Yesterday the IMF released the lastest Global Financial Stability Report and it isn't pretty. The IMF now sees via Zero Hedge:

From the report: Recovery Expected To Stall In Many Economies

"The updated WEO projections see global activity decelerating but not collapsing. Most advanced economies avoid falling back into a recession, while activity in emerging and developing economies slows from a high pace. However, this is predicated on the assumption that in the euro area, policymakers intensify efforts to address the crisis. As a result, sovereign bond premiums stabilize near current levels and start to normalize in early 2013. Also, policies succeed in limiting deleveraging by euro area banks. Credit and investment in the euro area contract only modestly, with limited financial and trade spillovers to other regions.

Downside Risks Have Risen Sharply

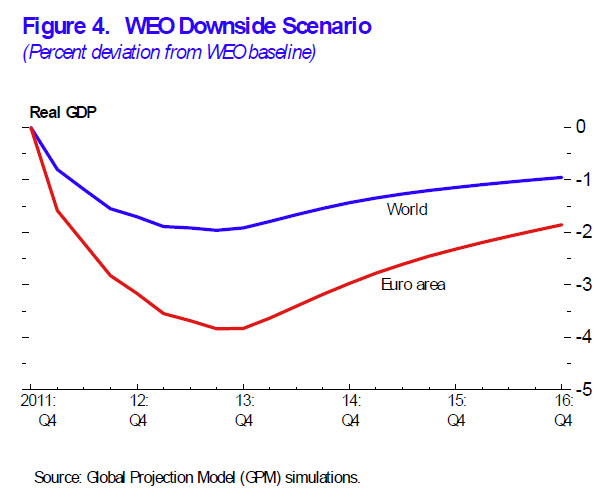

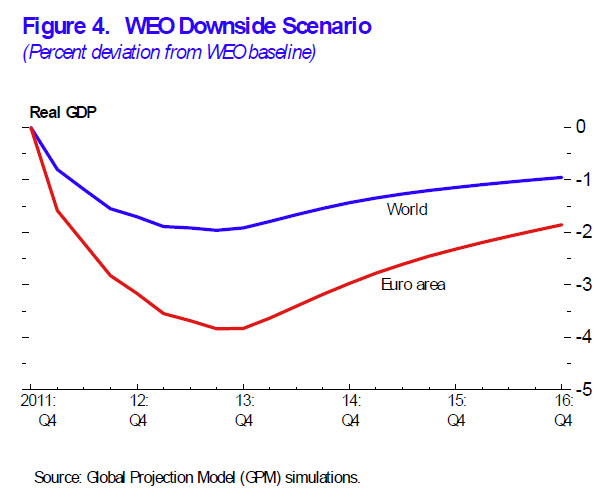

Risks stem from several sources. The most immediate risk is intensification of the adverse feedback loops between sovereign and bank funding pressures in the euro area, resulting in much larger and more protracted bank deleveraging and sizable contractions in credit and output. Figure 4 presents such a downside scenario. It assumes that sovereign spreads temporarily rise. Increased concerns about fiscal sustainability force a more front-loaded fiscal consolidation, which depresses near-term demand and growth. Bank asset quality deteriorates by more than in the baseline, owing to higher losses on sovereign debt holdings and on loans to the private sector. Private investment contracts by additional 1¾ percentage points of GDP (relative to WEO projections). As a result, euro area output is reduced by about 4 percent relative to the WEO forecast. Assuming that financial contagion to the rest of the world is more intense than in the baseline (but weaker than following the collapse of Lehman Brothers in 2008) and taking into consideration spillovers via international trade, global output will be lower than the WEO projections by about 2 percent.

