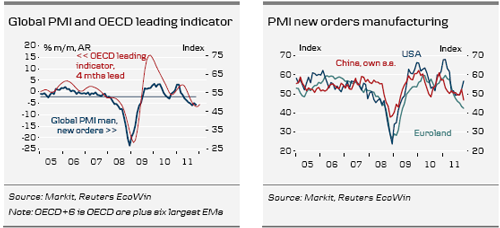

- Global leading indicators sent mixed signals in November, but were largely negative, as Asia joined Europe in posting deteriorating PMIs. On a more positive note, US figures were positive in both headline and forward-looking details. Global PMI fell back towards the September level, but we expect to see it increase again over the next few months, as Asia gets back on track, as particularly the effects of the flooding in Thailand wears off and price pressure from commodities continues to ease.

- We expect European PMIs to stay low for quite some time to come, continuing to signal recession. In the US, ISM is expected to move gradually higher into 2012 as growth recovers further in Q4 to 2.5-3.0%. Risks to global growth are still clearly on the downside as the European debt crisis remains far from resolved.

Global PMI

new orders fell to 48.6 in November from 49.5 in the previous month – returning to the September level. Thus, it still points towards sluggish growth in the global manufacturing sector over the months to come.

In the US, manufacturing ISM came out strong, increasing from 50.8 to 52.7. The details were solid as well, with a decent increase in the new orders component from 52.4 to 56.7. Likewise, the new order-inventory balance continued to show gains, improving growth prospects over the months to come.

In Euroland manufacturing PMIs show no signs of improvement, declining for the seventh month in a row. Service PMI increased moderately but remains well in contractionary territory. Scandinavian manufacturing PMIs signal contraction up ahead across the board, though we did see some minor improvements in Danish confidence indicators.

In Asia the overall picture has turned gloomier, as the flooding in Thailand hits the manufacturing sector. However, this effect will wear off and together with

expansionary Chinese monetary policy we expect to see improvements in the months to come. In CEE PMIs fell below 50 as eurozone demand continues to contract. Brazil PMI improved greatly, but remains at a low level.