Debt woes continue to hold the centre of the equity investment stage. Strategic focus is currently driven more by politics than by economic activity. U.S. politicians have once again refused to do the right thing at the right time. After months of negotiation the U.S. supercommittee failed to come up with a plan to restore health to a U.S. fiscal path in need of attention. The tug-of-war between U.S. politicians has left a sour taste in the mouths of investors, reducing their appetite for risk.

The regression of market sentiment is clear. The MSCI All Country index has lost most of the ground it gained in October. All regional MSCI indexes have moved lower in November. Latin and North American indexes have declined the least, while the EAFE and Europe All Country indexes have given back all of their October gains (table).

The inability of U.S. policymakers to remove political uncertainty at this critical stage of the cycle adds to the dark cloud of European debt problems.

Though the U.S. failure to agree will have only a marginal effect on federal spending in 2012, we await with interest the coming vote on whether to extend the payroll tax cuts that are set to expire at year end. Their expiry would increase taxes on earned income by 2 percentage points in 2012, crimping disposable personal income and therefore consumer spending. There exists a clear benefit for both parties to support the extension of payrolls tax cuts as they head into an election year.

European markets will stay volatile

The weakest link in the world economy is Europe, which looks headed for a mild recession. Euro-zone industrial production fell 2.7% in September and trade may have peaked. Volume imports fell 2.2% and exports fell 1.7% in September.

Since the economic outlook will remain challenging for some time, we expect continued volatility in European equities. It should be kept in mind that major austerity measures have been put in place with no visible growth strategy to counter the drag from belt-tightening. That makes top-line growth difficult or impossible for domestically oriented businesses and the region’s financial system, especially with its banks in need of improved capital ratios.

U.S. economy beating expectations

The lack of investor enthusiasm notwithstanding, economic indicators have given North American policymakers more breathing room. The latest ISM manufacturing survey showed new orders rising and customer inventories declining to levels normally seen as too low by survey respondents. Industrial production rose a robust 0.7% in October, outpacing initial expectations of 0.4%. Rail freight traffic, a good indicator of trends, improved robustly in October. Total carloads rose to a high for this cycle, a sign that the U.S. and Canadian economies are still growing.

Moreover, U.S. employment seems to be picking up. The four-week moving average of initial jobless claims has dropped below 400,000 for the first time since April (chart).

In sum, U.S. economic indicators support our 2012 growth outlook. Continued improvement would solidify market confidence, especially in North America,

despite the lack of progress in Washington.

U.S. earnings: another good quarter

With more than 99% of S&P 500 companies reporting, the Q3 earnings season is closing on a cheerful note. Index EPS is up 14.8% from a year earlier, a 4.5- point positive surprise. Sales were also impressive, a gain of 10.3% with a 1.2-point surprise. The cheer was broad-based – the ratio of positive to negative EPS surprises from companies in the index was 2.8. Q3 was a milestone in S&P 500 earnings: the fourquarter sum of index EPS reached an all-time high of 94.66. The previous peak of 91.47 was in Q2 2007.

Q3 earnings growth was due in large part to expansion of sales rather than of margins, a change from the margin-led growth of previous quarters. We expect margins to top out in the next couple of quarters and therefore expect sales growth to be the main driver of EPS in 2012.

… but 2012 will be more ordinary

We have been saying for some time that consensus expectations for 2012 earnings were too aggressive.

Analysts have been revising down their expectations for 2012 operating earnings. Since August 2011 the bottom-up consensus for 2012 EPS (four-quarter total) has declined 4.8%.

The consensus now puts 2012 earnings growth at 10.6%. We think that’s still too optimistic. We see 8%.

