In a curious and completely unfair move, the Italian government has decided to issue a massive bailout of €17 Billion to close down two failing banks.

As part of the deal, a bank called Intesa Sanpaolo (MI:ISP) will be making out like bandits as they have the option to buy any good assets that the two banks currently hold for pennies on the dollar, while all the bad assets get transferred to a bad bank.

"With these two banks out of the way, it seems the Italian banking crisis is now behind us, at least as far as the bankers are concerned. Now, we only have the mess that is left for the taxpayers to clean up," said Gabriel Debach, and eToro analyst in Italy.

At the end of the day, it's the Italian taxpayers who will end up footing most of the bill. Politicians claim that they don't have much of a choice but we all know how that goes. As if the Italian's self-inflicted political woes aren't big enough, it seems the human cockroach Silvio Berlusconi is again making political gains in the ravaged country.

We're still waiting to hear when the Italian general elections will be. Let me tell you when they do happen, it could be even stranger than a tea party with the mad hatter himself.

Today's Highlights

- Market Inconsistency

- Modi -Trump, May, and Draghi

- Ethereum Under Pressure

Please note: All data, figures & graphs below are valid as of June 26th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

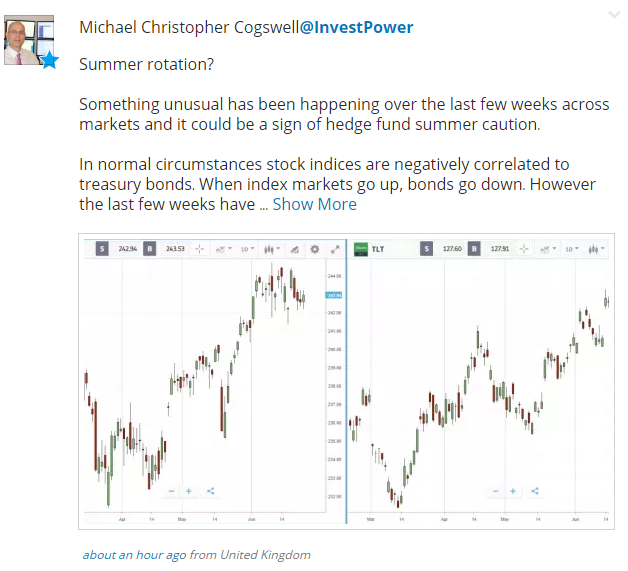

This analysis comes to you from popular investor Michael Cogswell, who goes by the handle @InvestPower on the eToro network. Seems he's found yet another glitch in the market matrix.

Usually, stock indexes and bonds tend to move in the opposite direction but here we can see both rising simultaneously.

This shows us that stock investors aren't willing to part with their shares while bonds investors are shying away from risk.

It seems that volatility hovering near the all time lowest levels has everybody a bit confused at the moment.

Eventful Day Ahead

The top event is Indian Prime Minister Narendra Modi visiting Donald Trump in the White House. Also on the agenda, Theresa May will give further details on how she sees the rights of EU residents in the UK after Brexit, even though May still has no deal with the DUP.

The cherry on the top today is Mario Draghi, who will open a grand old central banking ceremony in Portugal.

Though the VIX and stock indexes are relatively silent, there's plenty of movement in the currency markets lately and even more in the cryptocurrencies...

Down the Rabbit Hole

Those investing on the world's second largest cryptocurrency are already feeling the crunch and many are hitting the panic button.

The issue is, that when an asset rises this fast, it doesn't really have time to build itself any familiar price patterns or notable levels of support.

Notable network congestion during recent ICOs has caused alternative investors to start questioning the stability of the ethereum blockchain and no doubt some developers are starting to look at alternative options to implement their decentralized apps and smart contracts.

It's come a long way from $11 in February to a peak of $425 in June.

At this point, we can only guess where it might turn around. Technical and fundamental analysis won't be much help here. We need to think about the psychological levels. Could be that we'll hold $250 and go straight to the moon from here.

However, we should also be prepared for the possibility of a trip down to $200, $150, or even $100. The best way to prepare for these type of moves is to analyze your portfolio and diversify to the best of your ability.

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.