Future’s So Bright, We Gotta Hike Rates

“The simple message is the economy is doing well. We have confidence in the robustness of the economy and its resilience to shocks.” – Janet Yellen, March 15, 2017.

Really?

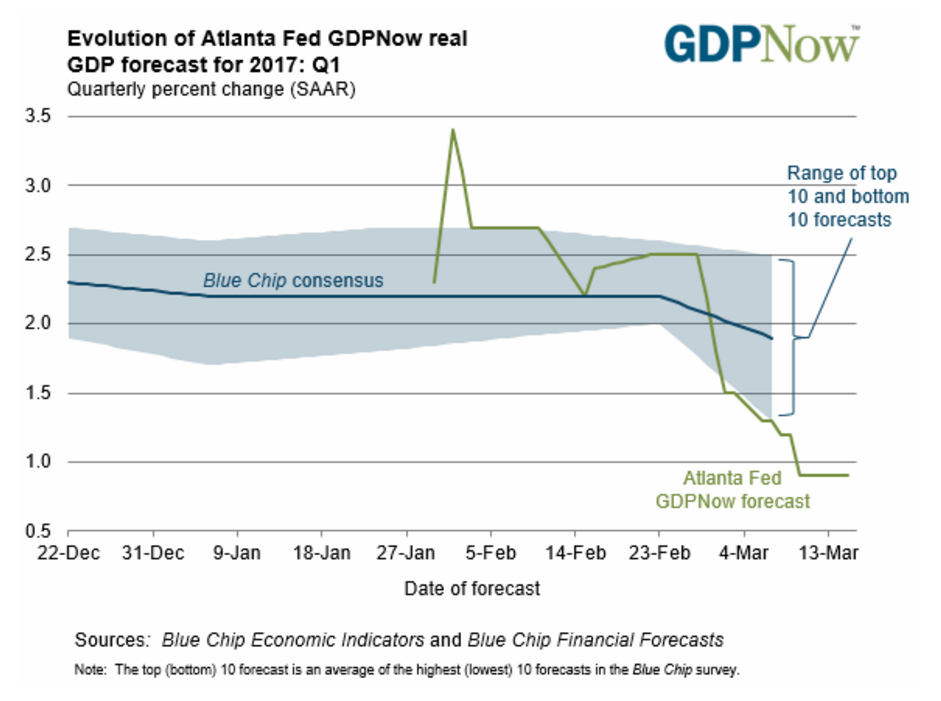

Because while were you saying that the GDP NowCast from the Atlanta Fed just collapsed from nearly 3% at the beginning of the year, to just 0.9% currently.

