Upstream energy firm, Cabot Oil & Gas Corporation (NYSE:COG) is set to report third-quarter 2016 results on Oct 28, before the market opens.

In the last four quarters, Cabot posted an average negative earnings surprise of 5.13%. The underperformance stemmed from weakness in the oil and gas prices.

Let’s see how things are shaping up for this announcement.

Factors to Consider This Quarter

Cabot Oil & Gas Corp.'s diversified asset portfolio is spread between low-risk/long reserve-life Appalachian assets and large-volume/rapid-payout Gulf Coast properties. It also holds a variety of large prospect inventories in the Rocky Mountains and the Anadarko Basin that have a broad mix of production and payout profiles. The company’s exposure to these high quality assets helps it to achieve industry leading rates of return. These factors should bode well for the upcoming earnings too.

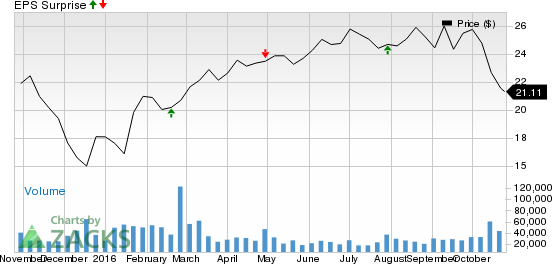

CABOT OIL & GAS Price and EPS Surprise

Cabot boasts a conservative balance sheet with $500 million of cash on hand and a manageable leverage of less than 35%. This provides the company ample flexibility to make acquisitions as well as grow internally. We also appreciate the company’s ongoing cost-control measures.

However, Cabot is a natural gas dominated exploration firm with high exposure to commodity prices. As a result, the company’s earnings and cash flows are likely to be adversely affected by the persistent crude price weakness.

Also, Cabot has set its 2016 capital budget at $345 million, down significantly from the year-ago spending level of around $775 million. This might negatively affect production and cash flows of the company.

Earnings Whispers

Our proven model does not conclusively show that Cabot will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP:Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 4 cents. Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

Zacks Rank: Cabot has a Zacks Rank #3. Though a favorable Zacks Rank increases the predictive power of ESP, a 0.00% ESP makes surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Rank #4 and 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Although an earning beat looks uncertain for Cabot, here are some firms that you may want to consider on the basis of our model, which shows that they have the right combination of elements to post an earnings beat this quarter.

CONE Midstream Partners LP (NYSE:CNNX) is expected to release earnings results on Nov 4. The partnership has an Earnings ESP of +2.70% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

CSI Compressco LP (NASDAQ:CCLP) has an Earnings ESP of +27.27% and a Zacks Rank #3. The company is anticipated to release earnings on Nov 4.

Antero Midstream Partners LP (NYSE:AM) has an Earnings ESP of +8.82% and a Zacks Rank #2. The company is likely to release earnings on Oct 26.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

ANTERO MIDSTRM (AM): Free Stock Analysis Report

CONE MIDSTREAM (CNNX): Free Stock Analysis Report

CABOT OIL & GAS (COG): Free Stock Analysis Report

CSI COMPRESSCO (CCLP): Free Stock Analysis Report

Original post

Zacks Investment Research