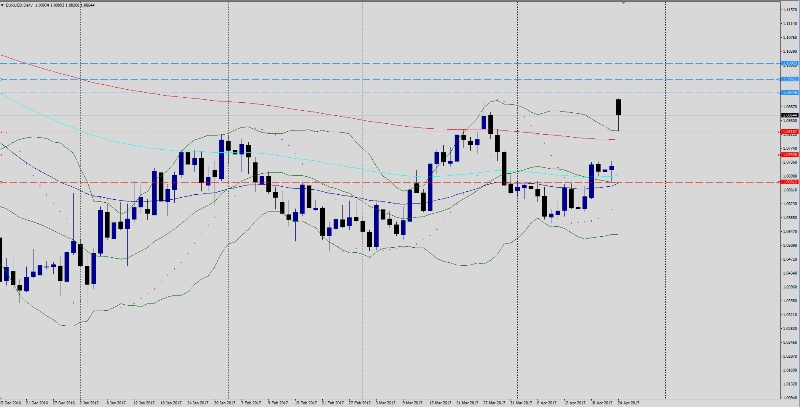

EUR/USD inaugurated early trading sessions with a +190-pips upward gap, then added +2-pips and clocked 5 months a half high at 1.0918 driven by optimism aroused by yesterday's French Election first round outcome given that Macron (Pro EU) headed first with 23.7% of French voters, Le Pen (Anti EU) second 21.7%. But what really boosted EUR/USD is that Fillon (Pro EU) came third with 19.9% and has requested his supporters to add their votes to Macron, hence an EU dissociation now falls into a thin scenario but still, a second round will be conducted on May the 7th where Macron and Le Pen face each others neck to neck, and Frexit will a greasy item on the menu which will create a high volatility of the pair trading coming days, depending on how French Polls play ahead.

The pair failed to guard the 1.09 level, retreated to 1.0820 low as minor down-trend correction, currently trading 1.0864 intraday. U.S Index also gaped -$0.78 with a 98.83, adding -$2.41 losses to April the 10th 101.24 high. Although EUR/USD currently bullish, market should expect a choppy bullish and bearish sideways trade for the pair in the coming hours. Trade could be poised with shy price action in the coming 2 hours ahead of German Ifo and Buba reports, but volatility should re-kick after the release.

Fundamentals:

1- EUR -German Ifo Business Climate today at 8:00 AM GMT.

2- EUR - German Buba Monthly Report today at 10:00 AM GMT.

Technical Overview:

Trend: Bullish Sideways

Resistance levels: R1 1.0924, R2 1.0962, R3 1.1005

Support levels: S1 1.0818, S2 1.0755, S3 1.0681

Comment: The market is bullish with expectations of intensive choppy sideways trade due to the above fundamentals. Dips should fight S1. Closing above 1.08 is positive. A penetration for R1 level projects additional hikes towards R2 level. A penetration for S1 level will increase selloffs and wash towards S2 level at which below, the cable will turn bearish. Keep an eye on U.S index levels.