American Financial Group Inc. (NYSE:AFG) has announced the offering of 3.50% $300 million senior notes, which will mature on Aug 15, 2026. The notes have been offered at 99.608% of face value.

American Financial plans to deploy the net proceeds to fund the acquisition of the shares of National Interstate Corporation common stock, which are currently not owned by its wholly owned subsidiary, Great American Financial Corporation. The merger is expected to close in the fourth quarter of 2016.

The American Financial affiliate will have to pay $320 million to acquire the shares of National Interstate. The acquisition would result in National Interstate shareholders receiving a special cash dividend of 50 cents per share immediately before the effective time of the merger. However, the transaction is subject approval from majority shareholders of National Interstate.

The aforesaid offering is expected to close on Aug 22, 2016 and is not conditioned on the consummation of the merger.

American Financial has displayed its prudence by issuing senior notes amid a low interest rate environment to procure funds. It demonstrates conscious efforts by the company to capitalize on the low interest rate environment to reduce interest burden, thereby facilitating margin expansion.

Previously, American Financial redeemed its $132 million outstanding 7% Senior Notes, due Sep 2050, at par value on Sep 30, 2015. The insurer also issued $150 million of 6% Subordinated debentures in Nov 2015.

As of Jun 30, 2016, the long-term debt of the company was $1 billion, flat with that at the end of 2015. The debt-to-equity ratio as of Jun 30, 2016 was 20%, down from 21.7% at the end 2015. However, the latest offering will increase the debt-to-equity ratio by 426 basis points.

Nevertheless, given American Financial’s strong capital position, we remain confident about the company’s debt servicing capability.

Zacks Rank and Stocks to Consider

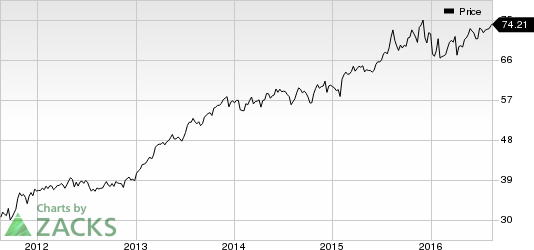

Currently, American Financial holds a Zacks Rank #2 (Buy). Investors may also consider stocks like Allied World Assurance Company Holdings, AG (NYSE:AWH) , Argo Group International Holdings, Ltd. (NASDAQ:AGII) and NMI Holdings, Inc. (NASDAQ:NMIH) . Each of these stocks sports a Zacks Rank #1 (Strong Buy).

ARGO GROUP INTL (AGII): Free Stock Analysis Report

AMER FINL GROUP (AFG): Free Stock Analysis Report

ALLIED WORLD AS (AWH): Free Stock Analysis Report

NMI HOLDINGS-A (NMIH): Free Stock Analysis Report

Original post