If you need any indication on just how split consensus on today’s rates decision is, just take a look at the ‘RBA’ Google (NASDAQ:GOOGL) News search and read the contrasting list of headlines that pops up:

“Why the RBA should cut by twice as much”

“Hold your horses: RBA rate cut no sure bet”

“Will the RBA cut rates tomorrow?”

Not a clue!

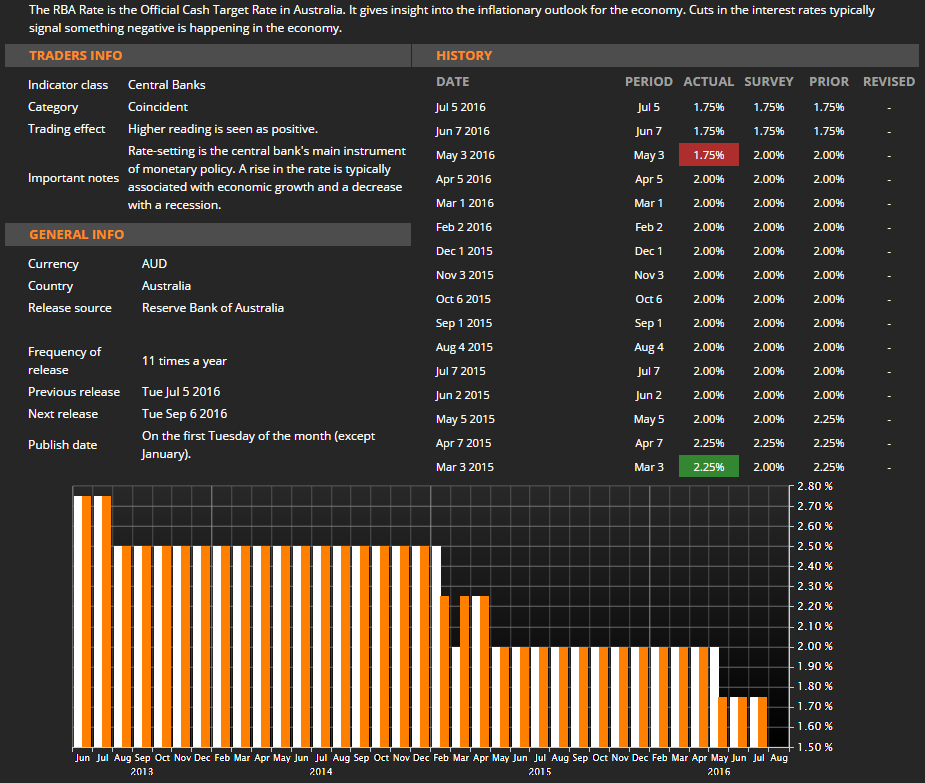

Yet the market on the other hand, shows much more of a directional bias, with both surveyed economists and interest rate futures indicating a cut being the more likely outcome.

Interest rate futures are pricing in roughly a 65% chance that the RBA moves, while the Bloomberg polling shows 20/25 surveyed economists expecting a cut, all leading to the expectation for the official cash rate to be cut from 2.00% to a record low 1.75% this afternoon.

Yes indeed, today’s meeting is a live one!

If the RBA does cut, it is going to be all about inflation. As you can see from the screenshot taken from the News Terminal above, the May interest rate cut wasn’t the surveyed outcome, with analysts underestimating the importance of the last big CPI miss.

Now sure, last week’s Australian headline q/q CPI figure came in as expected, but inflation has continued to remain subdued at just 1% in annual terms. This is the weakest gain since 1999 and still well below the 2%-3% target band.

Analysts like to speak about flexibility around the target band, but when push comes to deflationary shove, the RBA don’t seem to want to mess around. This makes me hugely wary of going against the grain here and expecting anything but a cut.

So a cut means you should short AUD/USD?

Well not necessarily! There are no prizes for being right or wrong on a central bank call and just because you side with consensus and get it right, doesn’t mean the market will give your trade the strong directional move you’re looking for.

