The red-hot gold stocks surged again this week in an apparent early-summer breakout. This strong buying is defying their seasonally-weak odds this time of year. Investors are flocking back to the miners as gold powers higher on also-counter-seasonal strong investment buying. Such unprecedented gold-stock strength in early June highlights how undervalued the miners remain relative to gold, but is suspect.

Summers are usually lackluster times for gold, and thus silver and their miners’ stocks. These summer doldrums exist for a couple reasons. Gold simply enjoys no recurring demand spikes driven by cultural or income-cycle factors in June and July unlike during most of the rest of the year. It’s before the Asian-harvest, Indian-wedding-season, and Christmas gold buying that flares up like clockwork in second halves.

And investors all over the world shift their focus in the summer from markets to vacations, so gold’s key investment demand usually stalls too. Thus gold and the gold stocks rarely do anything of note in June and July. They usually drift listlessly sideways to lower in a barren sentiment wasteland. I’ve done a lot of research work on gold and gold-stock seasonality in the past, and summers are absolutely the worst times.

Today’s gold-stock bull only just ignited in mid-January out of extreme fundamentally-absurd 13.5-year secular lows. So this is this young bull’s first summer. But the last secular gold-stock bull ran from way back in November 2000 to September 2011. During that 10.8-year span, the flagship HUI gold-stock index blasted an astounding 1664% higher! Great fortunes are won riding bull markets in gold stocks.

For my seasonality work, I consider those bull-market years from 2001 to 2012. Only the last 6 weeks of 2000 saw that gold-stock bull, so 2000 was overwhelmingly a bear year. And gold stocks were consolidating high in 2012 before gross Fed distortions started crushing gold in early 2013. So it’s interesting to see how gold stocks fared in summers between 2001 to 2012, the last bull-market years before 2016’s new one.

On average over that 12-year span, the HUI exited June 0.6% lower from its May close. And by the end of July, those average summer losses quadrupled to 2.5%. That reversed sharply in August as that big Asian-harvest gold buying came online, with average gold-stock performance since the end of May surging to +3.9% per the HUI. But June and July, the summer doldrums, have always been weak on average.

As of this Wednesday, the data cutoff for this essay, the HUI had rocketed 16.2% since its May 31st close! That is incredible, defying all precedent. While the previous best early-summer performance by this point in June was 2001’s +14.8%, the seasonal average is a considerable 2.3% loss over June’s first couple weeks. Even good gold-stock early Junes only see the HUI up 5% or so. 2016 is proving a major outlier!

There are a couple main reasons why this is happening. Gold stocks suffered an uncharacteristically-weak May. Between 2001 and 2012, May was the best calendar month of the year for gold stocks, as the HUI enjoyed average gains of 6.9%. But in May 2016 the HUI plunged 13.8% in its worst bull-market May on record. And extreme up or down months are usually followed by opposing mean reversions.

But more importantly, gold itself has seen rare early-summer strong investment buying. I wrote a whole essay last week exploring this in depth. American stock investors are continuing to aggressively buy GLD (NYSE:GLD) shares for a variety of reasons. This ongoing massive gold investment buying counter to normal weak summer seasonals is forcing this metal higher so the gold stocks are naturally following.

While I certainly didn’t expect this record early-summer strength in precious-metals land, I did realize there was a possibility gold investment demand would remain stronger than normal coming off those deep secular lows of late 2015. So I realized the big profits on 1/3rd of our extensive gold-stock and silver-stock trading books in late May, and decided to hold the remaining 2/3rds through summer just in case.

Worst case we’d get stopped out preserving most of our huge gains, and the apparent best case now unfolding exceeds my wildest hopes. So now the big question is whether the gold stocks can sustain their enormous early-summer gains through the rest of the summer doldrums that typically end in late July. Many investors and speculators are waiting, now anxiously, for the usual late-July seasonal buying op.

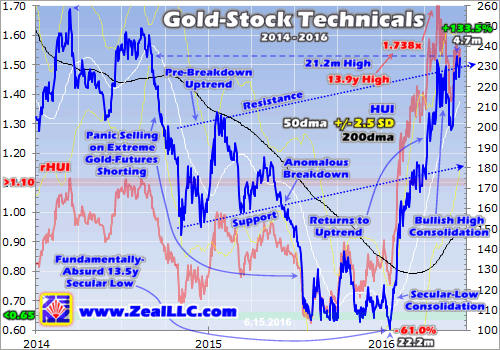

Technically and fundamentally, there’s no problem at all with gold stocks’ recent gains or current price levels. Gold stocks still remain quite low in the grand scheme and very undervalued compared to prevailing gold prices. This first chart examines today’s gold-stock technical situation, looking at that leading HUI gold-stock index, its trends, and its key moving averages. Gold-stock prices are far from excessive.

Though the HUI has skyrocketed 133.5% higher in just 4.7 months as of last week, these gold-stock price levels are still quite low. This extreme early-bull action erupted off that fundamentally-absurd 13.5-year secular low in mid-January. When prices in any market are forced to greatly-anomalous extremes, they always soon mean revert sharply in the opposite direction. That’s the whole story of this new gold-stock bull.

