NZD/USD extended the bullish momentum on Asian trading session lifted by positive inflation expectations at 1.9% compared with 1.7% on previous sessions. Kiwi found comfort last week with collapsing USD at 99.23 low and even though US index showed some minor recovery today clocking a high 100.23, NZD is ignoring USD and currently flying solo. NZD/USD awaits today GDT price index today at 1:30 PM GMT, but the main focus is shifted till tomorrow's RBNZ interest rates decision at 8 PM GMT, followed by a press conference on behalf of RBNZ at 9:00 PM GMT.

RBNZ current interest rates are 1.75% and forecasts are to leave it unchanged but due to 1.9% inflation expectations published today, the odds of a rate hike are increasing.

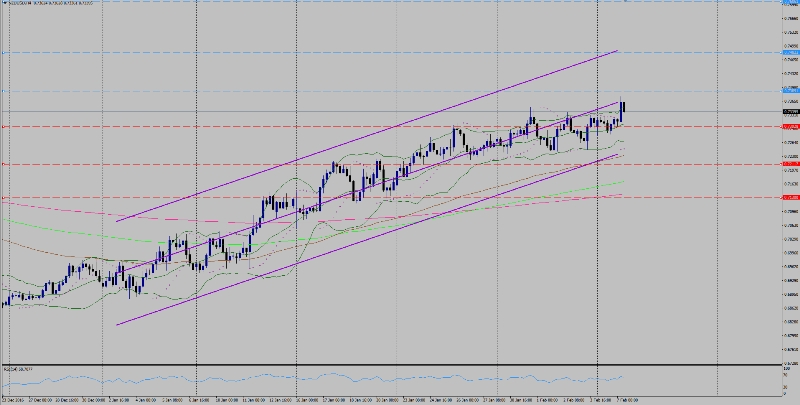

Trend: Bullish Sideways

Key levels to watch: Daily Pp 0.7311

Resistance Levels: R1 0.7389, R2 0.7482, R3 0.7606

Support levels: S1 0.7301, S2 0.7211, S3 0.7130

Remark: Look forward for today's GDT index which could shake the pair level but expectations of higher volatility will take place shortly before and after RBNZ interest rates decision. Also, Gov Wheeler speech on Thursday early sessions.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.