For the 24 hours to 23:00 GMT, the EUR declined 0.09% against the USD and closed at 1.1080.

In economic news, data indicated that Eurozone’s Sentix investor confidence index rose to a level of 4.2 in August, highlighting that the outcome of Britain’s decision to leave the European Union had little impact on the common currency region. The index recorded a reading of 1.7 in the previous month and beating markets expectations for it to climb to a level of 3.0. Additionally, Germany’s seasonally adjusted industrial production advanced more-than-anticipated by 0.8% on a monthly basis in June, compared to a revised drop of 0.9% in the prior month while markets expected it to advance by 0.7%.

In the US, data suggested that the labour market conditions index rebounded to a level of 1.0 in July, marking its first gain this year and adding to the evidence that the nation’s labour market is regaining momentum. The index had declined to a level of -1.9 the previous month whereas markets expected it to remain flat.

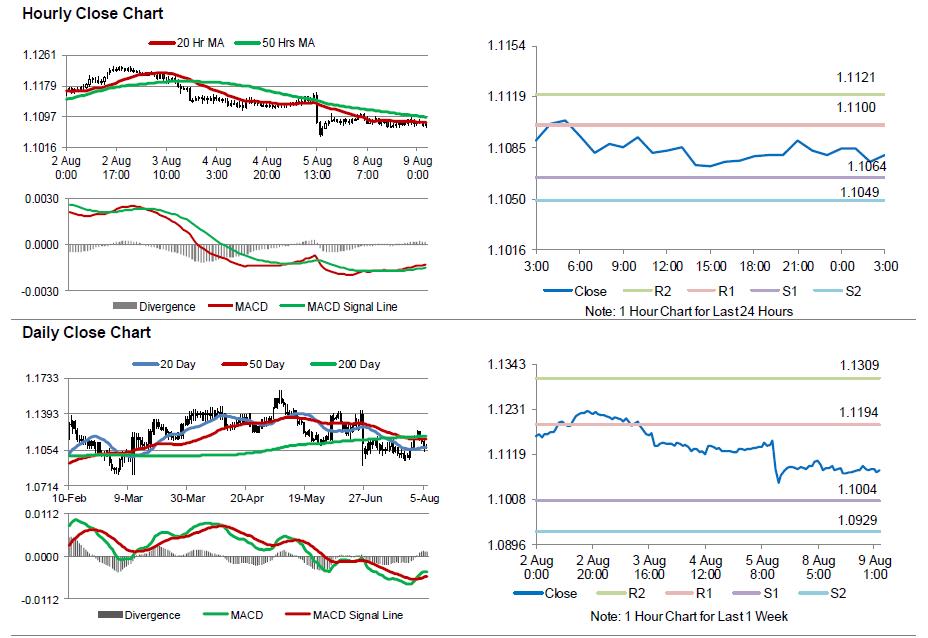

In the Asian session, at GMT0300, the pair is trading at 1.108, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.1064, and a fall through could take it to the next support level of 1.1049. The pair is expected to find its first resistance at 1.1100, and a rise through could take it to the next resistance level of 1.1121.

Moving ahead, market participants would look forward to Germany’s trade balance data for June, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.