As with any bearishness over the years, it has to be taken with a grain of salt. If the market drops hard, then a hard bounce is right around the corner, and if the market sells off slowly but surely, the gains that could have been made by shorting it, will hardly be worth it.

Right now the market is playing out the latter scenario, with two gaps at the same price level overhead on the SPDR S&P 500 (NYSE:SPY) that remains unfilled. So while the sell-off seems to have some momentum on its side, I don't expect it to last quite honestly.

If 2155 can break then you have something notable worth talking about, but that isn't in the here or now, unless the Fed minutes that come out today change that scenario.

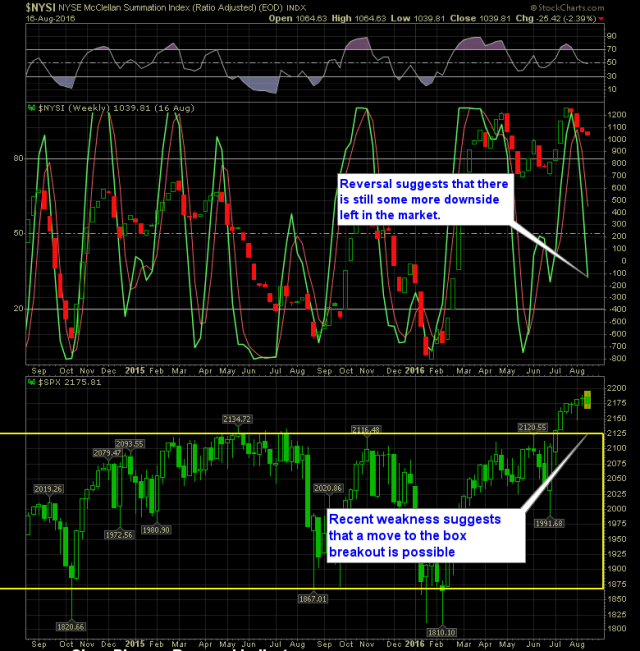

On the SharePlanner Reversal Indicator below you have a bearish reversal in effect, but rather than correcting through price, it is primarily correcting through time with an up/down/up/down price action.

Here's the SPRI: