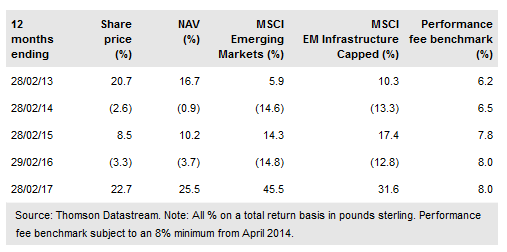

Utilico Emerging Markets Ltd (LON:UEM) aims to generate long-term total returns from a portfolio invested primarily in operational and cash generative companies in emerging markets infrastructure and utility sectors. UEM typically holds about 60 to 90 high-conviction positions and is broadly diversified by both sector and geography; the manager has a long-term investment approach and aims to generate a 15% pa total return from each holding. More than 95% of the portfolio is invested in well-established businesses with 75% comprising companies paying a dividend. UEM has increased or maintained its dividend every year since launch in 2005.

Investment strategy: Focus on infrastructure/utilities

Charles Jillings has managed UEM since the fund was launched in July 2005; he adopts a long-term, bottom-up investment approach, avoiding short-term ‘noise’ in the stock markets. Companies considered for investment have attractive fundamentals, such as strong cash flows supporting dividend yields, and trade at a discount to their estimated intrinsic value. Meeting with company managements and site visits are key elements of the investment process. UEM’s gearing has increased as the manager has taken advantage of attractive company valuations to add exposure outside of UEM’s largest positions. At end-February 2017, net gearing was 3.6%.

To read the entire report Please click on the pdf File Below