AT&T ( (NYSE:T) ) just released its second-quarter earnings results, posting earnings of $0.72 per share and revenue of $40.52 billion.

Currently, T has a Zacks Rank #2 (Buy), but it is subject to change following the release of the company’s latest earnings report. Here are 5 key statistics from this just announced report below.

AT&T:

1. Matched earnings estimates. The company posted earnings of 72 cents per share (excluding 17 cents from non-recurring items), which was in line with our Zacks Consensus Estimate of $0.72.

2. Missed revenue estimates. The company saw revenue figures of $40.52 billion, just missing our estimate of $40.66 billion.

3. “One year after our acquisition of DIRECTV, the success of the integration has exceeded our expectations,” said CEO Randall Stephenson. “Cost synergies are ahead of target, we’ve added nearly 1 million DIRECTV subscribers since the acquisition, and our new video streaming services are scheduled to roll out later this year.

4. In the report, the company said that full-year guidance is “on track to meet or exceed expectations.”

5. T was down $0.52, or 1.22%%, to $42.00 as of 4:50 p.m. EST in after-hours trading shortly after its earnings report was released.

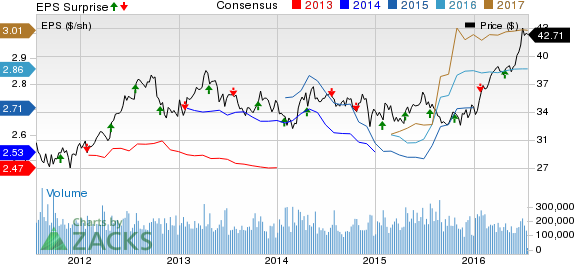

Here’s a graph that looks at AT&T’s latest earnings performance:

AT&T Inc. is a premier communications holding company. Its subsidiaries and affiliates, AT&T operating companies, are the providers of AT&T services in the United States and around the world. Among their offerings are the world's most advanced IP-based business communications services, the nation's fastest 3G network and the best wireless coverage worldwide, and the nation's leading high speed Internet access and voice services.

AT&T INC (T): Free Stock Analysis Report

Original post

Zacks Investment Research