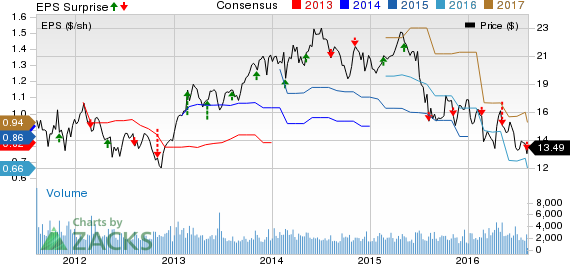

Calgon Carbon (NYSE:CCC) logged a profit of $7.9 million or 15 cents per share in second-quarter 2016, roughly a 37.3% drop from $12.6 million or 24 cents per share recorded a year ago. Earnings per share missed the Zacks Consensus Estimate of 17 cents.

Calgon Carbon raked in revenues of $132.6 million in the reported quarter, down around 2.1% year over year. Sales, however, surpassed the Zacks Consensus Estimate of $129 million.

Gross margin (excluding depreciation and amortization), in the reported quarter was 33.9%, compared with 37.5% in the year-ago quarter. The decline was mainly due to lower volume of higher-margin products.

The company’s shares rose roughly 3.8%, to close at $13.49 on Aug 8.

Segment Performance

Revenues from the company’s core Activated Carbon and Service segment decreased roughly 2% year over year to $121.1 million in the second quarter. Potable water and specialty market sales increased in all geographic regions. These increases were offset by lower sales of powdered activated carbon for treating coal-fired power plant mercury emissions in North America, and reduced sales to industrial and food market customers in all geographic regions.

The Equipment division’s revenues declined around 8.3% year over year to $8.8 million. Higher sales of carbon adsorption equipment and ion exchange equipment was more than offset by reduced ballast water treatment system sales.

Sales from the Consumer segment jumped 18.2% year over year to $2.6 million in the quarter on the back of an increase in the sale of carbon cloth for defense applications.

Financial Position

Calgon Carbon ended second-quarter 2016 with cash and cash equivalents of $51.2 million, up from $50.1 million as of Jun 30, 2015. Long term debt was $101.6 million as of Jun 30, 2016, up from $87.3 million as of Jun 30, 2015.

The company declared a dividend of 5 cents per share, payable on Sep 15, 2016.

Outlook

Calgon Carbon declared the establishment of an additional cost-improvement program that is expected to generate savings of more than $10 million, most of which are projected to be realized in 2017. This brings the total targeted annual cost and efficiency improvements from the inception of the company’s cost-improvement program that started in 2012, to over $60 million.

Calgon Carbon also said that CECA completed the works council consultation process and the former signed the definitive purchase deal related to its planned acquisition of the European wood-based activated carbon and filter aid business of Arkema Group. The company remains on track to complete the transaction in the fourth quarter and expects it to be accretive to earnings in 2017 by 8–11 cents per share, barring any purchase accounting impacts, and to add incremental value thereafter.

Zacks Rank

Calgon Carbon currently has a Zacks Rank #4 (Sell).

Some better-ranked companies in the pollution control space are H2O Innovation Inc. HEOFF and Heritage-Crystal Clean, Inc. (NASDAQ:HCCI) – both sporting a Zacks Rank #1 (Strong Buy) and Casella Waste Systems Inc. (NASDAQ:CWST) , holding a Zacks Rank #2 (Buy).

CALGON CARBON (CCC): Free Stock Analysis Report

CASELLA WASTE (CWST): Free Stock Analysis Report

HERITAGE-CRYSTL (HCCI): Free Stock Analysis Report

H2O INNOVATION (HEOFF): Free Stock Analysis Report

Original post

Zacks Investment Research