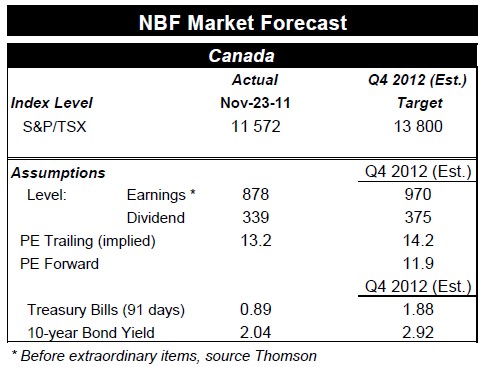

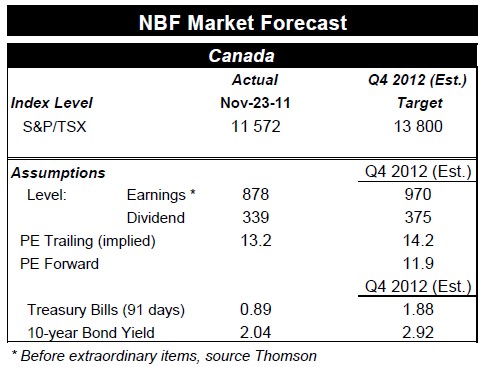

Canadian earnings: generally good

With more than 90% of companies in the S&P/TSX Composite reporting, the Canadian Q3 earnings season is almost over. Banks are the only major group yet to report; they are scheduled to do so in the first week of December. At this writing the overall results are good: EPS growth of 37.3% with a 7.8- point positive surprise. The sectors with the largest surprises are Financials, Health Care and Energy. Though the upside surprise was strong overall, fewer than half the index companies beat expectations. The top-line story is similar: sales growth of 17.8% with a 10.0-point surprise but only 48% of companies

contributing on the upside. Only among Financials did a majority of companies beat sales expectations. The lack of breadth suggests that expectations were generally too optimistic, an inference supported by relatively large revisions in EPS forecasts since early October. Over the period since then, the IBES EPS estimate has decreased 4.0% for calendar 2011 and 0.6% for 2012, implying EPS growth of 26.1% in 2011 and 14.3% in 2012. The 2011 estimate is now in line with our own. The 2012 estimate seems high to us. Our own call is 8%, reflecting a topping-out of profit margins and a softening of sales growth next year. We accordingly expect a further downward revision of 6 percentage points in the consensus.

Crude on a roll

The big news so far this quarter is the price strength of West Texas Intermediate (WTI) crude oil, which temporarily jumped back above $100 a barrel. At this writing WTI is up 29.8% from its October 4 bottom of $75.36, making it one of the top-performing commodities of Q4 so far. The surge has narrowed the large Brent-WTI spread, which reached $29 on September 21.

The WTI price run-up is due in part to a decline of crude inventories since the end of August. Stockpiles are back to the April level.

This price dynamic has implications for strategy, since the jump in WTI is accompanied a significant decrease of its refining margin.

The combined movements benefit the oil exploration and production industry at the expense of refiners, whose margins are squeezed. The integrated oil and

gas industry is less affected.

The price moves also benefit the Canadian Energy sector at the expense of its U.S. counterpart, since oil & gas exploration accounts for more than 13% of the S&P/TSX Composite but only 2.3% of the S&P 500. Integrated oil & gas, on the other hand, is the largest industry of the S&P 500, accounting for more than 7% of index capitalization (weight in the TSX: 6.6%).

However, we are not ready to overweight our Energy exposure. The sector is exposed to macroeconomic risks that are high at present. We expect oil to trade below $100 a barrel next year, as a result of (1) a weakening of demand if Europe’s recession is worse than expected and (2) added supply (normalization of the Brent price) as Libyan production rises.

Natural gas down

A particular challenge for the Energy sector is the downtrend of natural gas prices, which offsets the gain from rising oil prices. The Henry Hub price is currently the lowest since October 2010.

Sector rotation

Since the beginning of 2011 there has been a clear shift in investor comfort with risk. The best performers of the year to date are risk-off havens. The total return of the S&P/TSX Preferred Share index (+4.6%) has outdone the S&P/TSX Completion index (−9.4%), the S&P/TSX 60 (−10.8%) and the S&P/TSX Smallcaps index (−17.2%).

Small-cap stocks have been the worst-hit over the year to date. With volatility high and uncertainty paramount, we suggest that investors hold reduced positions in this group for now.

Among sectors, resources and Industrials led the market until early November, when non-defensive sectors began to lose ground against the market.

Sector advantage continues to swing widely from month to month. In response to this volatility we continue to promote sector neutrality. We suggest a tactical slight overweighting in Materials because of our bias toward gold. Supporting this bullishness are negative real interest rates in the developed world and strong demand for bullion from central banks, which bought 148.4 tonnes of it in Q3. The World Gold Council reports that central banks are on track to buy 450 tonnes in 2011, a record since at least 1970. Our least-favoured sectors are Information Technology and Consumer Discretionary stocks.

