The Japanese yen is almost unchanged on Monday, following gains in the Friday session. The pair is trading at 104.50. On the release front, it’s a quiet start to the trading week. Japan’s trade surplus narrowed to 0.27 trillion, but easily beat expectations. Later in the day, the Bank of Japan releases the minutes of its monetary policy meeting. There are no US releases on Monday. On Tuesday, Federal Reserve chair Janet Yellen will appear before the Senate Banking Committee.

With the BoJ shying away from further easing, the Japanese yen could take advantage and continue to climb against the US dollar. USD/JPY has climbed 6.4% so far in June, and the yen’s strength has alarmed Japanese policymakers, who continue to warn against currency manipulations. On Friday, Japanese Finance Minister Taro Aso said that he wanted global coordination against what he termed “abrupt changes” in currency movements. The US has called on Japan to refrain from any unilateral movement, and at the recent G-7 meeting of finance ministers, the US and Japan publicly bickered as to whether the yen’s rise was a “disorderly movement”.

The UK goes to the polls on Thursday, as the country votes in a historic referendum on whether to remain in the EU. The campaign between the “Leave” and “Remain” camps has resumed on Monday, following the killing of a Labor MP last week, which shocked the UK and briefly suspended campaigning. Polls released on Friday showed the Remain camp with the lead, and this has boosted the pound in Monday trading. Prime Minister David Cameron and other senior government ministers have warned that that a vote to leave the EU would cause turmoil in global financial markets, and a recent UK Treasury report says an EU exit will wipe out 800,000 jobs in the UK and cause a recession. With the referendum’s outcome very much in doubt, traders can expect volatility in the currency markets during the week.

With the Fed’s June policy meeting behind us, the markets are speculating on the timing of another rate hike. In the heady days of December when the Fed raised interest rates, there was talk of up to four hikes in 2016. Fast forward to June, and the Fed hasn’t made a move so far this year. Many analysts are predicting only one hike in 2016, but on Friday, St. Louis Fed President James Bullard said that the economy may need just one hike in the next 2-1/2 years. Bullard did not mince words, bluntly stating that the Fed had done a poor job in its predictions about the US economy, and said the markets have no faith in the Fed’s “dot plot” of projected interest rate policy, as the Fed’s actual pace of rate hikes was much slower than its projections. Bullard added that this “mismatch” between word and action had caused distortions in the global financial markets and eroded credibility in the Federal Reserve.

US inflation and employment numbers were soft on Thursday. Core CPI and CPI, the primary gauges of consumer inflation, both posted small gains of 0.2%, within expectations. The Federal Reserve continues to insist that inflation will head towards its target of 2.0 percent, but given current inflation levels are not much above zero, it’s hard to see this happening, absent a huge surge by the US economy. Meanwhile, Unemployment Claims increased to 277 thousand, above the estimate of 267 thousand. This marked a four-week high, and once again raises questions about the strength of the US labor market. The employment picture appeared to be very bright in early 2016, but the Nonfarm Payrolls report of just 38 thousand in May shocked the markets and could delay a rate hike by the Federal Reserve.

USD/JPY Fundamentals

Sunday (June 19)

- 19:50 Japanese Trade Balance. Estimate 0.13T. Actual 0.27T

Monday (June 21)

- 19:50 Japanese Monetary Policy Meeting Minutes

Upcoming Key Events

Tuesday (June 21)

- 14:00 Federal Reserve Chair Janet Yellen Testifies

*Key events are in bold

*All release times are EDT

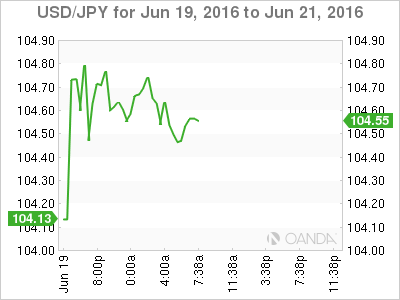

USD/JPY for Monday, June 20, 2016

USD/JPY June 20 at 6:50 EDT

Open: 104.62 Low: 104.36 High: 104.84 Close: 104.50

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 101.07 | 102.36 | 103.73 | 104.99 | 105.87 | 107.16 |

- USD/JPY has shown limited movement in the Asian and European sessions

- 103.73 is providing support

- 104.99 is a weak resistance line

- Current range: 103.73 to 104.99

Further levels in both directions:

- Below: 103.73, 102.36 and 101.07

- Above: 104.99, 105.87 and 107.16

OANDA’s Open Positions Ratio

The USD/JPY ratio is showing little movement on Monday, consistent with the lack of movement from USD/JPY. Long positions have a strong majority (69%), indicative of trader bias towards USD/JPY breaking out and moving to higher ground.