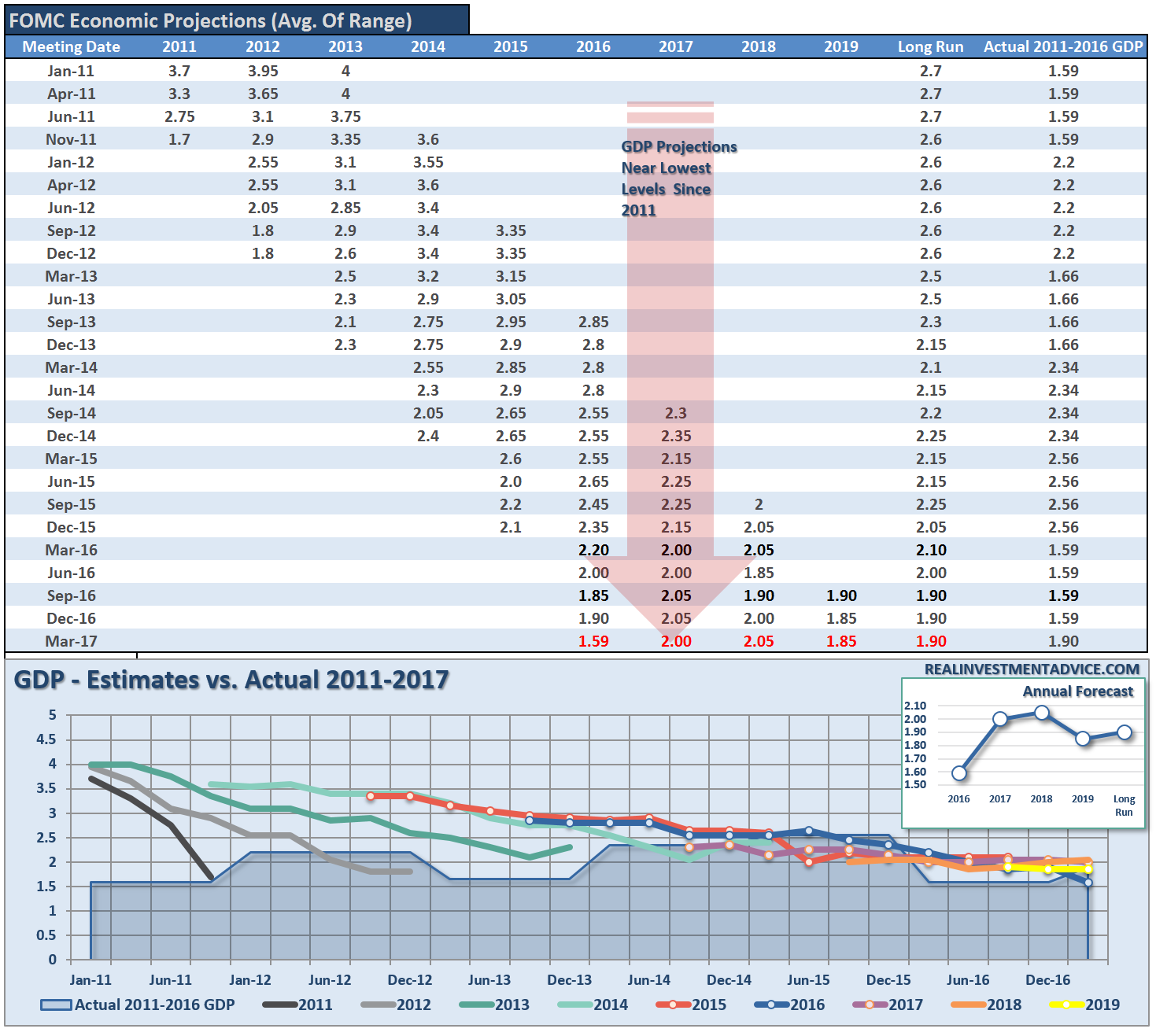

The problem, as has been a continued issue with the Fed’s projections, is the expanse between the Fed’s “fantasy” and economic realities. This is shown in the table below which documents the median of the Fed’s economic projections versus what actually happens. In every single year, the March projections have consistently been revised lower.

Yet, besides being the world’s worst economic forecasters, the market still believes every statement she makes.

Unfortunately, for market participants chasing asset prices on the back of “Make America Great Again” and Trump’s promise of 3-4% annualized GDP growth, the Fed is maintaining their expectations of the lowest long-term growth rates on record.

Someone is going to be wrong. Quite likely, it will be both of them.

Is Fed Late To The Game?

With the Federal Reserve lifting interest rates by another 0.25%, while also tilting hawkishly into the rest of year suggesting further rate hikes, she noted economic activity had expanded at a “moderate pace,” and the U.S. labor market continued to strengthen with job gains remaining “solid”. Of course, given the February employment report of 235,000 jobs, and improving manufacturing reports, the move would certainly seem logical

However, all may not be what it appears.