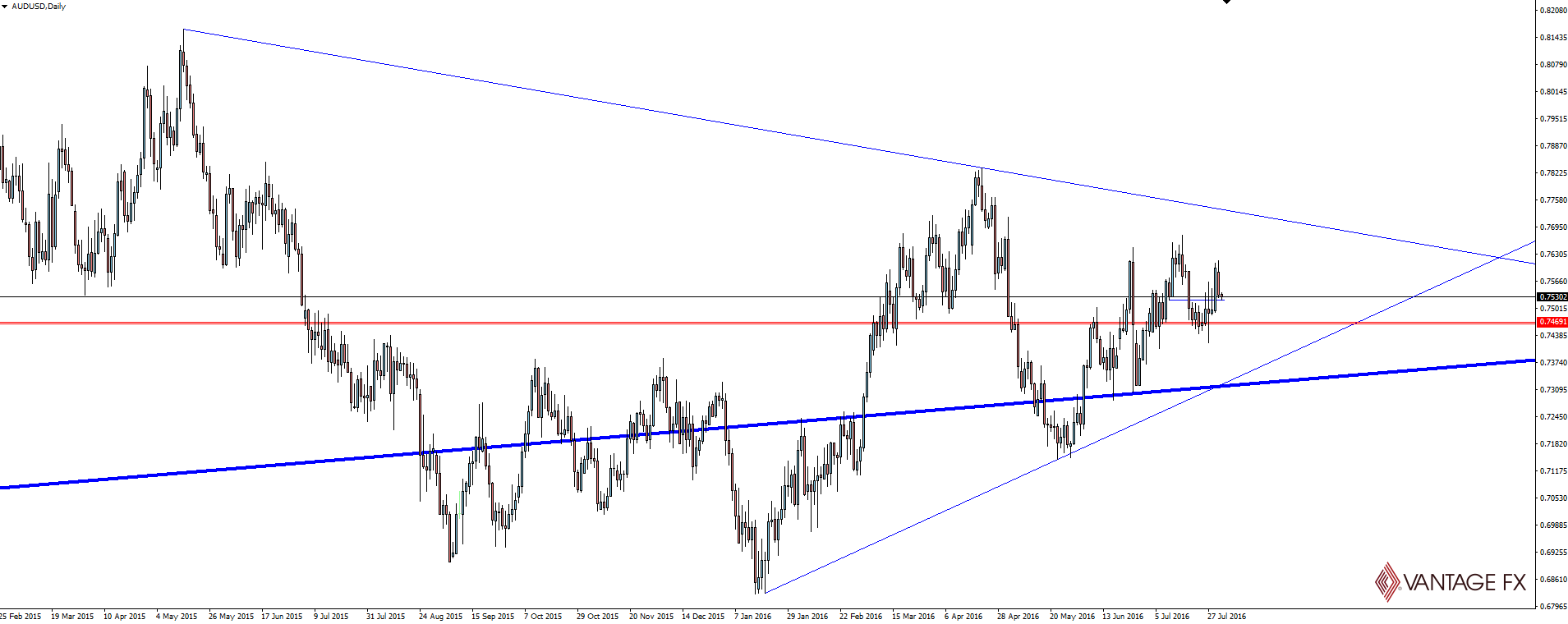

AUD/USD Daily:

From a technical point of view, the higher time frame AUD/USD chart has bounced off weekly support and continues to rally in the face of adversity. In a higher time frame context, the daily triangle that you can see on the above chart could even be viewed as a continuation flag, just waiting for the kick it needs to break out toward new highs.

On the downside there is plenty of higher time frame support just below market, something that in my opinion has helped prop up the Aussie through all the market craziness we’ve been experiencing lately.

So putting this all together, we have an expectantly bearish market going into a live RBA meeting where the ‘shock’ will be a no change to interest rates. That says to me that the greatest risk of disappointment lies with AUD/USD shorts. No matter what the RBA does, the sensible trade from a risk:reward point of view is more likely long AUD/USD.

