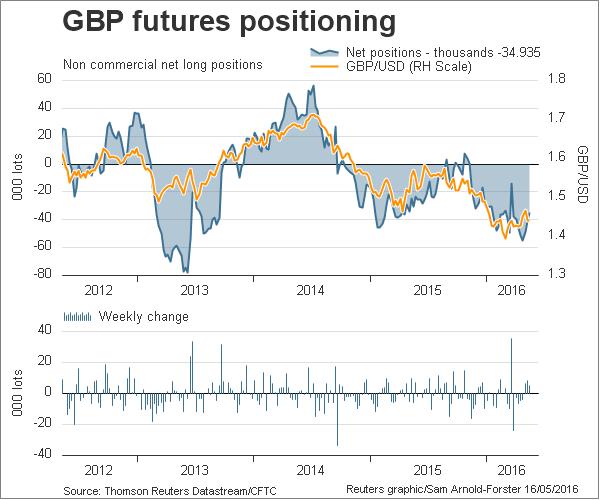

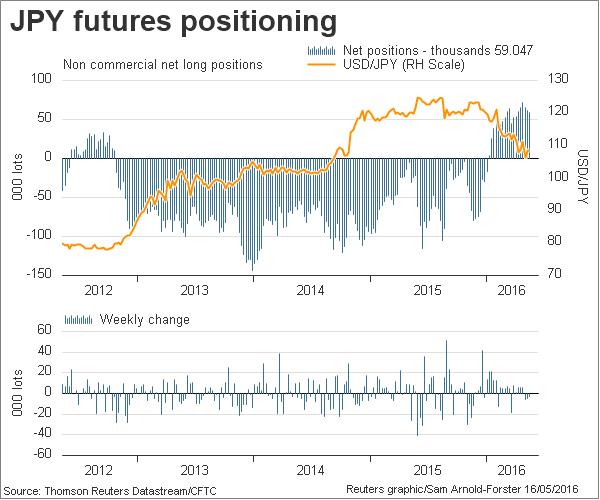

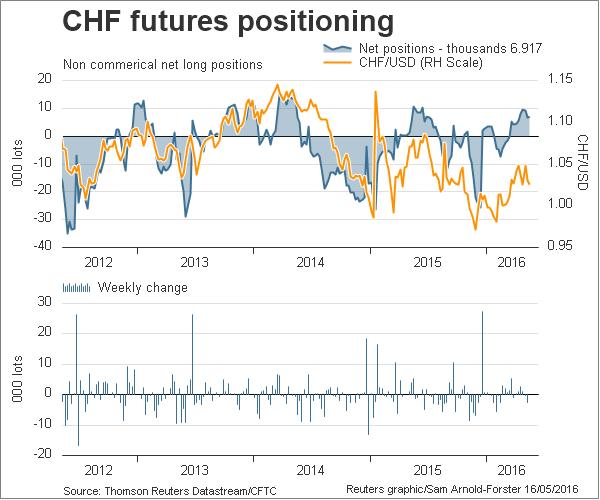

Let’s take a look at what the latest COT report data is showing us from a trend and net change week over a week perspective…

- EUR bearish, flat on the week

- GBP bearish, increased on the week

- JPY bullish, increased on the week

- CHF bullish, increased on the week

- AUD bullish, decreased on the week

- CAD bullish, flat on the week

EUR/USD Outlook – Bearish

Latest official commentary notes that the ECB is monitoring property prices for risk of asset bubbles stemming from its quantitative easing program, according to Governing Council member Ewald Nowotny’s comments in Vienna. He also stated that the ECB doesn’t have exchange rate goal nor does it have means to influence currency. Key domestic data focus this week will be on EuroZone CCPI due on Wednesday.

COT Indicators

- Index active buy signal consolidates

- Strength active sell signal strengthens

- Momentum buy consolidates

LFOrder Flow Trader Bearish

GBP/USD Outlook – Bearish

Sterling was under pressure over the week firstly from a raft of data weakness which shows UK Factory Output having fallen to its lowest levels since 2013, followed by a Dovish Bank of England who kept rates unchanged but sounded the alarm bells over Brexit risk. ECPI on Tuesday will be key domestic data focus this week alongside earnings and employment data on Wednesday.

COT Indicators

- Index sell signal strengthens

- Strength sell signal strengthens

- Momentum buy signal given

LFOrder Flow Trader Bullish

USD/JPY Outlook – Bullish

The Japanese Yen softened over the week with moves fuelled mainly by a recovery in risk appetite, which saw JPY safe-haven demand diminished, but also by comments from Japanese Financial Minister Taro Aso who said that the BOJ is ready to intervene in the currency market if JPY moves are volatile enough to hurt the country’s trade and economy. GDP data on Wednesday will be key domestic data focus.

COT Indicators

- Strength active sell signal, ticks down

- Index active sell signal ticks down

- Momentum flat, awaiting new signal

LFOrder Flow Trader Bullish

USD/CHF Outlook – Bullish

With EUR having moved counter-intuitively higher in response to the latest ECB measures, it seems some pressure has likely been alleviated from the SNB who refrained from moving on rates at their recent meeting. Worth noting however that recently SNB’s Jordan has warned of a “nuclear” option in the event of continued CHF appreciation stating that the SNB can cut the exemption from negative deposit rates that it extended to most domestic banks’ reserves. The latest CPI data for Switzerland showed that inflation grew 0.3% MoM as expected, adding support for the Swiss Franc.

COT Indicators

- Strength active sell signal consolidates

- Index active sell signal consolidates

- Momentum active sell signal consolidates

LFOrder Flow Trader Bearish

AUD/USD – Outlook Bullish

The Australian Dollar continued to slide lower this week extending losses seen on the back of the RBA’s first rate cut of 2016 which also saw the bank lowering its inflation forecasts. The latest labour market data also added pressure as Australian job advertisements eased in April, providing further signs demand for labour had peaked after the strong run in 2015. Unemployment rate on Thursday will be the key domestic data focus for the week.

COT Indicators

- Strength active buy signal ticks down

- Index active buy signal ticks up

- Momentum sell signal given

LFOrder Flow Trader Bullish

USD/CAD Outlook – Bullish

The Canadian Dollar recovered recent losses this week driven by a fresh turn higher in Oil which was boosted by comments from the International Energy Agency who said that they expect Oil supply to dramatically reduce in H2 this year driven by strong demand and falling supply owing to recent production outages around the globe. Retail Sales and CPI on Friday will be the key domestic data focus of the week.

COT Indicators

- Strength sell signal ticks lower

- Index active sell signal remains at lows

- Momentum signal turns flat, await new signal

LFOrder Flow Trader Bullish