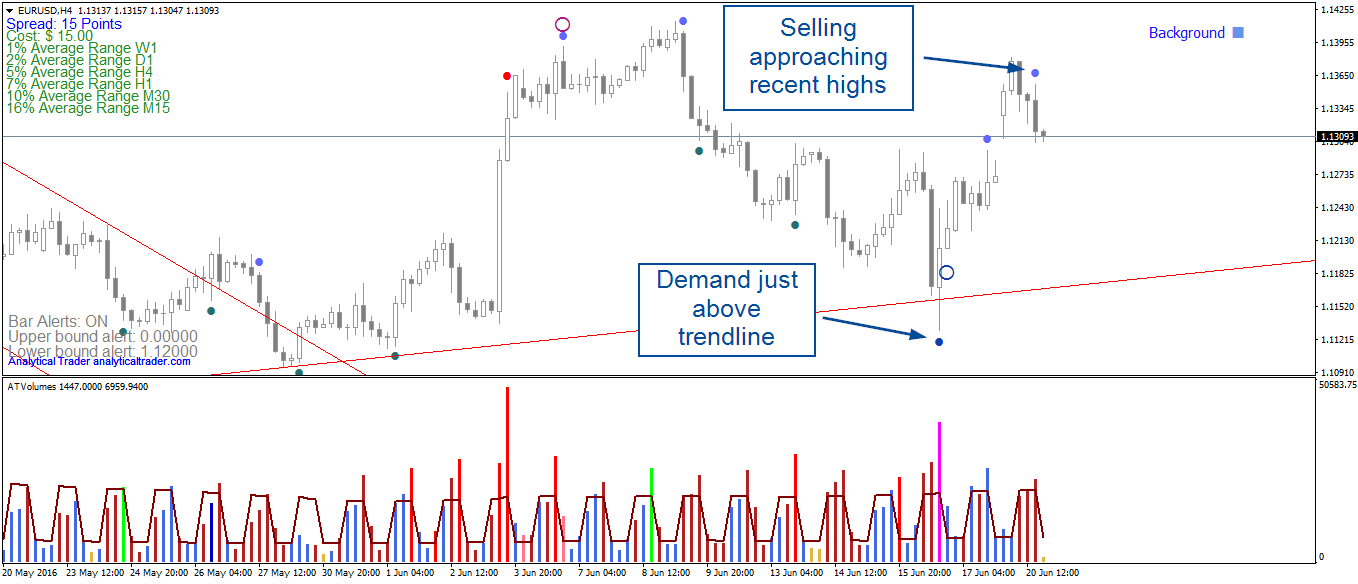

This rally comes from heavy demand seen near the trendline, which showed trend support. Over the next sessions, more buying supported higher prices, and Sunday’s gap provided a final push.

Reaching 1.14, it wasn’t able to breakout, and in the last hours, VSA showed minor supply in EUR/USD. I expect prices to close the gap and test the 1.120 – 1.125 area, which would be another opportunity to go long in this pair.

Caution on Thursday’s Brexit, which might be bearish for the euro if it wins, as investors would expect an economic downturn for one of the biggest EU economies, and therefore, less demand for euros.

