Asian markets traded mixed on Wednesday, as doubts over Greece’s debt burden clashed with Tuesday’s cheer. The Nikkei climbed 1% to 8551, lifted by a sharp 6.6% rally in Elpida Memory on news the company is seeking a deal with Micron Technology. The Hang Seng rose .3%, to 19687, while the Kospi and ASX 200 settled little changed. The Shanghai Composite fell 1.4% to 2264, following Tuesday’s powerful 4.2% rally, the largest single-day gain in more than 2 years.

European shares traded mixed as well. The FTSE rose .2%, the DAX gained .3%, while the CAC40 eased .2%. Societe Generale shares surged 6% as Greece resumed debt negotiations, on hopes the bank’s losses due to exposure to Greek debt will be less than feared.

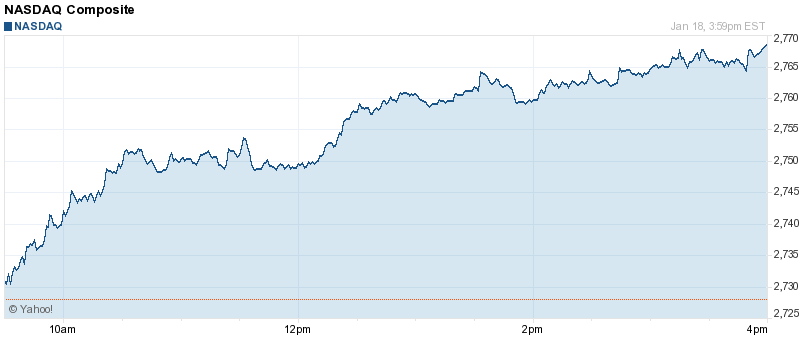

Upbeat data and rumors of a possible Greek-debt deal later in the week sent US stocks higher. The Nasdaq led the advance, climbing 1.5%. The Dow rose 97 points to 12576, and the S&P 500 gained 1.1% to 1308.

Nasdaq Rallies 1.5%,

Goldman Sachs surged 6.8% after beating earnings estimates, while Bank of NY Mellon sank 4.6% after reporting weak earnings.

Currencies

The Euro surged 1.6% as hopes for a solution to Greek’s debt woes lifted the single currency. The Australian Dollar rallied 1.2% to 1.0430, the Swiss Franc advance 1% to 1.0654, and the Pound climbed .8% to 1.5441. The Canadian Dollar posted a smaller .4% gain to 1.0112, and the Yen inched up fractionally to 76.99.

Economic Outlook

The NAHB housing market index jumped to 25 from last month’s reading of 21, blowing past analyst estimates of a rise to 22. Industrial production rose by .4%, slightly less than forecast, and PPI slipped .1%, following last month’s .3% gain.

Stocks Gain on IMF Hopes, Kodak Files for Bankruptcy

Equities

Asian markets rallied to their highest level in more than a month, following news the IMF is hoping to raise $600 billion in funding to help tackle the euro debt crisis. The Nikkei gained 1% to 8640, the Kospi jumped 1.2%, and the Hang Seng rallied 1.3%. China’s Shanghai Composite climbed 1.3%, nearly erasing Wednesday’s 1.4% drop. Australia’s ASX 200 lagged the region, easing .1%, as employment data showed an unexpected drop of 30K jobs in December.

France’s CAC40 soared 2% to 3329, as European indexes traded higher, following strong bond auctions in Spain and France. The DAX gained 1%, and the FTSE rose .7%, as European banks rocketed up 7.4% on hopes the IMF will help address the ongoing debt crisis.

US stocks posted moderate gains, thanks to positive economic and earnings news. The Dow rose 45 points to 12624, the Nasdaq rallied .7%, and the S&P 500 gained .5% to 1314.50.

Currencies

European currencies advanced, as renewed hopes for a debt solution lifted the region. The Euro and Swiss Franc gained .8%, and the Pound rose .4% to 1.5484. The Yen fell .4% to 77.12, while the Australian Dollar closed down .1% to 1.0412.

Economic Outlook

Weekly unemployment claims dropped to 352K, vastly exceeding analyst expectations of 387K. CPI was flat, while core CPI rose .1%, in line with forecasts. On a weaker note, housing starts fell to 660K, 30K short of forecasts.

Asia Rallies, Western Markets end Mixed

Equities

Asian markets advanced on Friday, shrugging off a weak PMI report from China. The Nikkei rallied 1.5% to 8766, and the Kospi surged 1.8%, both settling at their highest close in months. The Shanghai Composite climbed 1% to 2319, and the Hang Seng gained .8% to 20110, reaching a 3.5 month high as it crossed back above the 20000 mark. Australia’s ASX 200 lagged slightly behind, rising .6%.

