10 Year Treasury Note Non-Commercial Positions:

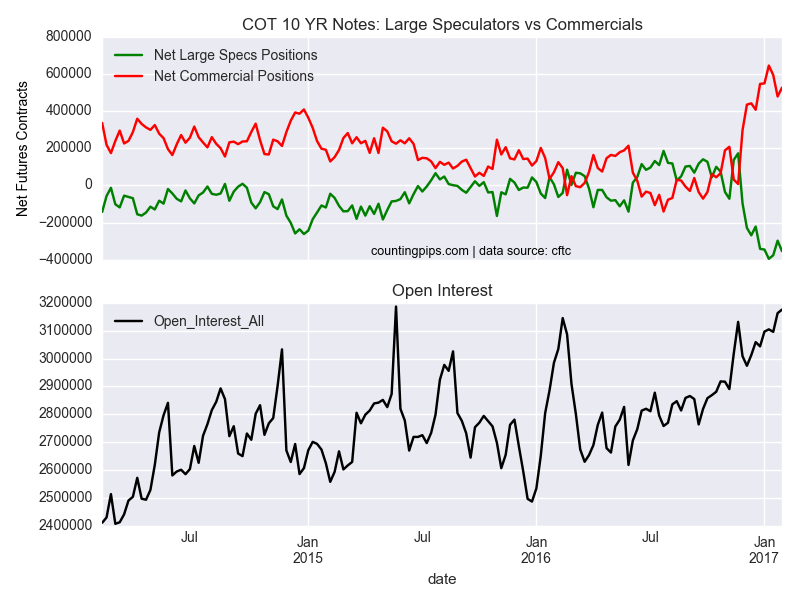

Large speculators resumed adding to bearish net positions in the 10-Year treasury note futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

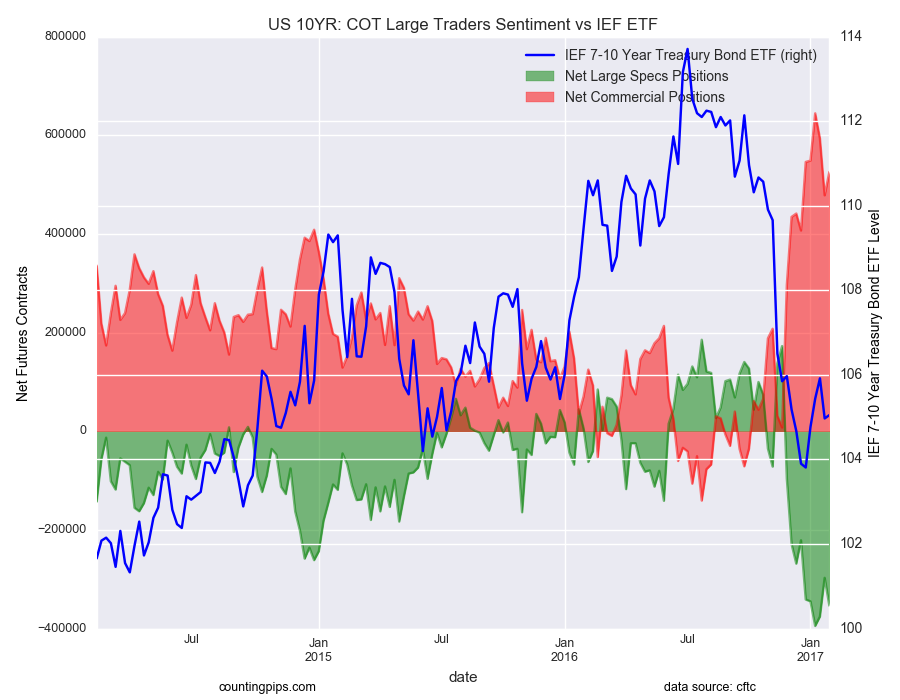

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of -353,651 contracts in the data reported through January 31st. This was a weekly change of -56,472 contracts from the previous week which had a total of -297,179 net contracts.

Speculators had pulled back on bearish positions the previous two weeks after reaching an all-time bearish high on January 10th before last week’s increase.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 525,913 contracts last week. This is a weekly increase of 47,551 contracts from the total net of 478,362 contracts reported the previous week.

IEF 7-10 Year Bond ETF (NYSE:IEF):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $105.05, which was a slight gain of $0.08 from the previous close of $104.97, according to ETF market data.