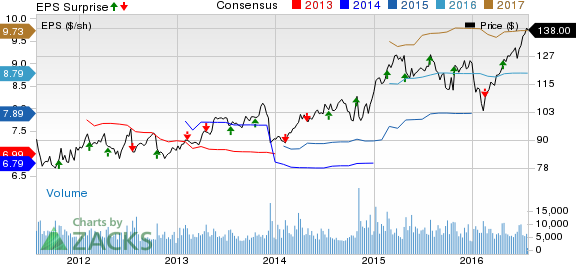

Laboratory Corporation of America Holdings (NYSE:LH) or LabCorp reported a solid second quarter 2016 with adjusted earnings per share (EPS) of $2.31, up 10.5% from the year-ago quarter. Adjusted EPS exceeded the Zacks Consensus Estimate by 0.9%.

On a reported basis, LabCorp’s net earnings came in at $198.2 million or $1.91 per share against $169.8 million or $1.66 per share a year ago.

Net revenue for the second quarter increased 7.4% year over year to $2.38 billion, ahead of the Zacks Consensus Estimate of $2.33 billion. Strong organic volume growth and tuck-in acquisitions contributed to the topline growth. However, these positives were partially offset by adverse currency exchange movement.

Quarter under Review

Currently, LabCorp reports under two operating segments: LabCorp Diagnostics (LabCorp’s legacy business, except for its clinical trial services business, which is now part of Covance Drug Development; and includes the nutritional chemistry and food safety business, previously part of Covance), and Covance Drug Development (Covance’s legacy business, except for its nutritional chemistry and food safety business, which is now part of LabCorp Diagnostics; and includes LabCorp’s legacy clinical trial services business).

In the reported quarter, LabCorp Diagnostics reported net revenue of $1.66 billion, up 5.4% year over year, fueled by organic volume growth of 1.2% (measured by requisitions), price, mix and tuck-in acquisitions, partially offset by unfavorable foreign currency translation of 0.3%. The company reported a 3.5% increase in revenue per requisition in the quarter.

Covance Drug Development reported a 12.2% rise in net revenue to $722.4 million in the second quarter of 2016 driven by broad-based demand, partially offset by the 70 basis points (bps) negative impact due to foreign currency translation. At Constant Exchange Rate (CER) and excluding the impact of the expiration of the Sanofi (PA:SASY) site support agreement, net revenue increased 16.4% year over year on increased demand.

Gross margin fell 4 bps to 34% in the quarter. Adjusted operating income surged 9.6% year over year to $418.8 million. Accordingly, adjusted operating margin expanded 39 bps from the year-ago quarter to 17.2% despite a 4.5% rise in selling, general and administrative expenses to $408 million.

LabCorp exited the second quarter with cash and cash equivalents of $639.6 million compared with $696.3 million at the end of the first quarter. Year-to-date operating cash flow was $466.6 million, comparing favorably with an operating cash outflow of $309.8 million in the year-ago period. Free cash flow came in at $328.2 million, significantly up from free cash flow of $206.9 million in the year-ago period.

Update on Sequenom Deal

In a separate press release, LabCorp announced that it has entered into a definitive agreement to acquire Sequenom, Inc. (NASDAQ:SQNM) , a prominent name in non-invasive prenatal testing (NIPT) for reproductive health. The deal has been inked for an equity value of $302 million representing total enterprise value of $371 million.The acquisition is expected to get completed by the end of 2016 subject to customary closing conditions.

According to LabCorp, this acquisition will be strategically fit for the company’ business as Sequenom’s NIPT and genetic testing capabilities will further advance LabCorp’s aim to deliver advanced diagnostic solutions. The inclusion will also expand LabCorp’s geographic reach both domestically and internationally.

Outlook

LabCorp updated its 2016 financial outlook. Taking into consideration the foreign exchange rates effective as of Jun 30, 2016, the lower end of the net revenue growth expectation has been raised to a new range of 9.5% to 10.5% over 2015 (from the earlier expectation of 8.5% to 10.5%). This includes a 50 bps impact from unfavorable foreign exchange headwind (earlier expectation was 40 bps) resulting from the strengthening of the dollar. The current Zacks Consensus Estimate for revenues is pegged at $9.34 billion.

Adjusted EPS guidance for 2016 has also been raised to the range of $8.60−$8.95 (earlier $8.55−$8.95). The current Zacks Consensus Estimate of $8.79 falls above the mid-point of the guided range.

Free cash flow is expected in the band of $900−$950 million (up 24%–31% over the prior year) (unchanged).

Our Take

LabCorp’s consolidated second-quarter earnings and revenues managed to exceed the respective Zacks Consensus Estimate. This has been a strong quarter with respect to organic volume growth in LabCorp Diagnostics, accelerated revenue growth in Covance Drug Development and operating leverage. We believe that with the integration of Covance, LabCorp is perfectly positioned to drive long-term profitable growth through a combination of world-class diagnostics, drug development expertise and knowledge services. Although the strengthening of the dollar continues to weigh on the company’s year-over-year performance, the raised 2016 outlook is a firm indication that the scenario is going to rebound down the line.

Zacks Rank

LabCorp currently carries a Zacks Rank #2 (Buy). Two other well-ranked stocks in the sector are CR Bard Inc. (NYSE:BCR) and The Cooper Companies Inc. (NYSE:COO) . Both the stocks hold the same Zacks Rank as LabCorp.

SEQUENOM INC (SQNM): Free Stock Analysis Report

BARD C R INC (BCR): Free Stock Analysis Report

LABORATORY CP (LH): Free Stock Analysis Report

COOPER COS (COO): Free Stock Analysis Report

Original post

Zacks Investment Research