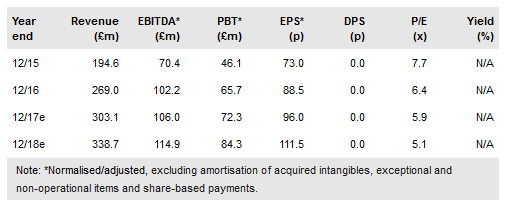

Jackpotjoy plc’s (LON:JPJ) maiden London-listed results demonstrated the benefits of leading market brands in a profitable and cash generative business. Pro-forma group revenues grew 15% in FY16, with industry leading EBITDA margins of 38%. The stock has suffered from unusually high net debt, a lack of dividend and a complex relationship with Gamesys. However, the revised terms of the contract, together with the end of the major earn-out period, suggest that deleveraging will be on track. 2017 trading multiples of 6.7x EV/EBITDA and 5.9x P/E are far below the sector and, as JPJ continues to demonstrate its market dominance in bingo-led gaming, the stock appears attractive as a turn-around candidate.

Maiden London results: Market-leading margins

JPJ reported robust first results as a UK-listed stock. Pro-forma revenues grew 15% to £269m in FY16, with an adjusted EBITDA of £102.2m, above our estimates of £265m and £98.6m respectively. Operating cash flow conversion was 81% (101% excluding an exceptional transaction). As a market leader in online bingo-led gaming, growth in the Jackpotjoy division was particularly strong, with an EBITDA margin of 45%. In line with JPJ expectations, Q117 revenue grew c 10%.

To read the entire report Please click on the pdf File Below