As investors approach retirement, most generally reduce the overall risk profile of their portfolios, moving from more aggressive allocations towards more conservative investments. Some of the key investment risks investors tend to reduce are: equity risk, credit risk and interest rate risk. Reallocating away from equities into fixed income or cash, as well as moving from high beta stocks towards low beta stocks, is generally utilized to mitigate risk. With regards credit risk and interest rate risk, we analyzed the implications on the overall risk profile of a portfolio, by altering the credit quality and duration of international fixed income investments. Our analysis shows that reallocating within the international fixed income component may appreciably help manage a portfolio’s overall risk profile.

With ongoing financial turmoil and volatility, and historically low interest rates increasing the likelihood of a rising interest rate environment globally, managing the international fixed income allocation may be of the utmost importance. Specifically, we find that reallocating away from duration and credit risk may result in lower volatility and potential “black swan” risks.

Duration Considerations

Reducing the duration of international fixed income investments may significantly reduce a portfolio’s risk profile. The following chart illustrates the trade-off between risk and return when an investor moves further out the yield curve, increasing duration (interest rate) risk. We depict the risk-return profiles over a 10-year period for international fixed income investments with maturities of one to three years against those with maturities greater than 10 years:

Our analysis found that the standard deviation of returns increased proportionally more than the increase in annualized returns as the duration for international fixed income investments was increased. As a result, investments in shorter duration international fixed income securities generally produced improved risk-adjusted returns, as measured by the Sharpe ratio. For instance, we found that during the period 9/30/01 – 9/30/11, an investment in a basket of German Government securities with maturities between one and three years produced a Sharpe ratio of 1.30. In contrast, a corresponding basket of securities with maturities greater than 10 years would have generated a Sharpe ratio of 0.70.

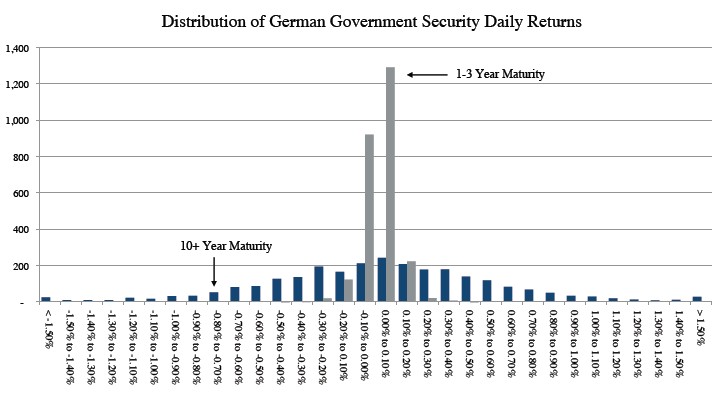

However, this only tells part of the story – not only has the price volatility of longer duration international securities been much higher than corresponding shorter duration international securities, but the distribution of daily returns for longer duration securities exhibits “fatter tails”. Using a basket of German Government securities – widely perceived as relatively safe international fixed income investments – we find a significant contrast in the distribution of daily returns for maturities between 1 and 3 years relative to those securities with maturities greater than 10 years over a 10-year period:

In an environment of rising interest rates globally, these price movements may be exacerbated to the downside, as longer duration securities have greater susceptibility to interest rate risk.

Credit Considerations

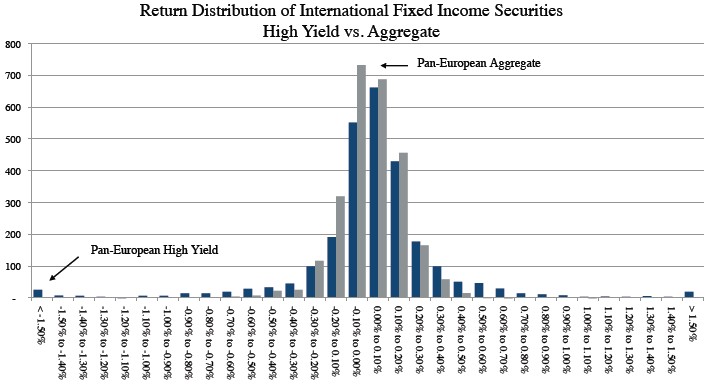

Increasing the average credit quality of international fixed income investments may reduce the overall risk profile of a portfolio’s international allocation. As an example, we analyzed the daily returns of an index comprised of high-yield pan-European fixed income securities (as a proxy for low credit quality) against that of a corresponding pan-European aggregate index of fixed income securities. We found a substantial divergence in both the absolute levels of volatility and the distribution of daily returns; specifically, lower credit quality investments tend to exhibit “fatter tails” than that expected under the normal distribution, and thus may be more prone to causing “black swan-”type of events. For instance, whereas during the 10-year period analyzed, we would expect 13 observations to fall below 2.58 times the standard deviation from the mean under the normal distribution assumption, we found 46 observations, more than 3.5 times this number.

Conclusion

While reallocating away from international equities to international fixed income may help reduce the risk profile, there appears evidence to support the notion that reallocation within the international fixed income allocation may also be an effective tool to manage the overall risk profile of a portfolio. Specifically, decreasing the credit and duration risk associated with international fixed income investments may help to reduce the overall risk profile of a portfolio. Notably, with ongoing instability in global markets, it may be an evermore-important consideration for investors to reduce the likelihood of a “black swan” event negatively effecting investment performance, by managing the duration and credit risk of international fixed income investments.

Investors may be able to reduce interest and credit risk in international fixed income investments by choosing bond funds with a commitment to reduced interest and credit risk. Currency funds may be worth considering as a tool to actively address interest and credit risk in a diversified portfolio. Such funds may be considered special cases of international bond funds, as they tend to focus on currency risk while seeking to mitigate interest and credit risk.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trimming Risk - An International Perspective for Retirement Investing

Published 11/15/2011, 08:08 AM

Updated 07/09/2023, 06:31 AM

Trimming Risk - An International Perspective for Retirement Investing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.