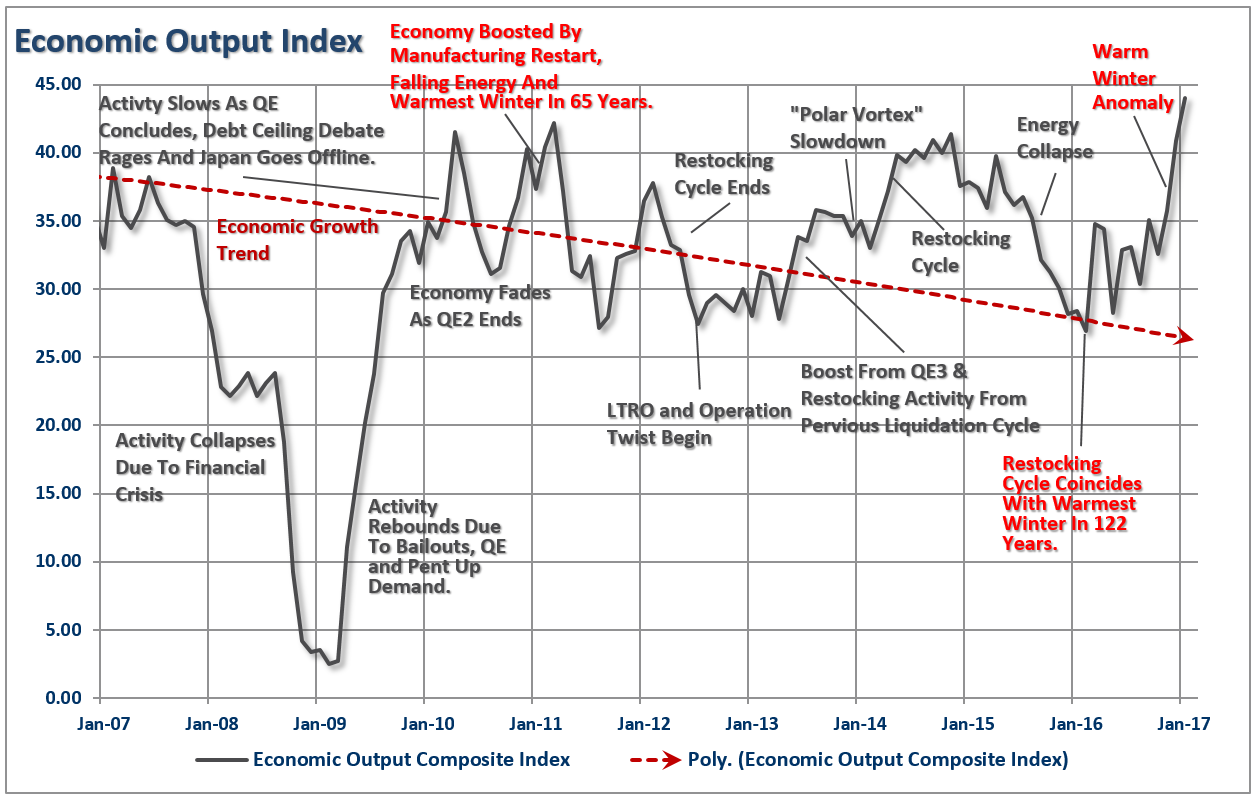

The last couple of months have marked some of the warmest winter temperatures that we have seen since 2011-2012. This is important, because of the “seasonal adjustments” applied to data collected during these typically cold months of the year. These “adjustments” boost the underlying data to normalize it and smooth the monthly volatility of the series into a more usable data set.

Here is the issue. When the winter is unseasonably warm, as it was this past year, workers are able to continue working in areas like manufacturing, construction, etc, where more normal inclement weather would have diminished those activities. So, when the “adjustments” are added to already abnormally high data levels, the data is skewed to the upside. This was something I noted back in 2013.

“I jest, of course, but what is relevant is that the effect of ‘Mother Nature’ has provided the short-term boosts to economic growth which kept a struggling economy above the water line. How many more natural disasters and warm winters will come to offset the negative economic impact of a zero interest rate environment coupled with a wave of deflationary pressures is unknown. However, you do have to admit that the ‘Mother Nature’ effect is quite interesting nonetheless and wonder, if even for just a moment, if Bernanke has her on speed dial.”

