For the 24 hours to 23:00 GMT, the EUR rose 0.5% against the USD and closed at 1.0584, after better-than-expected economic data across the Euro-zone boosted investor sentiment.

In economic news, the Euro-zone’s unemployment rate remained unchanged at a seven-year low of 9.8% in November, meeting market expectations, thus suggesting that the region’s economy remained on a gradual growth-path. Moreover, the region’s Sentix investor confidence index surged to a level of 18.2 in January, notching its highest level since August 2015, amid increased optimism over the region’s economic outlook. The index recorded a reading of 10.0 in the previous month, while markets were expecting the index to rise to a level of 12.8.

Elsewhere, Germany’s seasonally adjusted trade surplus widened more-than-anticipated to €21.7 billion in November, from a revised trade surplus of €20.6 billion in the prior month. Additionally, the nation’s seasonally adjusted exports came in better-than-expected by 3.9% on a monthly basis in November, rising at the fastest pace since May 2012, thus reaffirming expectations for a strong economic recovery in the fourth quarter of 2016. Markets expected exports to advance 0.5%, following a gain of 0.5% in the previous month. Also, seasonally adjusted imports climbed more-than-estimated by 3.5% MoM in November, compared to a revised rise of 1.2% in the prior month. Meanwhile, the nation’s seasonally adjusted industrial production advanced 0.4% on a monthly basis in November, advancing for the second consecutive month and undershooting market expectations for an increase of 0.6%. In the previous month, industrial production had registered a revised rise of 0.5%.

In the US, data revealed that the labour market conditions index fell to a level of -0.3 in December, down from a level of 1.5 in the previous month. Moreover, the nation’s consumer credit rose $24.5 billion in November, surpassing market anticipation for an advance of $18.4 billion and compared to a revised rise of $16.2 billion in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0614, with the EUR trading 0.28% higher against the USD from yesterday’s close.

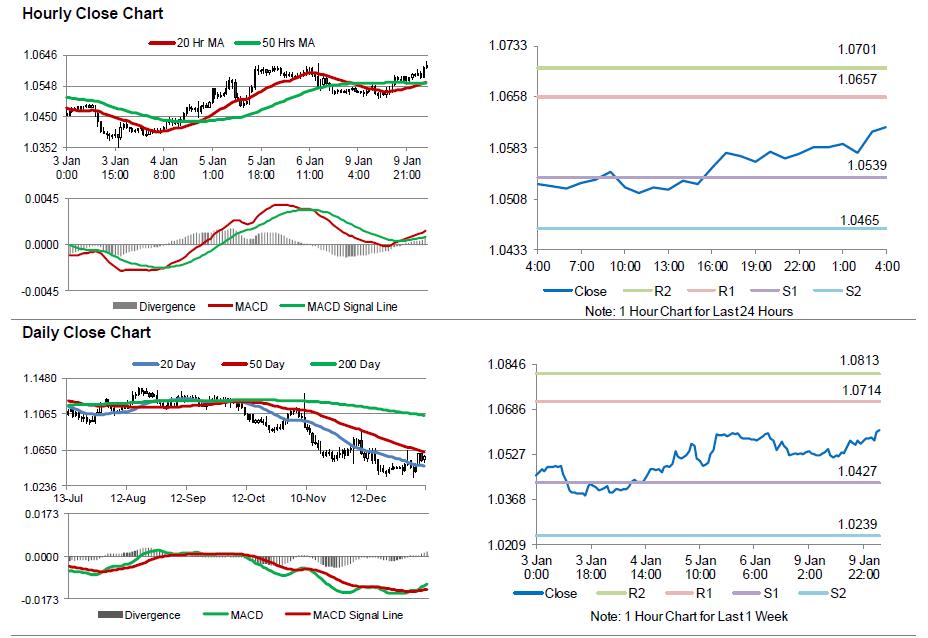

The pair is expected to find support at 1.0539, and a fall through could take it to the next support level of 1.0465. The pair is expected to find its first resistance at 1.0657, and a rise through could take it to the next resistance level of 1.0701.

With no major economic releases in the Euro-zone today, investors will shift their focus to the US NFIB small business optimism index for December, IBD/TIPP economic optimism index for January and JOLTs job openings for November, all scheduled to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.