Market Brief

The pound sterling rose 0.20% during the Asian session after George Osborne, Chancellor of the Exchequer, unveiled his plans to cut the corporate tax rate to 15% over the coming years. The plan is aimed at increasing incentives to invest in the UK. The current UK tax rate is 20%, but this should reach 17% by 2020.

The pound sterling tested 1.3308 on Monday morning before easing slightly to 1.3290. On the downside, the closest support lies at 1.3206 (low from June 30th), then 1.3121 (low from June 27th). On the upside, it is wide open to 1.3534 (high from June 29th), then 1.3846 (Fibonacci 38.2% on June’s debasement).

The Australian dollar fell strongly at the opening after the elections held on Saturday revealed the possibility of another hung parliament. For now, the Liberal-National coalition has been unable to secure the 76 seats required at the House of Representative for a majority government. The prospect of a minority government is raising concerns about the ability of the new government to contain the budget deficit.

Australian sovereign bond yields rose across the curve this morning, with the 2-year rate hitting 1.629%, while 5-year yields tested 1.677%, suggesting that another three years of weak political strength will increase the risk of a credit rating downgrade - Australia may indeed lose its AAA credit rating.

The Australian dollar opened 50 pips lower on Monday before bouncing back to 0.7513, boosted by the strong yield recovery. Australian equities were about to end in green for a fifth straight session, up 0.67%, on the prospect of the increasing likelihood of further easing from the central bank amid the temporary results.

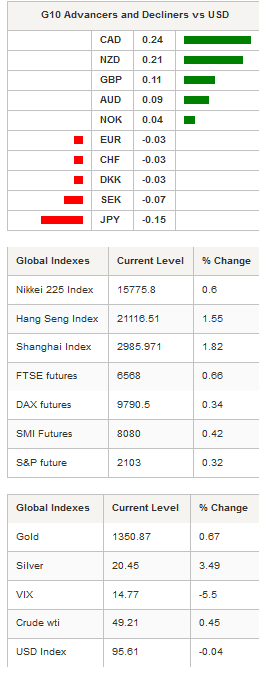

Silver continued its mad run, surging more than 3% to $20.38 during the Asian session, as speculators jumped into long silver positions. Long, non-commercial positioning reached 50% of total open interest (CFTC commitments on June 28th), suggesting that the odds of a correction have increased substantially.

Since the beginning of the year, silver has risen almost 50% against the backdrop of a worsening global outlook. Gold has also continued to gain ground, rising 0.70% to $1,350.80 an ounce on Monday. The yellow metal surged almost 30% since January.

EUR/USD traded sideways in Tokyo, remaining within the 1.1120 - 1.1144 range as investors await this week’s key data from the US (NFP, durable goods orders, unemployment rate, June FOMC minutes). A support can be found at 1.1024 (low from June 30th), while on the upside a resistance lies at 1.1169 (high from July 1st).

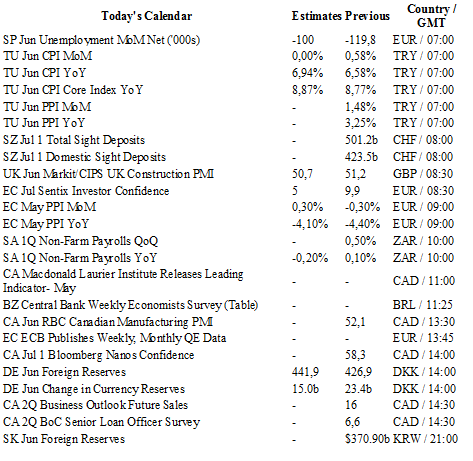

Today traders will be watching sight deposits from the SNB; manufacturing PMI from Canada; CPI from Turkey; unemployment from Spain.

Currency Technicals

EUR/USD

R 2: 1.1479

R 1: 1.1428

CURRENT: 1.1131

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3535

CURRENT: 1.3287

S 1: 1.3121

S 2: 1.3045

USD/JPY

R 2: 111.91

R 1: 106.84

CURRENT: 102.73

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9740

S 1: 0.9522

S 2: 0.9444