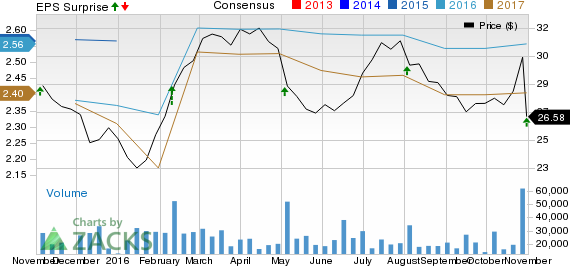

CenturyLink Inc (NYSE:CTL). (NYSE:T) reported strong financial results in the third quarter of 2016, wherein both the bottom and the top line beat the Zacks Consensus Estimate.

CenturyLink posted adjusted earnings per share of 56 cents, surpassing the Zacks Consensus Estimate of 55 cents. GAAP net income was $152 million or 28 cents per share compared with $205 million or 45 cents in the prior-year quarter.

Quarterly total revenue of $4,382 million was down 3.8% from the prior-year quarter but was slightly ahead of the Zacks Consensus Estimate of $4,381 million. Of the total, Strategic revenues totaled $2,015 million, up 4.5% year over year. Legacy revenues accounted for $1,900 million, down 7.9%. Data Integration revenues grossed $163 million, up 5.8%. Other services contributed the remaining $304 million, down 25.7%.

Quarterly operating expenses totaled $3,787 million, down 1.1% year over year. Meanwhile, operating income was $595 million compared with $656 million in the year-ago quarter.

Cash Flow

In the third quarter of 2016, CenturyLink generated $1,598 million of adjusted cash from operations compared with $1,782 million in the year-ago quarter. Adjusted free cash flow, in the reported quarter, was $186 million compared with $651 million in the year-ago quarter.

Liquidity

CenturyLink exited third-quarter 2016 with $140 million of cash and cash equivalents compared with $126 million at the end of 2015. At third-quarter end, total debt was $19,718 million compared with $20,225 million at the end of 2015. Meanwhile, the debt-to-capitalization ratio was 0.42, in line with the figure reported at the end of 2015.

Segmental Results

Business segment revenues dropped 1.1% year over year to $2,606 million in the third quarter. Segmental profits were $1,062 million, down 4.1% year over year. Segmental profit margin was 40.8% versus 42% in the year-ago quarter.

Consumer segment revenues were $1,472 million, down 2.4% year over year. Segmental profits were $816 million, down 6.4% year over year. Segmental profit margin was 55.4% compared with 57.4% in the year-ago quarter.

Subscriber Statistics

As of Sep 30, 2016, total access lines were 11.231 million, down 5.7% year over year. High-speed broadband customer count was 5.95 million, down 2% and Prism TV customer base totaled 0.318 million, up 18.21%. In the reported quarter, CenturyLink lost 40,000 high-speed broadband subscribers and 182,000 access lines but gained 7,000 Prism TV subscribers.

Q4 Outlook

For the fourth quarter of 2016, the company projects adjusted earnings per share and operating revenues in the range of 53 cents to 59 cents and $4.28 billion to $4.34 billion, respectively. Core revenues are estimated in the range of $3.86 billion to $3.92 billion. Operating cash flow is projected between $1.58 billion and $1.64 billion.

Recent Developments

CenturyLink has agreed to purchase Level 3 Communications Inc. (NYSE:T) for $24 billion. The cash and stock deal is expected to close by the end of third quarter of 2017. The merged entity will be able to compete with the likes of telecom giants like AT&T Inc. (NYSE:T) and Verizon Communications Inc. (NYSE:VZ) in the communications industry.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

AT&T INC (T): Free Stock Analysis Report

LEVEL 3 COMM (LVLT): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

CENTURYLINK INC (CTL): Free Stock Analysis Report

Original post

Zacks Investment Research