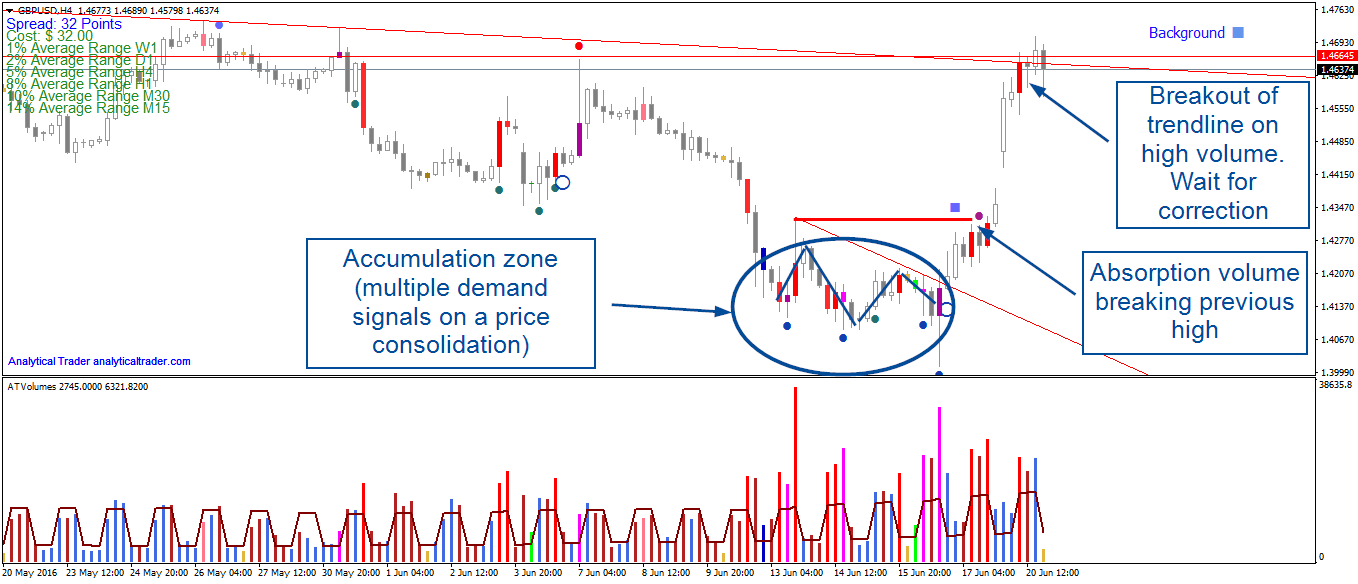

The pound is on a big rally as polls show the Remain vote is gaining ground against the Leave position. Looking at GU’s chart with volumes, we see that Pound was actually being bought days before this surge, on multiple days and sessions. At 1.432 it showed some congestion, possibly with many locked-in traders in the last high’s, selling at this point.

It continued to rally further and broke out what I believe it’s an important price, a long-term down trendline. The volumes continue to show buying, but with such extended prices, I would expect a correction soon. On a correction, a turn of the Dynamic Trend’s to green or low volume bars will provide a long entry opportunity.

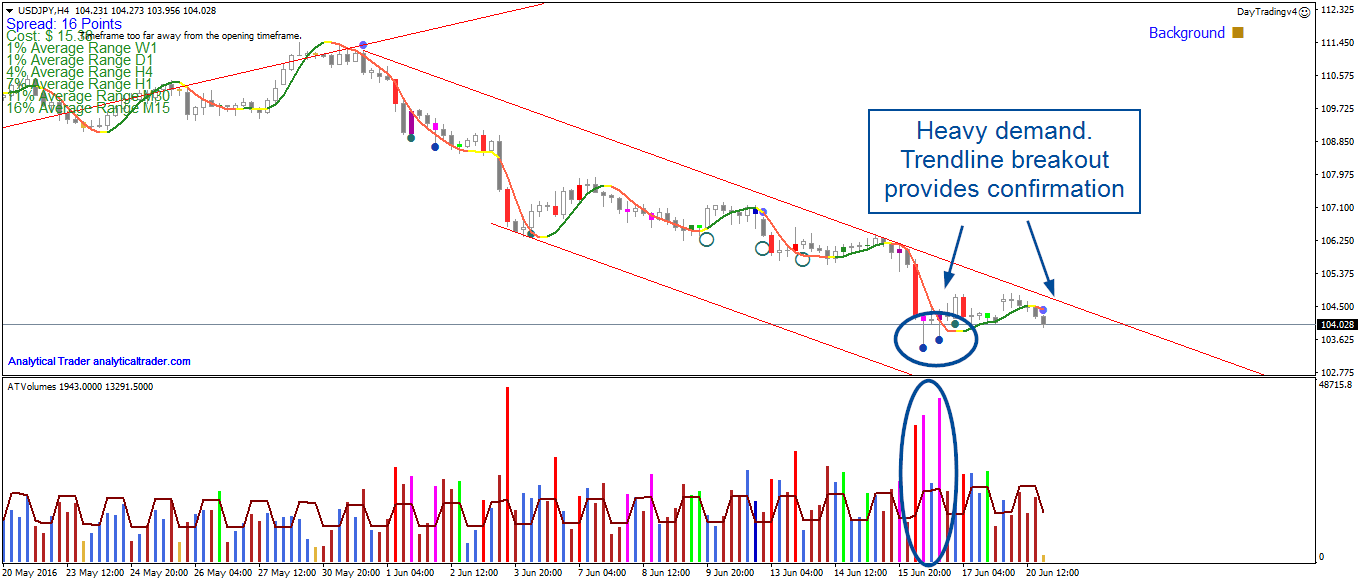

In USD/JPY we see various demand signals at this level, and a trendline break would be a good confirmation of the strength. For the time being, the background is weak, there’s a considerable downtrend behind, and I believe something more concrete is needed to be able to go long.

