Here are four stocks with buy rank and strong income characteristics for investors to consider today, June 19th:

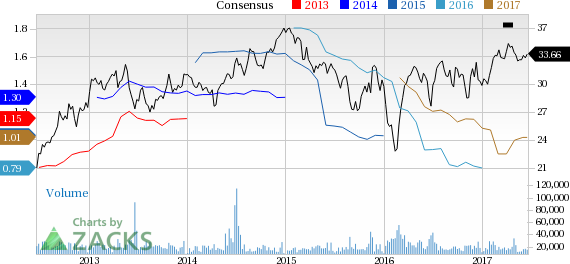

Weyerhaeuser Co. (WY): This real estate investment trusthas witnessed the Zacks Consensus Estimate for its current year earnings advancing 11% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 3.68%, compared with the industry average of 0.00%. Its five-year average dividend yield is 3.31%.

Tupperware Brands Corporation (TUP): This direct-to-consumer marketer of various productshas witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.8% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 3.83%, compared with the industry average of 1.17%. Its five-year average dividend yield is 3.73%.

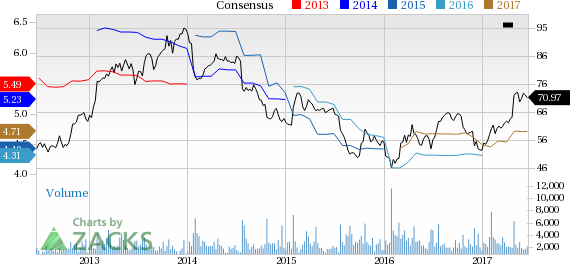

Target Corporation (NYSE:TGT) (TGT): This general merchandise retailerhas witnessed the Zacks Consensus Estimate for its current year earnings advancing 4.5% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 4.56%, compared with the industry average of 1.03%. Its five-year average dividend yield is 3.31%.

Moelis & Company (MC): This financial advisory services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12% over the last 60 days.

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.91%, compared with the industry average of 0.00%. Its five-year average dividend yield is 3.29%.

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

3 Stocks to Ride a 588% Revenue Explosion

At Zacks, we're mostly focused on short-term profit cycles, but the hottest of all technology mega-trends is starting to take hold...

By last year, it was already generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. See Zacks' Top 3 Stocks to Ride This Space >>

Weyerhaeuser Company (WY): Free Stock Analysis Report

Tupperware Brands Corporation (TUP): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Moelis & Company (MC): Free Stock Analysis Report

Original post

Zacks Investment Research