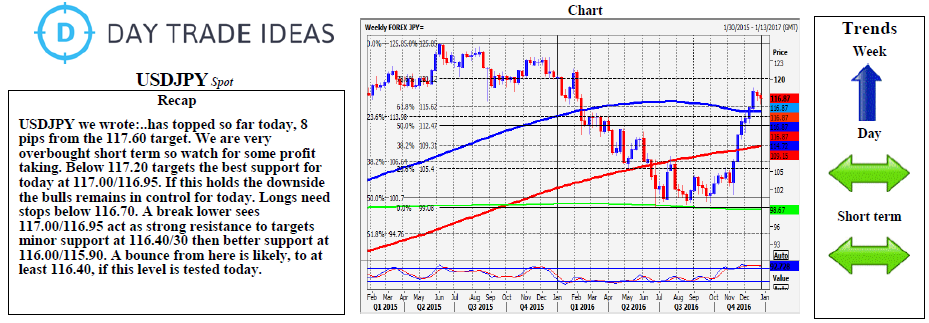

USD/JPY saw very overbought conditions trigger profit taking as expected, as we broke 117.00/116.95 to test support at 116.00/115.90, but over ran as far as 115.63. Looks like we will have a final retest of the support at 115.10/00 with better support at 114.65/55. I'm hoping this is tested for the best buying opportunity of this week. A low for the correction is expected. Try longs with stops below 114.00.

Bears are in short term control so gains are likely to be limited with first resistance at 116.05/10 then 116.35/38. However, if we continue higher look for a selling opportunity at 116.80/85, with stops above 117.15. An unexpected break higher could retest yesterday's high at 117.50/52.