On Oct 5, 2016, Zacks Investment Research upgraded Ciena Corporation (NYSE:CIEN) to a Zacks Rank #1 (Strong Buy). Going by the Zacks model, companies holding a Zacks Rank #1 have strong chances of outperforming the broader market over the next few quarters.

Why the Upgrade?

Ciena has been taking consistent initiatives to broaden its portfolio while diversifying its business lines. In addition, the company has also been undertaking geographical expansion, which is a big positive in our view.

Moreover, Ciena remains a beneficiary of the ongoing shift to cloud, which is also pushing up the demand for physical infrastructure to support that. In addition, rising demand for mobile connectivity and a booming market for Internet of Things bode well for this company.

Ciena’s largest telecom customers, AT&T (NYSE:T) and Verizon (NYSE:VZ) have been increasing their spending on infrastructure. This is an important growth driver for the company. In addition, owing to its diversification efforts, the company’s non-telecom customers are also contributing more to the top line of late. In the last reported quarter, non-telecom companies contributed nearly 37% of total sales.

Ciena’s focus on cost-cutting initiatives is another positive.

Nonetheless, there can be some challenges given the company’s highly leveraged balance sheet and intense competition from peers.

Stock to Consider

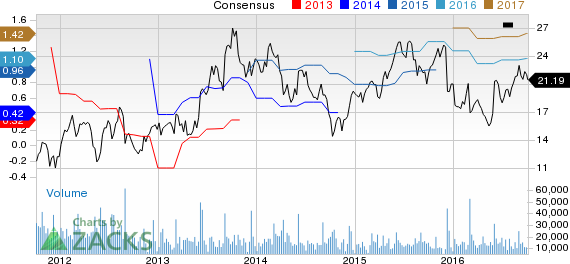

Another stock worth considering in the same space is Finisar Corp. (NASDAQ:FNSR) , sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus estimate for Finisar’s current fiscal year surged 63.5% over the past 30 days.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

CIENA CORP (CIEN): Free Stock Analysis Report

FINISAR CORP (FNSR): Free Stock Analysis Report

Original post

Zacks Investment Research