Whether it was an earthquake, typhoon, the nuclear meltdown of Japan, warm winter cycles, Hurricane Sandy, tornadoes in Oklahoma, or just good old fashioned collapses in energy prices, each has had its impact on economic growth. Given the history of warm winter seasonal adjustment skewing, we are likely to see “repayment” coming towards the summer as the “adjustments” begin to run in reverse.

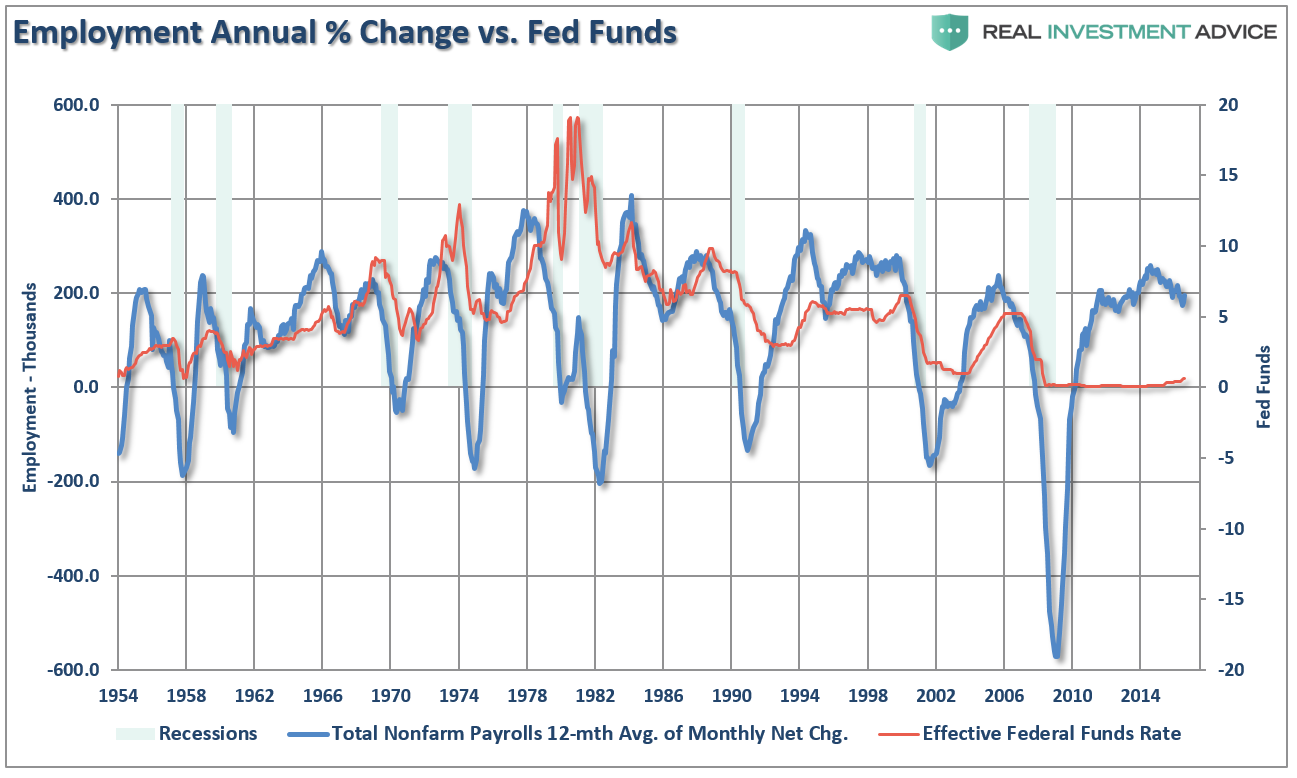

