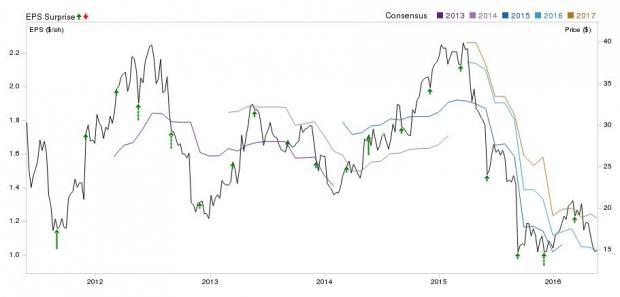

Zumiez, Inc. (NASDAQ:ZUMZ) is slated to release first-quarter fiscal 2016 results on Jun 2. Last quarter, the company had delivered a positive earnings surprise of 8.2%. In fact, it has outperformed the Zacks Consensus Estimate by an average of 8.1% over the trailing four quarters. Let’s see how things are shaping up for this announcement.

Factors Influencing this Quarter

Though Zumiez’s earnings history depicts a positive picture, the company has been posting negative comparable-store sales for thirteen straight months now. The primary reason for the continued sales decline is the slowdown in traffic and the absence of defined fashion trends. Additionally, the company is battling headwinds like foreign exchange volatility that has been affecting its business in borders and tourist spots.

Given its sluggish performance in the first quarter, the company expects to report loss per share at or slightly below the lower end of its previous guidance. The company had earlier projected first-quarter fiscal 2016 loss per share in the range of 7−11 cents.

Earnings Whispers

Our proven model does not conclusively show that Zumiez is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1, 2 or 3 for this to happen. This is not the case here, as you will see below:

Zacks ESP: Earnings ESP for Zumiez is currently pegged at 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 12 cents per share.

Zacks Rank: Zumiez carries a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Nike Inc. (NYSE:NKE) , expected to report earnings on Jun 23, has an Earnings ESP of +2.08% and a Zacks Rank #3 (Hold).

Carnival (LON:CCL) Corp. (NYSE:CCL) , expected to report earnings on Jun 28, has an Earnings ESP of +5.26% and a Zacks Rank #3.

Darden Restaurants Inc. (NYSE:DRI) , expected to report earnings on Jun 28, has an Earnings ESP of +0.93% and a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

CARNIVAL CORP (CCL): Free Stock Analysis Report

ZUMIEZ INC (ZUMZ): Free Stock Analysis Report

DARDEN RESTRNT (DRI): Free Stock Analysis Report

NIKE INC-B (NKE): Free Stock Analysis Report

Original post

Zacks Investment Research