USD/SGD has posted modest losses on Monday, as the pair trades slightly above the 1.40 line early in the North American session. In economic news, it’s a quiet start to the trading week, with just one US event on the calendar, Flash Manufacturing PMI. Later on Monday, Singapore will release the Consumer Price Index.

The Singapore dollar started off the month of February in good shape, trading above the 1.42 line. Like other minor currencies, however, it has endured a rough month, and is currently struggling to remain above the symbolic 1.40 line. Singapore’s biggest export market is China, so the slowdown which as gripped the Asian giant in recent months has taken its toll on the Singapore economy. Domestic wholesale trade plunged 14.9% year-on-year in the fourth quarter, as the economy struggles with the double-whammy of the Chinese slowdown and the collapse in oil prices.

The US released key inflation reports last week, with CPI posting a flat reading of 0.0%, while Core CPI improved to 0.3%, marking the strongest gain since April 2015. These readings didn’t shake up the markets, but they managed to beat the forecasts, so speculation has increased that the Fed may reconsider a rate hike in March. However, such a move still seems unlikely, unless inflation picks up dramatically. Earlier in the week, the Federal Reserve sent out a cautious message in its minutes, which reiterated the central bank’s concern that turmoil in global markets could have negative repercussions for the US economy. Policymakers sent out a broad hint that a rate hike is unlikely in March, as they discussed “altering their earlier views of the appropriate path for the target range for the federal funds rate”. This could have a negative impact on the US dollar, as investors may look elsewhere to park their funds if US rates are not moving higher anytime soon. Federal Reserve chair Janet Yellen said last week that the Fed still planned to raise rates later in 2016, but FOMC member James Bullard argued that there was room to delay any rate moves, given global financial turmoil and weak US inflation. Many experts are skeptical that the Fed will make any more moves before next year, but central banks have a way of surprising the markets.

USD/SGD Fundamentals

Monday (Feb. 22)

- 9:45 US Flash Manufacturing PMI. Estimate 52.3 points

- 00:00 Singapore Consumer Price Index

Upcoming Key Events

Tuesday (Feb. 23)

- 10:00 US CB Consumer Confidence. Estimate 97.4 points

*Key events are in bold

*All release times are EST

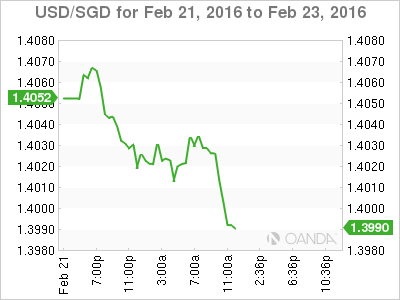

USD/SGD for Monday, February 22, 2016

USD/SGD February 22 at 9:20 EST

Open: 1.4061 Low: 1.4004 High: 1.4073 Close: 1.4027

USD/SGD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3810 | 1.3927 | 1.4016 | 1.4139 | 1.4248 | 1.4368 |

- 1.4016 is providing support

- 1.4139 is a strong resistance line

- Current range: 1.4016 to 1.4139

Further levels in both directions:

- Below: 1.4016, 1.3927, 1.3810 and 1.3721

- Above: 1.4139, 1.4248 and 1.4368