The flagship HUI gold-stock index was actually climbing in a nice uptrend between late 2014 and mid-2015 before an anomalous breakdown driven by extreme gold-futures shorting. Gold stocks have only returned to that pre-breakdown uptrend rendered in this chart. They initially shot up to support before consolidating in March prior to breaking through. After that they blasted right up to resistance in April.

The HUI’s epic 31.0% surge in April catapulted it up to 233.5 as that month ended. After such massive and fast gains, the gold stocks needed to consolidate and they did in May. The HUI had drifted back down near 203.1 before a colossal miss on the US monthly jobs report on June’s first Friday ignited enormous 2.7% and 11.6% rallies in gold and the HUI! That was gold stocks’ biggest up day in 7.5 years.

The entire premise of these strong gold and gold-stock rallies in June 2016 defying normal behavior this time of year is based on the idea the Fed won’t hike rates again anytime soon. That exceedingly-weak jobs report, coming in at just +38k in May compared to economists’ expectations of +164k, was seen as tying the Fed’s hands. The Yellen Fed has long claimed data-dependency, and that jobs number was dreadful.

The idea that this Fed’s joke of a new rate-hike cycle is on hold again is what ignited these rare summer gold and gold-stock rallies. Even though gold has thrived in past Fed-rate-hike cycles with average gains of 26.9% in all 11 since 1971, traders irrationally fear them. So these summer rallies’ Achilles heel is anything that resets market expectations from dovish to hawkish on more near-future Fed rate hikes.

With that jobs report making it all but impossible for the Fed to hike at its latest FOMC meeting held this week, the HUI climbed to 235.2 late last week. But that merely made for a trivial 0.7% gain in the 6 weeks or so since the HUI’s previous bull high in late April. The gold stocks have been consolidating high, which is perfectly normal after such a blistering run higher. And they’ve only regained mid-2014 levels.

With the HUI only at a 21.2-month high, it was still relatively low in the grand scheme as this week’s FOMC meeting approached. So gold stocks’ absolute early-summer levels are far from excessive, they aren’t a problem at all technically. Then the perpetually-dovish Yellen Fed somehow managed to come across as even more dovish than traders expected. So gold and the gold stocks caught another big bid.

The Fed made no hints of a rate hike coming at its next meeting in July, the FOMC members’ projections of future federal-funds-rate levels dropped from their last ones a quarter earlier, and the decision not to hike was unanimous with no dissent from the FOMC’s rare hawkish members. So futures-implied odds of the FOMC hiking rates at its late-July meeting plunged from 21% before this week’s to just 12% after.

And that Fed dovishness is why investors flocked to gold and gold stocks this week, driving their anomalous intraday early-summer breakouts. And that’s the major risk these strong summer rallies face. The Fed’s modus operandi this year has been to talk tough between FOMC meetings warning of imminent rate hikes, but cowardly fold when the times to execute those decisions arrive. This will likely happen again.

The elite central bankers running the FOMC hate the fact that they have little credibility left in the eyes of traders. Fed officials have cried hawk so many times in recent years and failed to carry through that no one believes them anymore. Nevertheless, they keep trying to talk hawkish on rate hikes between FOMC meetings because they want to jawbone those key futures-implied odds of federal-funds rate hikes higher.

The Fed doesn’t want to risk surprising stock markets and sparking a major cascading selloff with a rate hike, so it has to first pave the way by talking hawkish enough to get futures traders expecting a rate hike prior to its execution. So there’s a high chance we’ll see plenty of hawkish rate-hikes-are-necessary-and-imminent speeches by top Fed officials this summer. Gold has suffered kneejerk selloffs on hawkish talk.

There’s also a good chance some economic data this summer will come in better than expected, which will get traders worrying about Fed rate hikes again. Since these rare summer surges in gold and its miners stocks were psychologically driven by Fed dovishness, Fed hawkishness is definitely a threat to their staying power. And with 6 weeks until late July, we certainly aren’t out of the summer-doldrums woods yet.

So it’s definitely prudent to remain cautious until gold’s major seasonal lows in late July arrive. If you’re already deployed in gold stocks and silver stocks, enjoy these awesome summer rallies but make sure you have stops in place. And if you’re looking to add positions in this sector, there’s no rush despite the surprising strength of the past couple weeks. This reminds me of some great Colorado highway signs.

As Interstate 70 drops out of the mountains coming into Denver from the west, there are striking giant yellow signs. One reads, “TRUCKERS, DON’T BE FOOLED, 4 MORE MILES OF STEEP GRADES AND SHARP CURVES”. Despite the awesome gold action in recent weeks, June and July have long proven historically no time to get excited about gold upside. We’re still early in gold’s weakest time of the year seasonally.

In addition to virtually no chance Fed officials won’t try to aggressively reset traders’ expectations back to hawkish over the next 6 weeks, American gold-futures speculators continue to maintain high longs and low shorts. These guys are very bullish, which means a lot of pent-up and potential gold-futures selling still exists that would likely easily temporarily overwhelm any gold investment demand. Be careful here.