In Europe, stocks closed slightly lower, but closed higher for the week. The FTSE, DAX, and CAC40 all eased .2%,

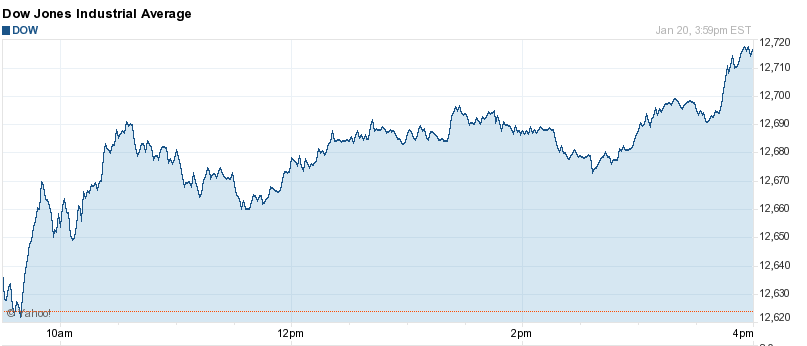

US stocks ended mixed as investors reacted to a heavy dose of earnings news. The Dow rallied 97 points to 12720, the S&P 500 gained .1%, while the Nasdaq closed down fractionally. The VIX tumbled 8% to 18.28.

Dow Rallies 97 Points on Strong Earnings News

Google shares tumbled 8.4% to 586, after falling short of analyst estimates. The company had beaten estimates on revenue for 8 straight quarters.

Currencies

The Pound advanced .6% to 1.5574, thanks to upbeat retails sales data which showed a gain of .6%, after last month’s .5% decline. The Australian Dollar rallied .7% to 1.0494. The Euro slipped .3% to 1.2935, settling in the middle of its daily range, while the Yen ticked up .1% to 77.03.

Economic Outlook

Existing home sales rose by 5% to an annualized rate of 4.61M, up from last month’s 4.39M reading, but fell slightly short of analyst forecasts.

Dollar Slips on Greek Debt Hopes

Equities

Many Asian markets were closed on Monday for the Lunar New Year. In Japan, the Nikkei closed flat at 8766, and Australia’s ASX 200 slipped .3% as miners fell.

European markets advanced on news that Greece was close to reaching a deal with debt holders. The FTSE climbed .9%, while the CAC40 and DAX gained .5%. The European banking index surged 3.9% amid rumors that France and Germany were calling for a relaxation of capital requirements.

US markets closed mixed in light trading. The Dow and Nasdaq declined .1%, while the S&P 500 edged up fractionally.

Currencies

The Euro crossed back above 1.30 to 1.3031, up .7% amid hopes for a Greece debt deal. Similarly, the Swiss Franc gained .8% to 1.0792. Both the Australian and Canadian Dollar rose .5%, while the Yen and Pound settle little changed.

Economic Outlook

Tuesday’s lone report is the Richmond manufacturing index, which is expected to rise from 3 to 6. The Fed will begin their 2-day meeting on Tuesday.

European Officials Reject Greek Debt Deal

Equities

In Asia, markets in Korea, China, and Hong Kong remained closed for the Lunar New Year. The Nikkei rose .3% to 8985, as Elpida Memory soared 4% on hopes for a successful merger with Micron Technology. The ASX 200 closed flat, surrendering earlier gains.

European shares declined as hopes for a Greek debt deal began to fade, after finance ministers rejected an offer from private debt holders. The FTSE and CAC40 fell .5%, and the DAX eased .3%, despite an upbeat PMI report which rose to its highest level in 4 months.

In the US, the major indexes closed mixed. The S&P 500 snapped its 5-day winning streak, slipping .1%, while the Dow ticked down 33 points to 12676. The Nasdaq posted a modest .1% rise.

Currencies

The Dollar traded mixed against world currencies, as traders paid little mind to the disappointing news from Greece. The Yen slumped 1% to 77.72 against the dollar, and the Australian dollar declined d.5% to 1.0477, while the Pound rose .3% to 1.5616. The Euro inched up 7 pips to 1.3026, and the Canadian Dollar edged up .1% to 1.0100.

Economic Outlook

The Richmond manufacturing index blew past forecasts, surging to 12 from last month’s reading of 3. Analysts had expected the index to rise to 6.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Housing Market Sentiment Soars to 4.5 Year High

Published 02/01/2012, 03:12 AM

Updated 05/14/2017, 06:45 AM

Housing Market Sentiment Soars to 4.5 Year High

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.