Accenture Plc (NYSE:ACN) has completed the acquisition of a majority stake in IMJ Corporation, a full-service digital agency, much ahead of the stipulated time period. The deal, which was inked this April, was initially expected to close by the year end.

Notably, last Sunday, the global IT management services provider announced that it has completed the deal. However, financial details regarding the same are still under wraps.

Founded in 1996, IMJ strives to help other companies in transforming their businesses using its end-to-end digital marketing services. Over the years, the company has grown into one of the largest independent digital agencies in Japan in terms of headcount.

Apart from this, its portfolio includes technology development, and design and usability services. It provides digital strategy services as well, which comprise strategies to improve the brand identity of clients, thereby helping them to maximize return on investment (ROI) from their digital programs.

IMJ will join the Accenture Interactive platform, which is part of the company's digital marketing-services arm, Accenture Digital. Accenture Interactive was formed in 2009 to offer superior consulting, technology and analytics services to chief marketing officers (CMOs).

Since the formation of Accenture Interactive, the company has made strategic acquisitions to enhance digital marketing capabilities, including the acquisition of Reactive Media Pty Ltd., an Australian digital services provider; and Brightstep, a Swedish digital content and commerce solution provider.

This latest acquisition will help Accenture to provide end-to-end digital marketing services, bringing a deeper and broader set of digital solutions to clients.

Furthermore, according to Atsushi Egawa, country managing director at Accenture Japan “Acquiring a majority stake in IMJ provides us with enhanced capabilities to deliver digital services in this dynamic market.”

IMJ, on the other hand, will be able to leverage Accenture Interactive’s complete suite of digital marketing services. The firm will now be able to deliver a wider range of services and undertake even more challenging and technically sophisticated workloads from its clients.

Considering the growing need for digital marketing, we expect Accenture’s investment in digital and marketing capabilities to boost its long-term growth. This will also help the company in effectively competing with other digital marketing service providers such as International Business Machines Corp. (NYSE:IBM) , Dell and Deloitte.

Although Accenture’s strategy of growing through acquisitions is encouraging, we are slightly cautious of intensifying competition from the likes of Cognizant Technology Solutions (NASDAQ:CTSH) and a strained IT spending environment.

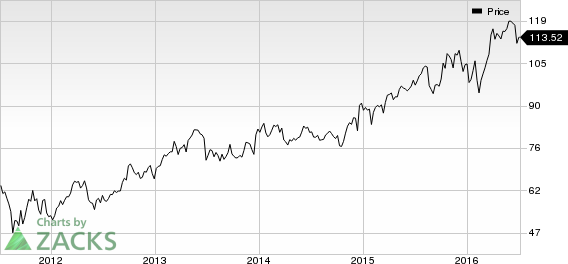

Currently, Accenture has a Zacks Rank #2 (Buy). A top-ranked stock in the technology sector is Diodes Incorporated (NASDAQ:DIOD) , sporting a Zacks Rank #1 (Strong Buy).

INTL BUS MACH (IBM): Free Stock Analysis Report

COGNIZANT TECH (CTSH): Free Stock Analysis Report

DIODES INC (DIOD): Free Stock Analysis Report

ACCENTURE PLC (ACN): Free Stock Analysis Report

Original post