Daily Outlook: All eyes are on Greece and Italy as their new governments will attempt to lead their financially struggling countries out of the metaphorical toilet. One would have expected that such news would have rallied the Euro higher on open, especially since the new Prime Minister for Greece is the former VP of the ECB while his Italian counterpart is also of the economist ilk. The markets barely gapped up this morning and are already trading below their open price:

While those news events are likely driving the movements behind the currency pairs we will continue to trade the technicals, as we always do, to put the pips in our pockets. Remember: technicals and fundamentals are birds of the same feather. Technical traders don’t deny that fundamentals move markets. But we also acknowledge that the mass emotions of the markets, and the conglomeration of fundamental data shows itself on the charts. So for example trouble in Europe over a period of months will be viewed as a series of fundamental data to Fundamental traders but to Technical traders it will be viewed as a strong bearish downtrend. Both accomplish the same thing – technicals, in our opinion, merely provide us the exit/entry points we need. The other sad truth about fundamentals is that by the time that most news reaches the masses it has already been in the hands of large hedge funds for a hours or days – which in the era of high frequency trading is an eternity. Technicals allow smaller traders to shave the pips they need off the larger moves caused by the big banks, like feeder fish hanging around a shark.

Alright, our technical rant is over! On to the trading setups:

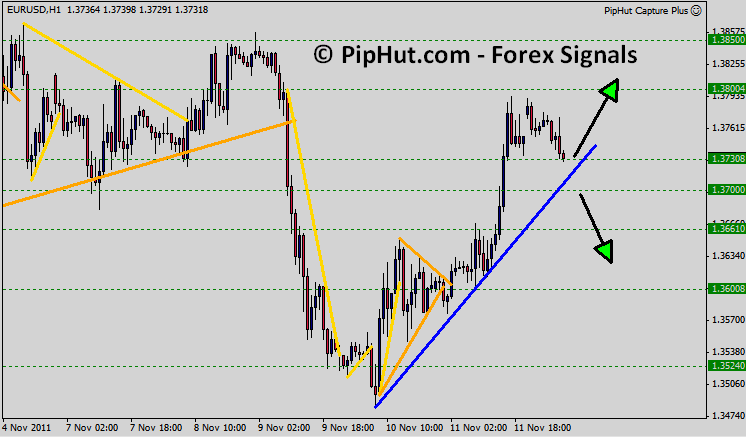

Trading Idea: We are tracking a rising blue trend support November 10th and November 11th lows shown on the chart above and will look to get long above it and short on breaks below. Primary trade is a long with candlestick confirmation on top of this support, currently at 3715 with targets at 3735, 3765, 3795 and 3825 for 110 pips profit. On a break below support, currently at 3700 and rising fast, we will short with targets at 3680, 3655, 3625 and 3600 for 100 pips potential.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Forex Signals – EUR/USD New Governments

Published 11/14/2011, 07:44 AM

Updated 07/09/2023, 06:31 AM

Forex Signals – EUR/USD New Governments

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.