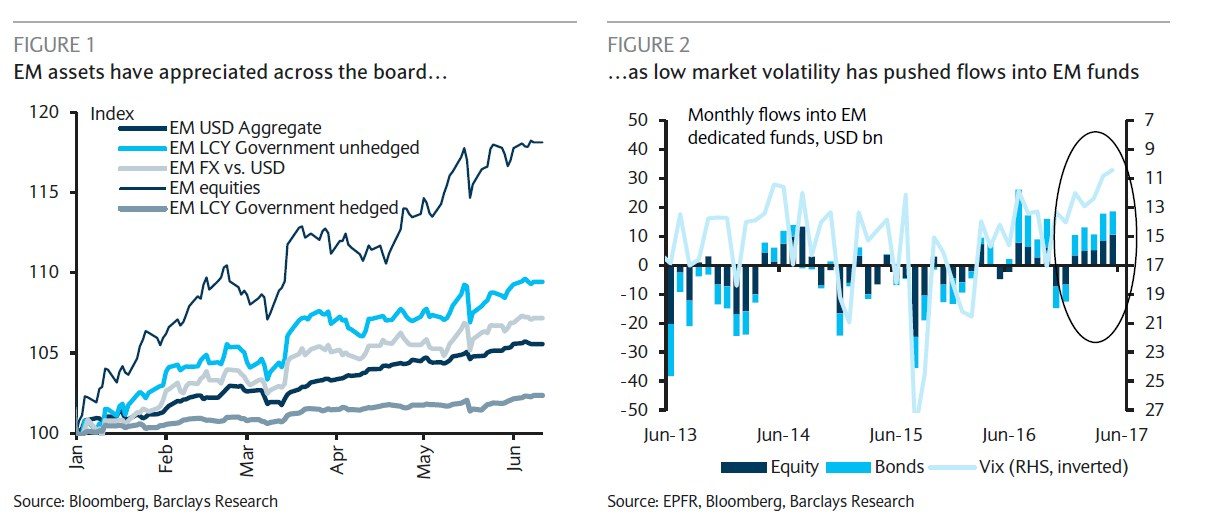

On the back of global growth recovery and supportive monetary policy by core central banks, emerging markets logged another positive Q2 performance, notes Barclays. Christian Keller and colleagues said in their June 23 research piece titled “Calm on the surface, some turbulence beneath” that they believe global growth recovery remains largely intact, despite losing some momentum.

Global Growth Recovery, Low volatility channel flows into EM funds

Highlighting the low-volatility environment supporting EM capital flows, Keller and team point out in “The Emerging Markets Quarterly” that global marketvolatility has dropped to multi-year lows. The analysts believe a lighter global events calendar over the summer will augur well for EM assets’ performance.

The Barclays (LON:BARC) analysts forecast that annual global growth will touch 3.8% in 2017, with EM growth in aggregate surpassing 5% and re-widening the gap with DM growth. In addition to a global growth recovery, the analysts believe EM asset performance will also be aided by supportive monetary policy by core central banks on the back of softening inflation dynamics.

Despite the above “push factors” for global growth recovery, the analysts caution that the EM growth picture as a “pull factor” has turned out to be more mixed in recent times. For instance, the analysts point to China’s renewed slowdown on the back of a strong Q1 and LatAm continuously lagging behind other EM regions.

However, the Barclays analysts anticipate that the rest of EM Asia will counterbalance the effects from a slowing China. Accordingly, the analysts have revised upwards their 2017 growth forecasts for some of the export-oriented Asian economies, such as Hong Kong, Malaysia, Korea and Singapore.

China’s currency to remain stable in near future

Keller and colleagues believe China’s slowing growth won’t fuel concerns about global markets. Citing recently published data, the analysts point out that China’s PMIs have been steady and corporate profits have shown increasing trends.

However, the analysts underscore that the country will tread a fine line between deleveraging and slowing growth. The analysts anticipate that the PBoC will stay put, with a low probability of moves in policy rates. Keller and team believe China’s currency will remain stable in the coming months with a largely stable CNY forecast.

The Barclays analysts anticipate that 2017 will be Emerging Europe’s best year since 2013, with Turkey’s growth momentum gaining pace and Russia witnessing a consumption-led recovery. However, the analysts believe Latin America is witnessing growth headwinds, and they have revised down their growth estimates for Argentina, Peru, and Cambodia in 2017 and for Brazil in 2018. The analysts pegged the region’s GDP to expand 1.6% y/y in 2017 and 2.2% y/y in 2018.