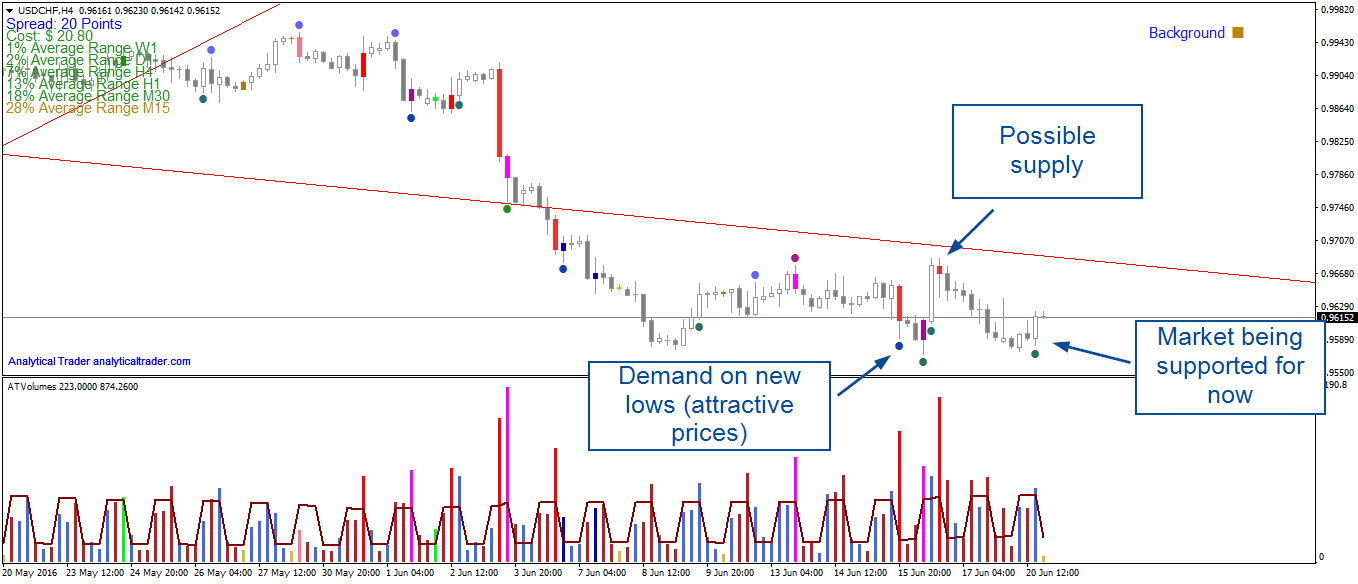

USD/CHF is also showing demand at these prices, though more modest. 0.967 is the level to watch for in this pair, since the high volume on that price (last red bar) suggests there are many sellers at those prices.

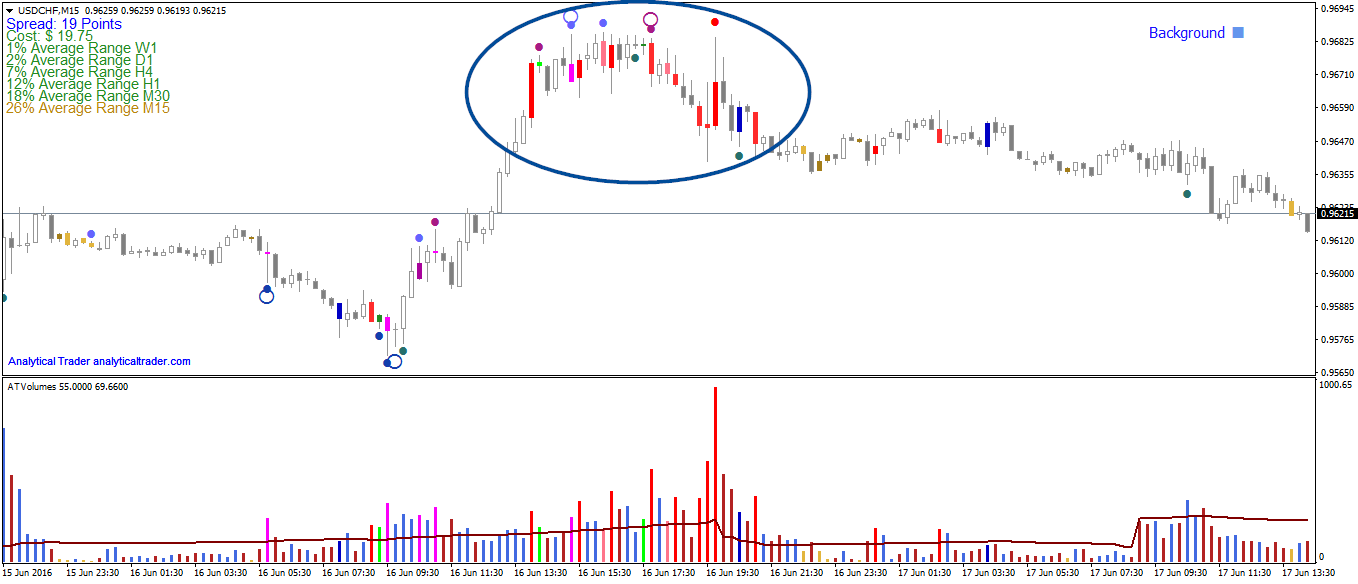

Every time there is a high volume bar, it’s good to check what happened in a lower timeframe, where VSA will show a clearer picture with the supply/demand signals. In this case, the picture below shows that bar actually showed supply. If there is more selling or low volume up bars near those prices, it will be a signal to short in M15/M30.