EU Commissioner Ollie Rehn started the countdown six days ago with his "ten days to save the Euro" statement.

Shortly thereafter Angela Merkel warned that this is a marathon.

Both are correct. This resembles a prime-time (market) soap opera with a continuing plot and a story and climax within each episode. The continuing theme is the threat of the collapse of specific European governments, the euro currency and the eurozone, and the failure of major European banks. This would start the dominoes falling as counter parties failed to honor obligations setting off the weapons of mass destruction -- the undocumented derivative exposure. Even those not directly affected would be caught up in the ensuing world-wide depression.

The episodic themes are the efforts of the participants to buy time by meeting the immediate crisis, while perhaps making small steps toward a more comprehensive solution. Each announcement from Europe involves a mini-plot. There are five steps:

1. Anticipation, where we are all expecting the worst;

2. Short-covering, when something is announced;

3. Evaluation, when critics point out that this is not a magic bullet;

4. Rejection, usually accompanied by that "kicking the can" phrase which Mrs. OldProf will not allow me to quote fully; and finally

5. Selling -- getting us ready for the next round.

Briefly put, the market seeks a comprehensive solution --- trillions of dollars of immediate relief, a guaranteed interest rate for all sovereign nations, unlimited bond buying by the ECB, or massive Chinese intervention. The market wants an answer, and it wants one right now!

The failure to act promptly means that it might already be too late....Stay tuned for next week.

The question is whether this will be an Aaron Sorkin "West Wing" style show....

Or Steven Bochco's great cop shows -- NYPD Blue and Hill Street Blues -- progress in a never-ending battle....

Or Aaron Spelling's famous cameo venues. Which is worse, Love Boat or Fantasy Island?

My Opinion

As regular readers know, by personal vote is for Sorkin. I do not expect a dramatic European solution --ever. I do expect gradual progress, which we are seeing on many fronts. When a reasonable solution has been achieved it will happen so gradually that it may not be recognized. The story will end and the series will fade away, leaving us to think about things like individual stocks and sectors and corporate earnings.

Since this is my weekly "opinion" piece, I am not going to try to prove it all right now. I will merely point out that this still looks like a messy, gradual compromise among leaders of democracies with differing policy preferences.

I'll have some investment thoughts on this in the conclusion.

A Note to Readers

When I take my occasional vacation, as I did last week, I always watch the market but I take a break from writing. I hoped to do the regular weekly WTWA column on my return, but a small illness intervened. I want to keep the investment update history intact, so I am providing that here in this abbreviated version.

The economic data presented a pretty good picture last week, and I'll go into this in more depth this weekend. Meanwhile, I have tried to provide a few thoughts every day on my investment diary, which I invite you to check out.

The Indicator Snapshot

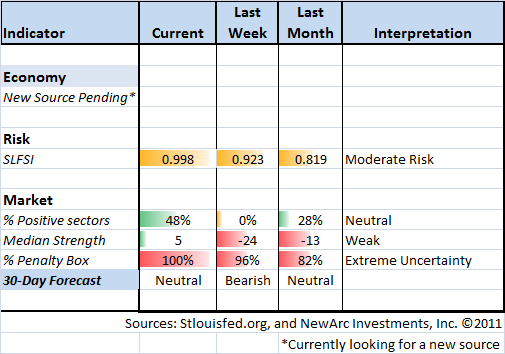

It is important to keep the weekly news in perspective. My weekly indicator snapshot includes important summary indicators:

An Economic/Recession Indicator. I am evaluating several candidates. None confirm the ECRI forecast of an inevitable and imminent recession. None of the leading candidates agree with the ECRI. These are sources that have a similar track record, greater transparency, but less PR. I realize that I am (long) overdue for making the choice for a new indicator, and it will be at least another ten days. It has been a careful research process, and I expect the explanation to require multiple articles. Meanwhile, if something really bad were taking place, I would make it clear in the weekly updates. I see the recession odds over the next nine months as being less than 25%.

The St. Louis Financial Stress Index.

The key measures from our "Felix" ETF model.

The SLFSI reports with a one-week lag. This means that the reported values do not include last week's market action. The SLFSI has moved a lot lower, and is now out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution. Before implementing this indicator our team did extensive research, discovering a "warning range" that deserves respect. We identified a reading of 1.1 or higher as a place to consider reducing positions.

Our "Felix" model is the basis for our "official" vote in the weekly Ticker Sense Blogger Sentiment Poll. We have a long public record for these positions. We voted "Bearish" this week.

[For more on the penalty box see this article. For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I'll do my best to answer.]

The Week Ahead

This week is all about Europe. We'll have more relevant data next week, after the big meeting.

Trading Time Frame

Our trading accounts have not had any US equity exposure for several weeks, and we are currently out of the market. While the ratings are turning positive, everything is in the penalty box. We are "abstaining" from the market but our official vote is neutral.

Investor Time Frame

Long-term investors should continue to watch the SLFSI. Even for those of us who see many attractive stocks, it is important to pay attention to risk. A month or so ago we reduced position sizes because of the elevated SLFSI. The index has now pulled back out of our "trigger range," but it is still high. For investors desiring this risk management approach we raised cash when the trigger hit the range. We have also been cautious with new accounts. We still do not have an "all clear" signal, but I expect this indicator to start moving lower.

Our Dynamic Asset Allocation model is also very conservative, with holdings in bonds and gold.

To summarize, we have a very conservative posture in most of our programs, recognizing the uncertainty and volatility.

A Final Thought

The last few weeks have been a very good time to buy stocks when volatility was extreme and also to sell calls to enhance yield.

I have been pretty accurate this year in my predictions about the economy, policy decisions, corporate earnings, and Europe. The stock market has generally rejected the progress in all of these fronts -- a denial of the data.

This is a strong indication of the general negative sentiment. It is confirmed by anecdotal evidence. Even though my investment positions have been very cautious and trading positions have been neutral to bearish, I have near unanimity in emails and commenters telling me that I am "too bullish." There are so many who do not see any hope for a European solution.

It makes me wonder if the series that most are choosing is "Lost."

Let me know your vote!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weighing the (rest of the) Week Ahead: The Eurozone Summit

Published 12/07/2011, 04:33 AM

Updated 07/09/2023, 06:31 AM

Weighing the (rest of the) Week Ahead: The Eurozone Summit

Is the climax coming?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.