Crazy huh! But it is what it is and as much as smoothly communicated monetary policy is good for markets, the best fundamental trades actually come from a re-pricing following reality not aligning with expectations (obviously Friday’s USD/JPY, BoJ inspired price action was an extreme case).

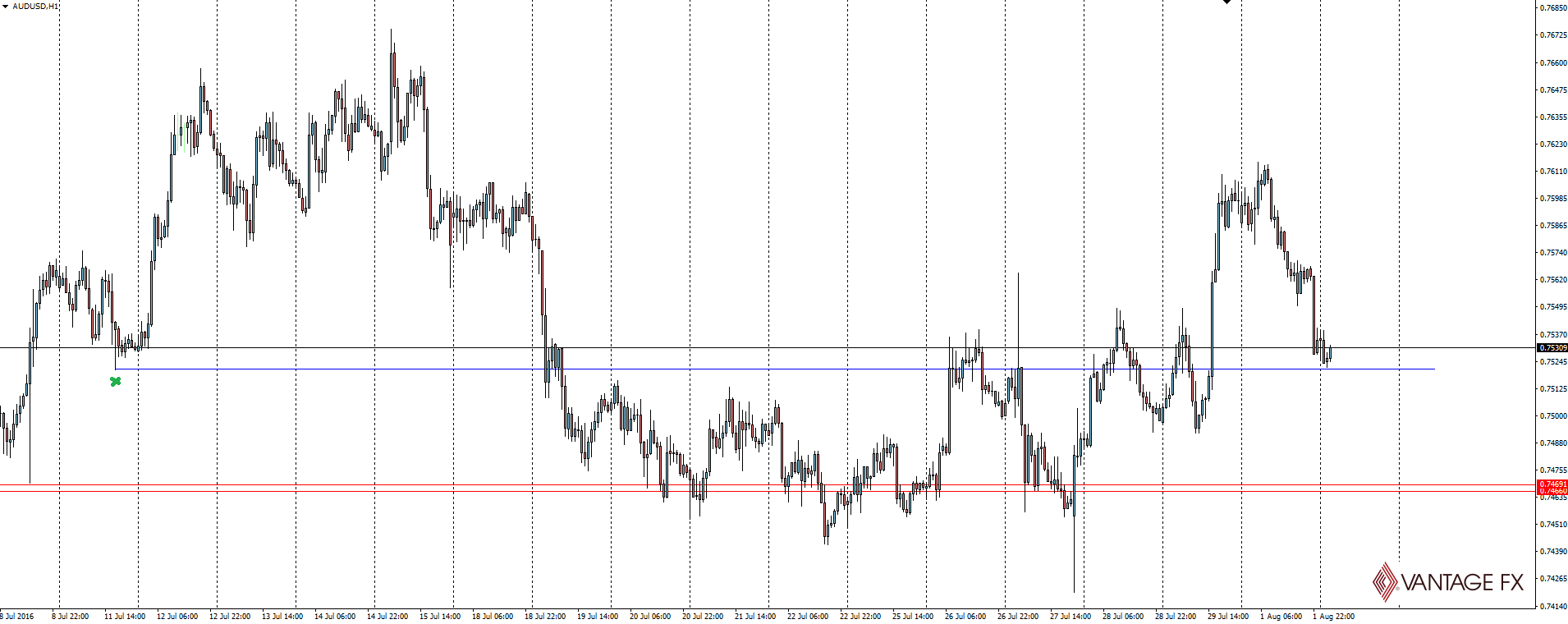

AUD/USD Hourly:

Zooming into the hourly chart, the one level that clearly stands out heading into the release is the above marked spike off which price rallied hard the last time it was tested from above.

Just be aware that we see a few tier 1 data releases out of Australia heading into the RBA, which could chop price around that little bit more than usual.

Stay safe!

On the Calendar Tuesday:

AUD Building Approvals m/m

AUD Trade Balance

NZD Inflation Expectations q/q

AUD Cash Rate

AUD RBA Rate Statement

GBP Construction PMI

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.