Another downside risk arises from insufficient progress in developing medium-term fiscal consolidation plans in the United States and Japan. In the short term, this risk might be mitigated as the turbulence in the euro area makes government debt of these economies more attractive to investors. However, as long as public debt levels are projected to rise over the medium term, and in the absence of well-defined and credible fiscal consolidation strategies, there is the possibility of turmoil in global bond and currency markets. A more immediate risk is that an accident-prone political economy will lead to excessive fiscal tightening in the near term in the United States. In key emerging economies, risks relate to the possibility of a hard landing, especially in the context of uncertain (possibly slowing) potential output. In recent years, a number of major emerging economies experienced buoyant credit and asset price growth as well as rising financial vulnerabilities. This has buoyed demand and may have led to overestimation of the trend growth rates in these economies. Should the dynamics of real estate and credit markets unwind triggered by losses in confidence and a paring back of expectations at home or by falling demand from abroad—the impact on economic activity could be very damaging.

Moreover, concerns about geopolitical oil supply risks are increasing again. The oil market impact of intensified concerns about an Iran-related oil supply shock (or an actual disruption) would be large, given limited inventory and spare capacity buffers, as well as the still-tight physical market conditions expected throughout 2012."

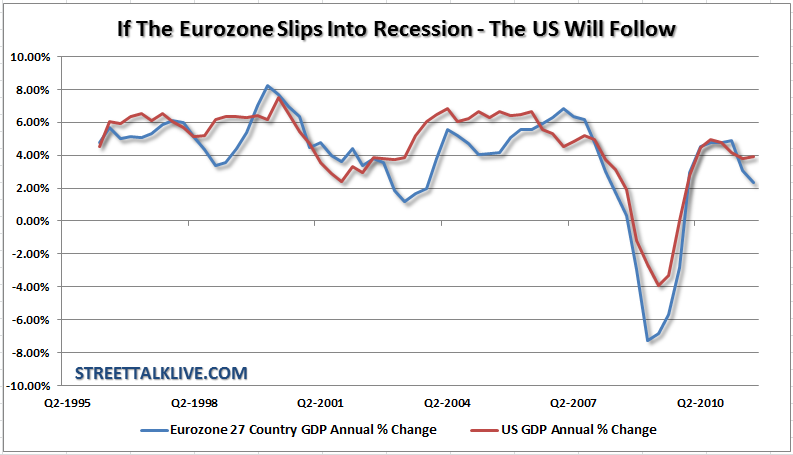

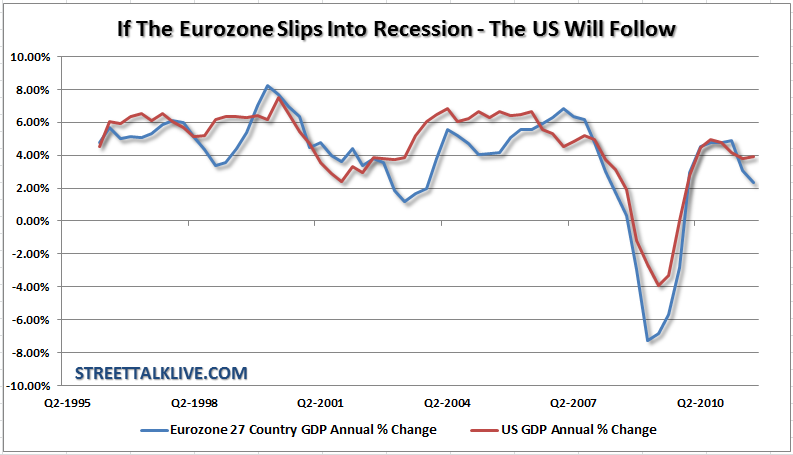

The US Will Not Avoid The Drag

So, with the IMF stating what is really more than obvious, that the Eurozone faces tremendous headwinds into the future. the interesting part of the report is that the 1.8% growth rate in the U.S. was left unchanged while the rest of the world's growth was slashed.This will absolutely not happen.

Today the world is more globally interconnected than at any time in past history. The internet, Fed Ex, cellular and satellite technology, faster mobility and coordinated planning have brought the world economies into close proximity with each other. You don't have to look any further than the recent earthquake in Japan that impacted the U.S. economy within the span of just 3 months. With the economy of one country dependent on that of another for goods and services from which revenue is derived, taxes are paid and money is spent - there is little margin for error.