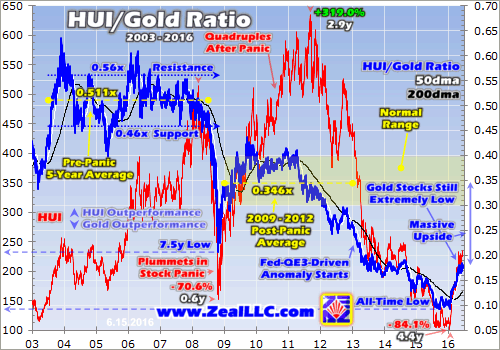

Nevertheless, any typical summer seasonal weakness is only a short-term concern. Gold stocks remain very cheap relative to gold, which drives their profits and hence ultimately their stock prices. This last chart looks at the ratio of that HUI gold-stock index to the price of gold. This HGR highlights how small gold stocks’ young new bull has been compared to its potential, and why this sector still has a long way to climb.

Gold stocks are ultimately leveraged plays on the price of gold. Since their mining costs are largely fixed during mine-planning stages, gold-price increases translate directly into higher profits. These profits rise far faster than gold prices, as I explained in a recent essay on gold miners’ Q1’16 fundamentals. The HUI/Gold Ratio is a quick proxy to distill down gold stocks’ crucial fundamental relationship with gold.

As of the middle of this week, the HGR was running at just 0.181x. While that’s double the HGR’s all-time low of 0.093x first seen in late September then again in mid-January, gold stocks still remain very undervalued at today’s prevailing gold prices. Between 2009 and 2012, the last normal years sandwiched between 2008’s stock panic and the Fed’s gross market distortions starting in 2013, the HGR averaged 0.346x.

The gold stocks still have a long ways to climb to mean revert back up to those normal levels relative to gold. At $1250, $1300, and $1350 gold, a merely-average 0.346x HUI/Gold Ratio implies this leading gold-stock index would need to soar to 433, 450, and 467. That’s another 85%, 92% and 100% above this week’s levels! And these HUI price projections are actually quite conservative for a couple key reasons.

Gold itself is mean reverting out of deep secular lows as well. Back in 2012 before the Fed’s QE3-driven stock-market levitation devastated gold investment demand and prices, gold averaged $1669. Plug that into that 2009-to-2012 normal-year HGR average, and the HUI target rockets to 577! And coming out of extremes, mean reversions almost always overshoot proportionally towards the opposite extreme before they end.

So both gold and the HUI’s ratio to it are almost certain to surge way beyond those average levels before their young bull markets fully run their courses over the next couple years. While no one yet knows how big those overshoots will eventually prove, the gold-stock price targets they imply are breathtaking. So gold stocks’ young bull is far from over, they still have massive upside regardless of what happens this summer.

Those truckers descending out of the mountains towards Denver risk being lulled into complacency by the first relatively-flat stretch of highway, which is far from the end of the steep risky part. Similarly very-rare gold and gold-stock early-summer surges driven by dovish Fed psychology doesn’t mean gold’s weak season has prematurely ended. We’ve got 6 more weeks of steep grades and sharp curves coming!

There’s certainly a chance the strong gold investment buying will continue, pushing gold and therefore its miners stocks even higher. This is especially true if lofty and wildly-overvalued stock markets once again start rolling over into their long-overdue cyclical bear. That possibility is why I held 2/3rds of our gold-stock and silver-stock trading books this summer, with huge gains protected by trailing stop losses.

But the odds of gold investors continuing to perceive the Fed as overwhelmingly-dovish until the end of July seem pretty slim. At some point soon here, it’s very likely the hawkish regional-Fed presidents are going to once again storm the podiums to pound the table about the need for rate hikes soon. Enough of that will spook the heavily-long gold-futures speculators into selling, which will quickly weaken gold.

So while I’m loving gold stocks’ anomalous early-summer rally adding to our huge unrealized gains, decades of experience trading this sector have made me wary of early-summer gold strength. Whether you want to deploy into a leading gold-stock ETF like the GDX VanEck Vectors Gold Miners ETF (NYSE:GDX), or higher-potential elite individual gold and silver stocks like we do, it’s probably prudent to first see what late July brings.

That’s the last major seasonal low ahead of the big autumn rallies in gold and gold stocks, which history has shown is the ideal time to buy on average. While gold and gold stocks may very well defy the odds to keep climbing over the next 6 weeks, chances are they won’t. Their summer-doldrums upside from here is likely modest at best, but the near-term downside risk out of record early-summer strength is considerable.

The bottom line is gold stocks’ strong early-summer rally is very bullish yet somewhat suspect. Gold stocks still remain relatively low technically and super-undervalued relative to gold, their young new bull is far from over. Yet early-summer strength is a very-rare anomaly, and it’s hard to imagine the extreme Fed dovishness fueling it persisting for the entire rest of this summer. So near-term caution remains in order.

Despite gold stocks’ sharp rally in recent weeks, we remain in the weakest time of the year seasonally for gold and gold stocks in June and July. History has proven the odds don’t favor sustainable summer rallies until early August. Thus it’s not prudent to chase these rallies and add new positions at this point. Enjoy the mounting gains in gold stocks you already own, but wait until seasonals shift bullish to buy more.