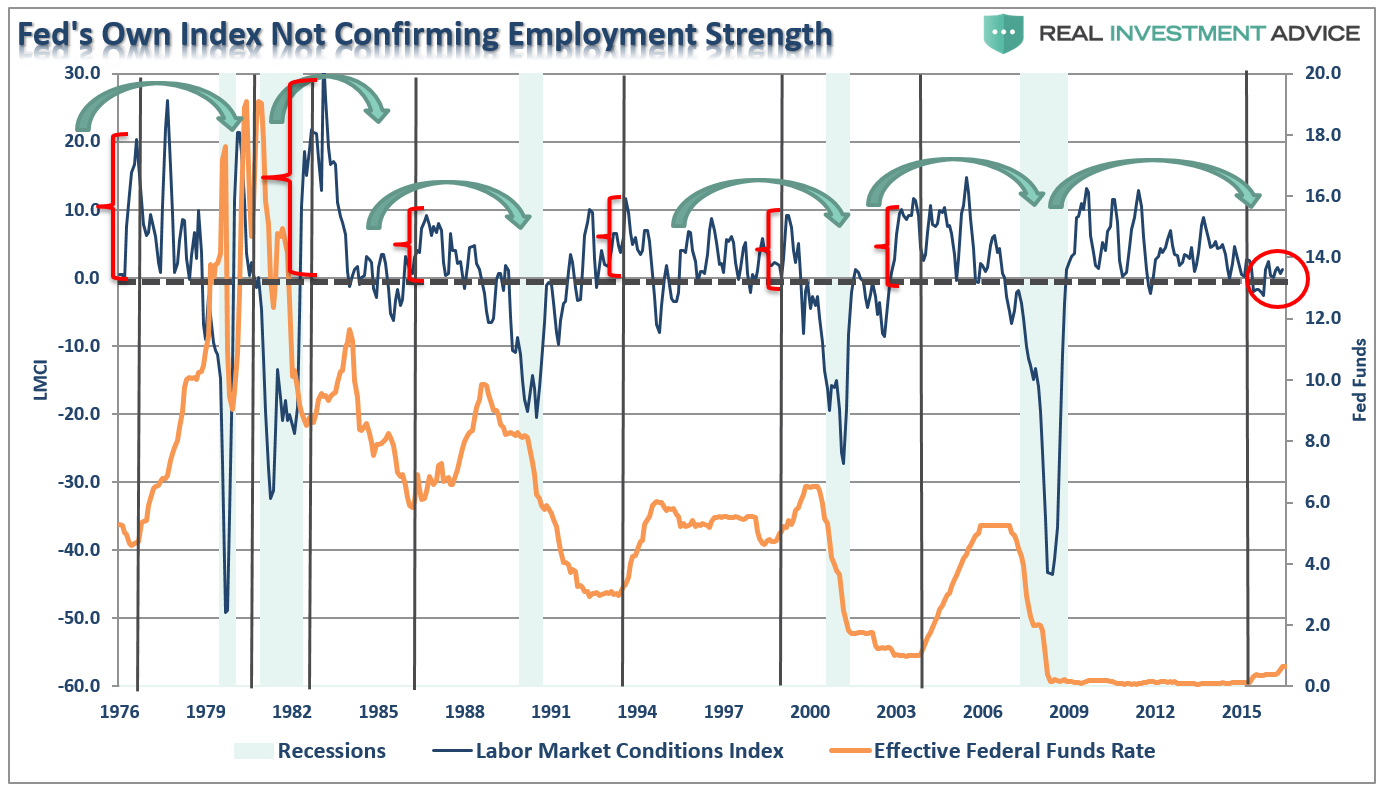

This is important given the seasonal adjustment phenomenon has likely skewed employment data over the last couple of months giving a false sense of confidence about the Fed’s ability to safely raise interest rates. As shown in the chart below the Fed has NEVER hiked rates previous when employment had already peaked for its current cycle and was beginning to decline.