The real issue is that the a debt crisis is still trying to be solved with debt. As David Rosenberg pointed out in today's missive: "Debt is a two-edged sword. Used wisely and in moderation, it clearly improves welfare. But, when used imprudently and in excess, the result can be a disaster. For individual households and firms, over-borrowing leads to bankruptcy and financial ruin. For a country, too much debt impairs the government's ability to deliver essential services to its citizens. Debt turns cancerous when it reaches 80-100% of GDP for governments..."

Well, don't look now but the U.S. is currently well in excess of 100% of debt to GDP and climbing with the median for OECD countries combined debt ratios of 400%. This is the first time that aggregate debt/GDP has risen above 100% since WWII. With this in mind it is clearly only a function of time until the interdependency between the Eurozone and the U.S. plays catch up. Since it is highly unlikely that the Eurozone will do what is necessary to fix their problems the downside risk to their economy is more than prevalent.

While economic indications have been better as of late it is more a testament to the warmest winter in 5 years than it is to a real recovery in the U.S. economy. Back to Rosie: "Indeed, in the U.S., we have seen a flurry of data showing that housing activity is in full-fledged recovery mode and how employment is picking up steam. As an example, a critical inflection point so far this year was that nice round +200k reading on December nonfarm payrolls, which was released on January 6th. The S&P 500 is up 3% since the release of that number.

But keep in mind that these numbers are all seasonally adjusted. They are expecting December to be bitter cold and adjust for the usually depressed level of economic activity (outside of holiday shopping) that typically occurs late in the year. And the seasonal adjustment process tends to weight more heavily the experience, for any given month, to the prior three years' worth of data.

Keep in mind that for the U.S. as a whole:

So, while there are plenty of strong convictions that the economy is on the mend to a recovery here in the U.S., the potential risks to investors is quite high if those assumptions are wrong.

- 2012 world growth outlook cut to 3.3% from 4.0%, 2013 growth revised lower to 3.9% from 4.5%

- 2012 US growth of 1.8%, 2013 at 2.2%

- 2012 UK growth of 0.6%, down from 1.6%

- 2012 China growth of 8.2%, down from 9.0%

- Eurozone to enter "mild" recession with -0.5% economic growth. Growth accelerates to 0.8% in 2013.

From the report: Recovery Expected To Stall In Many Economies

"The updated WEO projections see global activity decelerating but not collapsing. Most advanced economies avoid falling back into a recession, while activity in emerging and developing economies slows from a high pace. However, this is predicated on the assumption that in the euro area, policymakers intensify efforts to address the crisis. As a result, sovereign bond premiums stabilize near current levels and start to normalize in early 2013. Also, policies succeed in limiting deleveraging by euro area banks. Credit and investment in the euro area contract only modestly, with limited financial and trade spillovers to other regions.

Downside Risks Have Risen Sharply

Risks stem from several sources. The most immediate risk is intensification of the adverse feedback loops between sovereign and bank funding pressures in the euro area, resulting in much larger and more protracted bank deleveraging and sizable contractions in credit and output. Figure 4 presents such a downside scenario. It assumes that sovereign spreads temporarily rise. Increased concerns about fiscal sustainability force a more front-loaded fiscal consolidation, which depresses near-term demand and growth. Bank asset quality deteriorates by more than in the baseline, owing to higher losses on sovereign debt holdings and on loans to the private sector. Private investment contracts by additional 1¾ percentage points of GDP (relative to WEO projections). As a result, euro area output is reduced by about 4 percent relative to the WEO forecast. Assuming that financial contagion to the rest of the world is more intense than in the baseline (but weaker than following the collapse of Lehman Brothers in 2008) and taking into consideration spillovers via international trade, global output will be lower than the WEO projections by about 2 percent.

