Shares of the wings, beer and sports-centric restaurant chain Buffalo Wild Wings (NASDAQ:BWLD) surged in Wednesday morning trade above $165, a jump of nearly 13%. The company released its second quarter 2016 financial results, and despite a decline in same-store sales, BWLD was pleased with its performance.

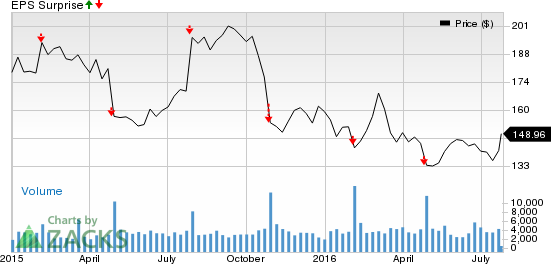

The company posted a slightly higher-than-expected EPS figure of $1.27, above the Zacks Consensus Estimate of $1.26. Revenue estimates of $502.32 million were not met though, as the company posted revenue of $490.2 million. Quarterly revenues did grow 15% year-over-year, though the growth was driven entirely by new restaurant openings and franchise acquisitions. Same-stores sales declined 2.1% and 2.6% at company-owned and franchised restaurants respectively.

On the bottom line the company’s net income grew 10.2% to $23.7, and a 13.1% increase in earnings per diluted share to $1.27, thanks to 548,402 shares being repurchased for $75 during the quarter. The company also reiterated its previous guidance for full-year earnings of between $5.65 to $5.85. The current Zacks Consensus Estimate for full-year earnings stands at $5.73.

On Monday, activist investor Marcato Capital Management disclosed a 5.1% stake in BWLD, making it the company’s fourth-largest investor. Sales declines may open up the opportunity for Marcato to instill some of the ideas it has for the company, like shaking up management, or altering the company’s capital structure.

Buffalo Wild Wings executives aren’t turning a blind eye towards Marcato’s ideas either, with President and CEO Sally Smith commenting, “We do have some capacity to take on debt.” Also according to Smith, the company would first look to repurchase shares, and then possibly offer a dividend. BWLD is holding an analyst day on August 16th where it intends to share its plans to enhance shareholder value, where some of these ideas could be discussed.

Buffalo Wild Wings is currently a Zacks Rank #2 (Buy), and shares of the company are up nearly 3% so far this year.

BUFFALO WLD WNG (BWLD): Free Stock Analysis Report

Original post

Zacks Investment Research