Furthermore, this same problem presents itself when looking at the Fed’s own Labor Market Conditions Index.

Another problem which is also likely skewing the inflation data has been the rise in oil prices. Since oil prices push through the commodity complex, inflationary pressures have risen in recent months. However, the recent drop in energy prices, and given the massive net long position discussed last weekend which could exacerbate the decline, will likely show up as a deflationary wave.

All of this suggests, the Fed may indeed be very late to the game and find themselves pushing the economy towards the next recession sooner than anticipated.

Something Is Amiss

Of course, at very low rates of economic growth, there is little wiggle room between slowing the economy and pushing it into a recession. However, it is hard to deny the rush of consumer and investor optimism since the election. But something appears to be amiss just beneath the surface.

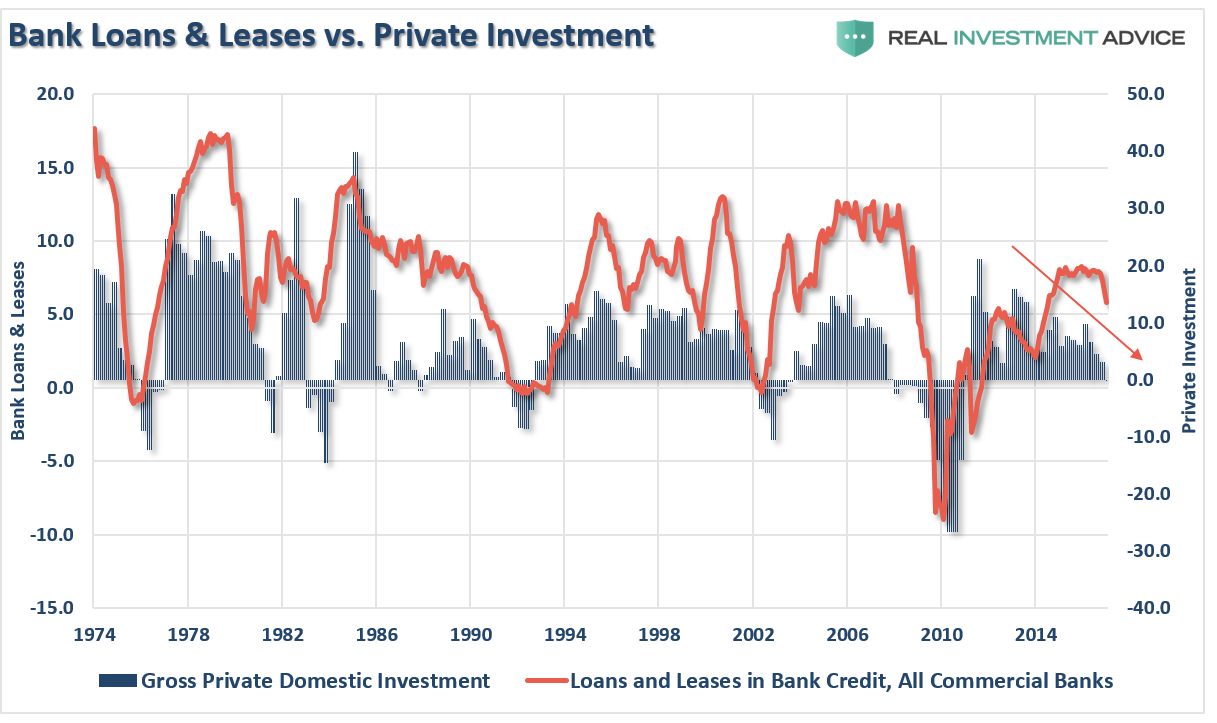

Credit is the “lifeblood” of the economy, and the recent rate hikes will eventually increase borrowing costs for credit cards and other short-term loans. Unfortunately, bank loans and leases are already on the decline, and delinquencies are on the rise, as higher borrowing costs make fixed investment less profitable. Remember, the REASON the Fed hikes interest rates in the first place is to SLOW economic activity in order to QUELL inflationary pressures.