Another downside risk arises from insufficient progress in developing medium-term fiscal consolidation plans in the United States and Japan. In the short term, this risk might be mitigated as the turbulence in the euro area makes government debt of these economies more attractive to investors. However, as long as public debt levels are projected to rise over the medium term, and in the absence of well-defined and credible fiscal consolidation strategies, there is the possibility of turmoil in global bond and currency markets. A more immediate risk is that an accident-prone political economy will lead to excessive fiscal tightening in the near term in the United States. In key emerging economies, risks relate to the possibility of a hard landing, especially in the context of uncertain (possibly slowing) potential output. In recent years, a number of major emerging economies experienced buoyant credit and asset price growth as well as rising financial vulnerabilities. This has buoyed demand and may have led to overestimation of the trend growth rates in these economies. Should the dynamics of real estate and credit markets unwind triggered by losses in confidence and a paring back of expectations at home or by falling demand from abroad—the impact on economic activity could be very damaging.

Moreover, concerns about geopolitical oil supply risks are increasing again. The oil market impact of intensified concerns about an Iran-related oil supply shock (or an actual disruption) would be large, given limited inventory and spare capacity buffers, as well as the still-tight physical market conditions expected throughout 2012."

The US Will Not Avoid The Drag

So, with the IMF stating what is really more than obvious, that the Eurozone faces tremendous headwinds into the future. the interesting part of the report is that the 1.8% growth rate in the U.S. was left unchanged while the rest of the world's growth was slashed.This will absolutely not happen.

Today the world is more globally interconnected than at any time in past history. The internet, Fed Ex, cellular and satellite technology, faster mobility and coordinated planning have brought the world economies into close proximity with each other. You don't have to look any further than the recent earthquake in Japan that impacted the U.S. economy within the span of just 3 months. With the economy of one country dependent on that of another for goods and services from which revenue is derived, taxes are paid and money is spent - there is little margin for error.

The real issue is that the a debt crisis is still trying to be solved with debt. As David Rosenberg pointed out in today's missive: "Debt is a two-edged sword. Used wisely and in moderation, it clearly improves welfare. But, when used imprudently and in excess, the result can be a disaster. For individual households and firms, over-borrowing leads to bankruptcy and financial ruin. For a country, too much debt impairs the government's ability to deliver essential services to its citizens. Debt turns cancerous when it reaches 80-100% of GDP for governments..."

Well, don't look now but the U.S. is currently well in excess of 100% of debt to GDP and climbing with the median for OECD countries combined debt ratios of 400%. This is the first time that aggregate debt/GDP has risen above 100% since WWII. With this in mind it is clearly only a function of time until the interdependency between the Eurozone and the U.S. plays catch up. Since it is highly unlikely that the Eurozone will do what is necessary to fix their problems the downside risk to their economy is more than prevalent.

While economic indications have been better as of late it is more a testament to the warmest winter in 5 years than it is to a real recovery in the U.S. economy. Back to Rosie: "Indeed, in the U.S., we have seen a flurry of data showing that housing activity is in full-fledged recovery mode and how employment is picking up steam. As an example, a critical inflection point so far this year was that nice round +200k reading on December nonfarm payrolls, which was released on January 6th. The S&P 500 is up 3% since the release of that number.

But keep in mind that these numbers are all seasonally adjusted. They are expecting December to be bitter cold and adjust for the usually depressed level of economic activity (outside of holiday shopping) that typically occurs late in the year. And the seasonal adjustment process tends to weight more heavily the experience, for any given month, to the prior three years' worth of data.

Keep in mind that for the U.S. as a whole:

- this was the warmest December in five years

- the average level of rain or snow this past December was the lowest since 2000

- The number of people who reported difficulty showing up for work due to inclement weather was the lowest since 2004."

So, while there are plenty of strong convictions that the economy is on the mend to a recovery here in the U.S., the potential risks to investors is quite high if those assumptions are wrong.