Asset allocation: staying neutral

Sovereign-debt uncertainty has resurfaced, with heavyweights Italy and Spain now the centre of market attention. With recession very likely in the euro zone and little strategy in place to boost its economy, we see no warrant for additional risk-taking at this point.

Meanwhile, Washington has given investors another signal that its political actors are not ready to compromise on policy. This hindrance to investor

sentiment could last until next year’s elections. There is always the possibility of new political developments as we approach 2013, the year in which a failure to reach agreement will trigger $800 billion in automatic spending cuts. Though our base case scenario is still one of continuing global growth, the risk of adversity is high. As a result this is no time for complacency and therefore we stand ready to review our asset allocation over the coming weeks if deemed necessary. For now we continue to suggest that clients stay neutral in equities, bonds and cash at this time.

The regression of market sentiment is clear. The MSCI All Country index has lost most of the ground it gained in October. All regional MSCI indexes have moved lower in November. Latin and North American indexes have declined the least, while the EAFE and Europe All Country indexes have given back all of their October gains (table).

The inability of U.S. policymakers to remove political uncertainty at this critical stage of the cycle adds to the dark cloud of European debt problems.

Though the U.S. failure to agree will have only a marginal effect on federal spending in 2012, we await with interest the coming vote on whether to extend the payroll tax cuts that are set to expire at year end. Their expiry would increase taxes on earned income by 2 percentage points in 2012, crimping disposable personal income and therefore consumer spending. There exists a clear benefit for both parties to support the extension of payrolls tax cuts as they head into an election year.

European markets will stay volatile

The weakest link in the world economy is Europe, which looks headed for a mild recession. Euro-zone industrial production fell 2.7% in September and trade may have peaked. Volume imports fell 2.2% and exports fell 1.7% in September.

Since the economic outlook will remain challenging for some time, we expect continued volatility in European equities. It should be kept in mind that major austerity measures have been put in place with no visible growth strategy to counter the drag from belt-tightening. That makes top-line growth difficult or impossible for domestically oriented businesses and the region’s financial system, especially with its banks in need of improved capital ratios.

U.S. economy beating expectations

The lack of investor enthusiasm notwithstanding, economic indicators have given North American policymakers more breathing room. The latest ISM manufacturing survey showed new orders rising and customer inventories declining to levels normally seen as too low by survey respondents. Industrial production rose a robust 0.7% in October, outpacing initial expectations of 0.4%. Rail freight traffic, a good indicator of trends, improved robustly in October. Total carloads rose to a high for this cycle, a sign that the U.S. and Canadian economies are still growing.

Moreover, U.S. employment seems to be picking up. The four-week moving average of initial jobless claims has dropped below 400,000 for the first time since April (chart).

In sum, U.S. economic indicators support our 2012 growth outlook. Continued improvement would solidify market confidence, especially in North America,

despite the lack of progress in Washington.

U.S. earnings: another good quarter

With more than 99% of S&P 500 companies reporting, the Q3 earnings season is closing on a cheerful note. Index EPS is up 14.8% from a year earlier, a 4.5- point positive surprise. Sales were also impressive, a gain of 10.3% with a 1.2-point surprise. The cheer was broad-based – the ratio of positive to negative EPS surprises from companies in the index was 2.8. Q3 was a milestone in S&P 500 earnings: the fourquarter sum of index EPS reached an all-time high of 94.66. The previous peak of 91.47 was in Q2 2007.

Q3 earnings growth was due in large part to expansion of sales rather than of margins, a change from the margin-led growth of previous quarters. We expect margins to top out in the next couple of quarters and therefore expect sales growth to be the main driver of EPS in 2012.

… but 2012 will be more ordinary

We have been saying for some time that consensus expectations for 2012 earnings were too aggressive.

Analysts have been revising down their expectations for 2012 operating earnings. Since August 2011 the bottom-up consensus for 2012 EPS (four-quarter total) has declined 4.8%.

The consensus now puts 2012 earnings growth at 10.6%. We think that’s still too optimistic. We see 8%.