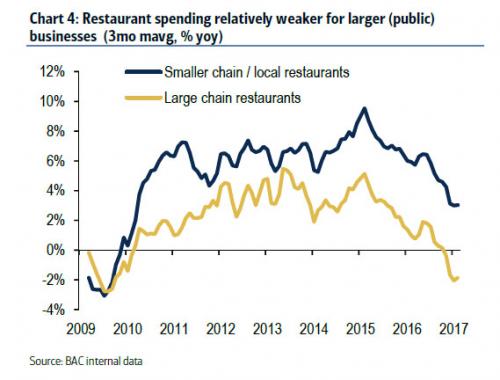

Importantly, as noted by Zerohedge, it is not just on the business side of the equation. Consumption, which makes up roughly 70% of economic growth, is also feeling the pinch of a slowing economy and higher borrowing costs as consumers continue to reduce spending at restaurants. This is not a sign of improving “confidence” in their economic outlook.

Of course, the decline in the luxury of “eating out” is not surprising once you realize that debt expansion has come to offset weak wage growth which has failed to keep up with the spiraling costs of healthcare, rent and gasoline prices.

While it is “hoped” that Trump’s policies will “Make America Great, Again,” in reality there has been little change to actual underlying economic activity which is dependent on consumer spending from already “tapped out” consumers.

As noted the problem for both the Fed, and investors, is the detachment between market “expectations” and fundamental “realities.”

In other words, if you are betting on a strong economic recovery to support excessive valuations and extremely stretched markets, you could be setting yourself up for disappointment.

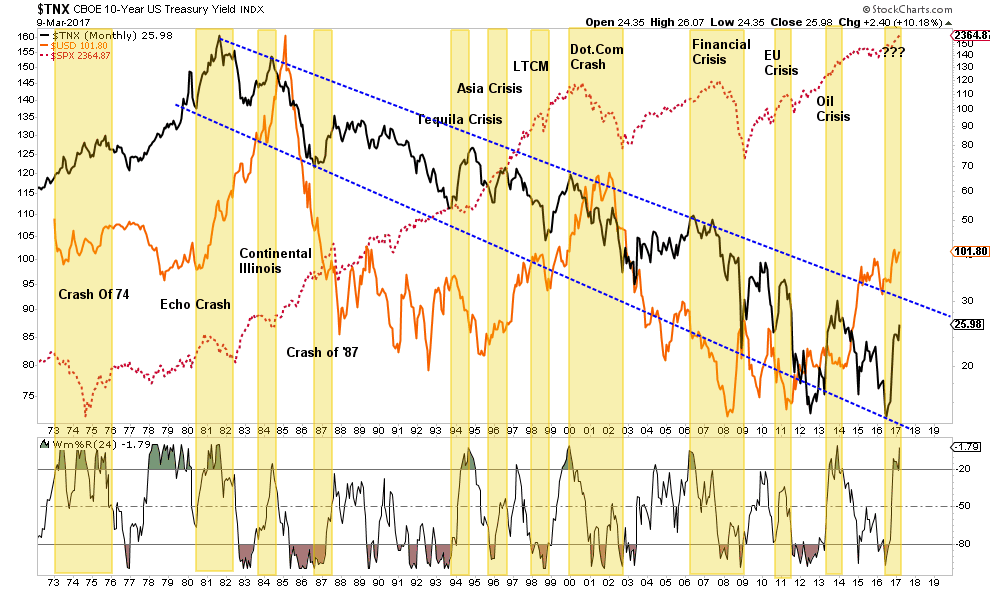

Oh, and don’t think for a moment that rising interest rates, combined with a strongly rising dollar, is somehow “good for stocks.”

It isn’t.

It has never been.

Just some things I am thinking about.