For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.0614.

In economic news, the Euro-zone’s flash consumer confidence index deteriorated to a three-month low level of -6.2 in February, more than market expectations of a fall to a level of -4.9, indicating that rising political uncertainty and higher inflation in the Euro-bloc may be taking its toll on the economy. The index had recorded a revised level of -4.8 in the previous month.

Separately, according to Bundesbank monthly report, German economy will likely strengthen in the first quarter of 2017, driven by high industrial activity and consumer spending.

In other economic news, Germany’s producer price index advanced 2.4% YoY in January, accelerating at its fastest pace since March 2012 and surpassing market consensus for a gain of 2.0%. In the prior month, the index had recorded a rise of 1.0%.

In the Asian session, at GMT0400, the pair is trading at 1.0578, with the EUR trading 0.34% lower against the USD from yesterday’s close.

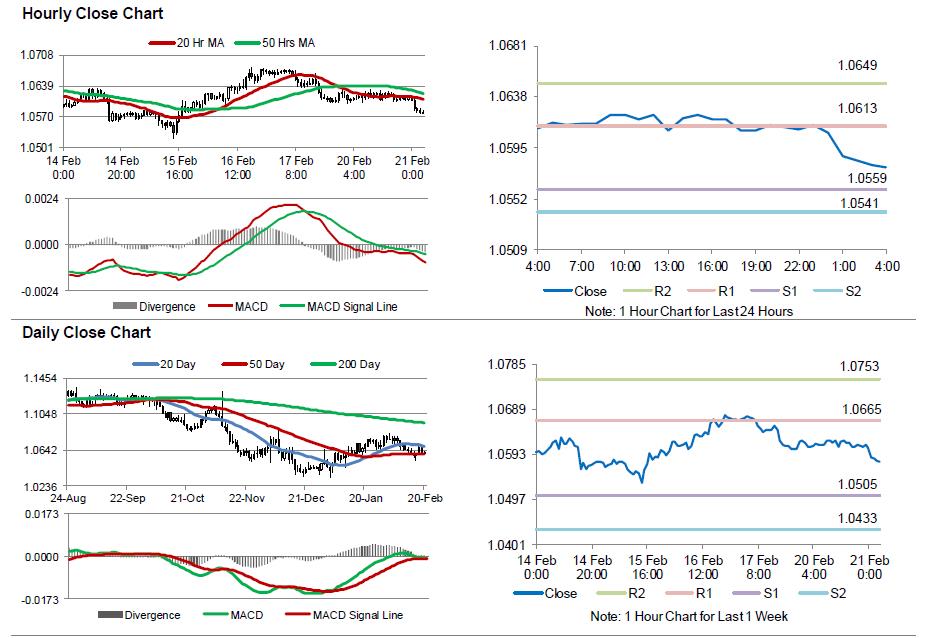

The pair is expected to find support at 1.0559, and a fall through could take it to the next support level of 1.0541. The pair is expected to find its first resistance at 1.0613, and a rise through could take it to the next resistance level of 1.0649.

Going ahead, investors will closely monitor the release of preliminary Markit manufacturing and services PMI, both for February across the Euro-zone, slated to release in a few hours. Moreover, the US flash Markit manufacturing and services PMI, both for February, scheduled to release later today, will be eyed by traders.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.