Long-Term Target

It's absolutely amazing to see how Intel (NASDAQ:INTC) has been cultivating the base for the last 15-years, since the crash in 2000.

It was a tough bet for investors who bought after the crash in 2000, as they are now finally reaping harvest after 16-years of waiting.

But, if you've been long in this stock recently (for long-term traders and investors), it's probably the best time to get in for the all-time-high target around 70s within 5-years.

Looking at the chart pattern, we can see that the downtrend (dotted red) resistance has been nullified, and now the uptrend (blue line) has been developing since 2010, while faithfully establishing higher lows and higher highs.

Recently, (2016) we have formed a more intermediate-term uptrend and it looks to move much higher with intermediate term target of 42-43.

Our Holdings

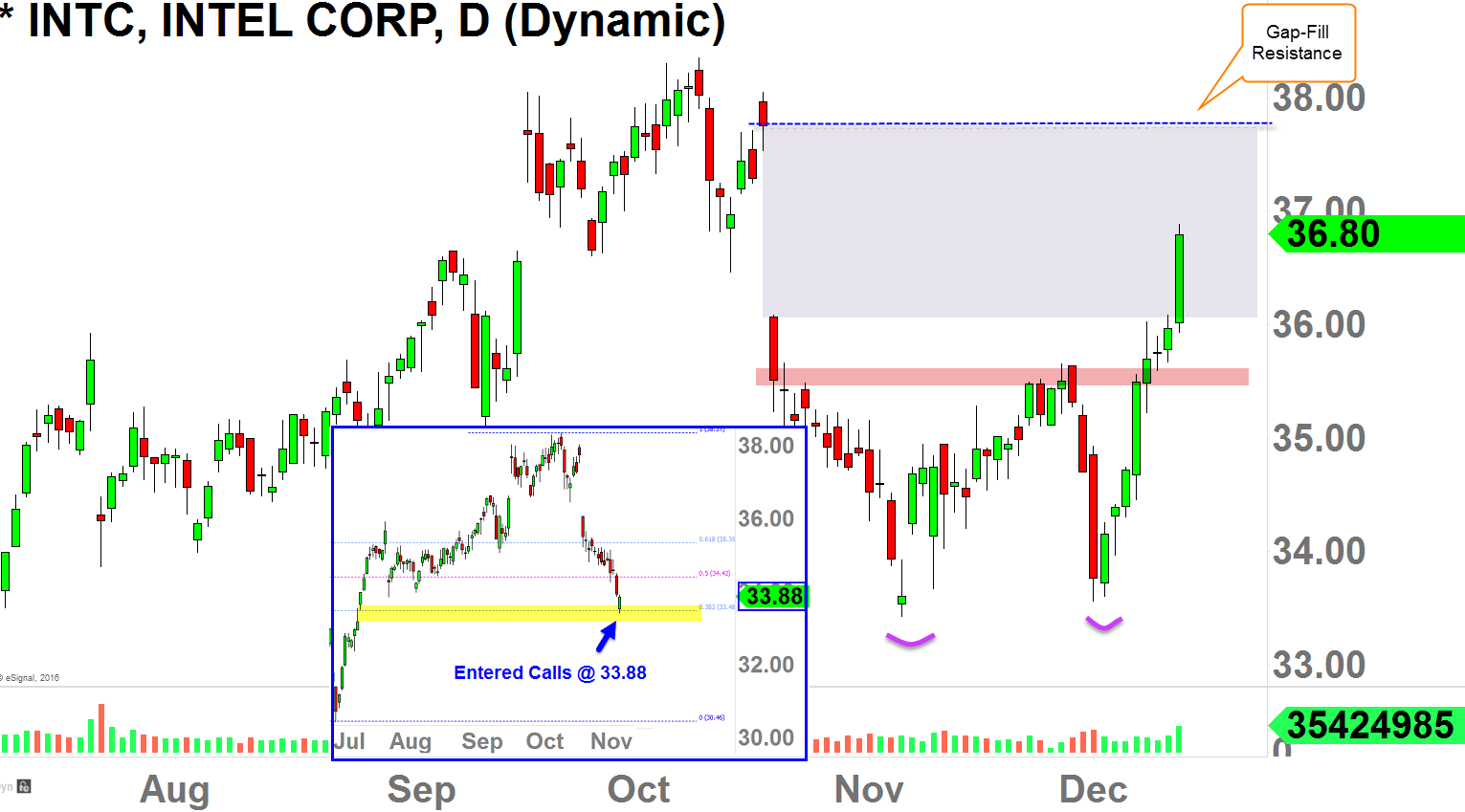

I traded my analysis, so I got long with calls (LEAPS) at 33.88, back on November 4th of this year.

This was the last level of my Fib. retracement zone, which, I came to the conclusion that the level might be acting as strong support.

Well, it did, by forming double-bottom reversal, as you can see in the chart above.

I had to be patient for about a month, but it's playing out nicely as the stock is now trading at 36.80 as of today.

My next minor term target is at 38-ish "gap-fill resistance" which I may unload some positions there.

I will write follow-up articles on INTC as we continue to be on watch for ATH target at 70ish.