Canadian earnings: generally good

With more than 90% of companies in the S&P/TSX Composite reporting, the Canadian Q3 earnings season is almost over. Banks are the only major group yet to report; they are scheduled to do so in the first week of December. At this writing the overall results are good: EPS growth of 37.3% with a 7.8- point positive surprise. The sectors with the largest surprises are Financials, Health Care and Energy. Though the upside surprise was strong overall, fewer than half the index companies beat expectations. The top-line story is similar: sales growth of 17.8% with a 10.0-point surprise but only 48% of companies

contributing on the upside. Only among Financials did a majority of companies beat sales expectations. The lack of breadth suggests that expectations were generally too optimistic, an inference supported by relatively large revisions in EPS forecasts since early October. Over the period since then, the IBES EPS estimate has decreased 4.0% for calendar 2011 and 0.6% for 2012, implying EPS growth of 26.1% in 2011 and 14.3% in 2012. The 2011 estimate is now in line with our own. The 2012 estimate seems high to us. Our own call is 8%, reflecting a topping-out of profit margins and a softening of sales growth next year. We accordingly expect a further downward revision of 6 percentage points in the consensus.

Crude on a roll

The big news so far this quarter is the price strength of West Texas Intermediate (WTI) crude oil, which temporarily jumped back above $100 a barrel. At this writing WTI is up 29.8% from its October 4 bottom of $75.36, making it one of the top-performing commodities of Q4 so far. The surge has narrowed the large Brent-WTI spread, which reached $29 on September 21.

The WTI price run-up is due in part to a decline of crude inventories since the end of August. Stockpiles are back to the April level.

This price dynamic has implications for strategy, since the jump in WTI is accompanied a significant decrease of its refining margin.

The combined movements benefit the oil exploration and production industry at the expense of refiners, whose margins are squeezed. The integrated oil and

gas industry is less affected.

The price moves also benefit the Canadian Energy sector at the expense of its U.S. counterpart, since oil & gas exploration accounts for more than 13% of the S&P/TSX Composite but only 2.3% of the S&P 500. Integrated oil & gas, on the other hand, is the largest industry of the S&P 500, accounting for more than 7% of index capitalization (weight in the TSX: 6.6%).

However, we are not ready to overweight our Energy exposure. The sector is exposed to macroeconomic risks that are high at present. We expect oil to trade below $100 a barrel next year, as a result of (1) a weakening of demand if Europe’s recession is worse than expected and (2) added supply (normalization of the Brent price) as Libyan production rises.

Natural gas down

A particular challenge for the Energy sector is the downtrend of natural gas prices, which offsets the gain from rising oil prices. The Henry Hub price is currently the lowest since October 2010.

Sector rotation

Since the beginning of 2011 there has been a clear shift in investor comfort with risk. The best performers of the year to date are risk-off havens. The total return of the S&P/TSX Preferred Share index (+4.6%) has outdone the S&P/TSX Completion index (−9.4%), the S&P/TSX 60 (−10.8%) and the S&P/TSX Smallcaps index (−17.2%).

Small-cap stocks have been the worst-hit over the year to date. With volatility high and uncertainty paramount, we suggest that investors hold reduced positions in this group for now.

Among sectors, resources and Industrials led the market until early November, when non-defensive sectors began to lose ground against the market.

Sector advantage continues to swing widely from month to month. In response to this volatility we continue to promote sector neutrality. We suggest a tactical slight overweighting in Materials because of our bias toward gold. Supporting this bullishness are negative real interest rates in the developed world and strong demand for bullion from central banks, which bought 148.4 tonnes of it in Q3. The World Gold Council reports that central banks are on track to buy 450 tonnes in 2011, a record since at least 1970. Our least-favoured sectors are Information Technology and Consumer Discretionary stocks.

Asset allocation: staying neutral

Sovereign-debt uncertainty has resurfaced, with heavyweights Italy and Spain now the centre of market attention. With recession very likely in the euro zone and little strategy in place to boost its economy, we see no warrant for additional risk-taking at this point.

Meanwhile, Washington has given investors another signal that its political actors are not ready to compromise on policy. This hindrance to investor

sentiment could last until next year’s elections. There is always the possibility of new political developments as we approach 2013, the year in which a failure to reach agreement will trigger $800 billion in automatic spending cuts. Though our base case scenario is still one of continuing global growth, the risk of adversity is high. As a result this is no time for complacency and therefore we stand ready to review our asset allocation over the coming weeks if deemed necessary. For now we continue to suggest that clients stay neutral in equities, bonds and cash at this time.