On September 30, I posted charts for Real Gross Domestic Income and Real Gross Private Domestic Investment.

Both indicators provide hints of recession possibility, but both are also prone to lots of false signals. Let’s recap the charts, then combine them to make a less noisy indicator.

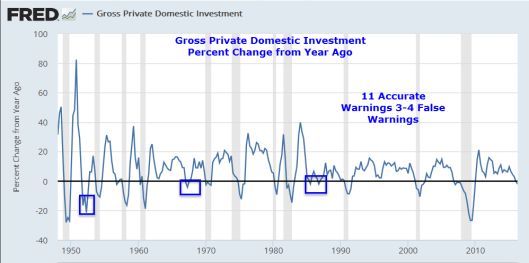

Real Private Gross Domestic Investment

Real private investment (not to be confused with income) is a measure of investment in the real economy, not under the influence of massive amounts of government spending.

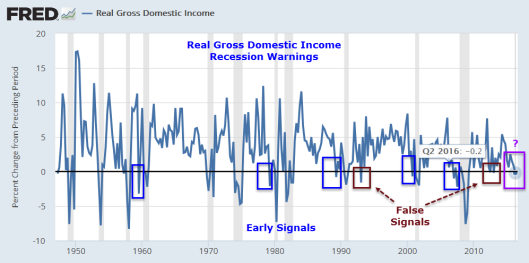

Real Gross Domestic Income

GDI is the sum of all income earned while producing goods and services within a nation’s borders. It differs from gross domestic product (GDP), which gauges economic activity based on expenditure.

The preceding two charts from Real GDI Provides Strong Recession Warning.

Investopedia provides this Explanation of GDI.

GDI is calculated as the total income payable in GDP income accounts. It can be calculated in two ways:

1. GDI = compensation of employees + gross operating surplus + gross mixed income + taxes – subsidies on production and imports

Compensation of employees encompasses the total compensation to employees for services rendered. Gross operating surplus, also known as profits, refers to the surpluses of incorporated businesses. Gross mixed income is the same as gross operating surplus, but for unincorporated businesses.

2. GDI = rental income + interest income + profits + wages + statistical adjustments

Statistical adjustments may include corporate income tax, dividends and undistributed profits.

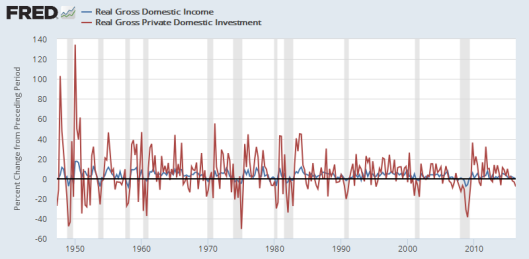

Combining GDI and GPDI

Real GDI and Real GPDI are frequently not in sync. When one is negative, quite often the other one isn’t.

Unless both are negative, the economy is typically not in recession. This provides a nice check that I had not noticed before.

All charts below show Real GDI and Real GPDI, on a percent change from previous quarter basis.

1947-2016

The above chart is very difficult to read due to overlaps and scale differences between the two series. Let’s hone in with a set of 10-year charts, overlapped by a year for ease in progressing from one chart to the next.

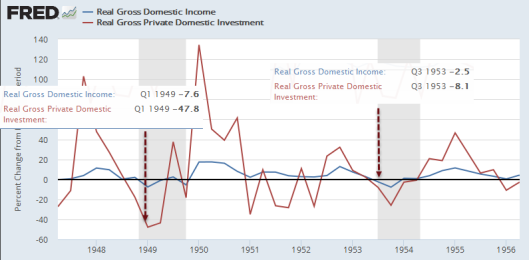

1947-1956

In the period 1947-1956 there two periods in which both indicators were negative, and both times the economy was in recession.

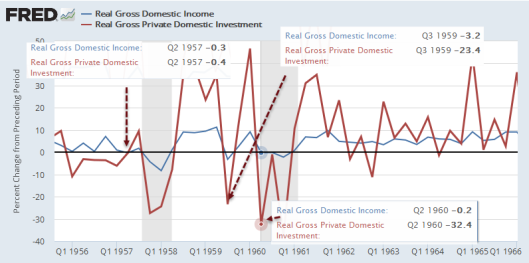

1956-1966

In the period 1956-1966, both recessions hit within a couple of quarters of the indicators going negative.

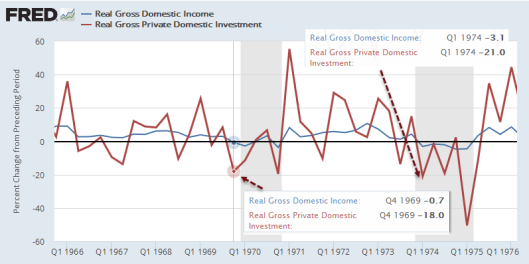

1966-1976

In the period 1966-76, there were two recessions. On one occasion the economy was already in recession when both indicators went negative. On the other occasion a recession soon followed.

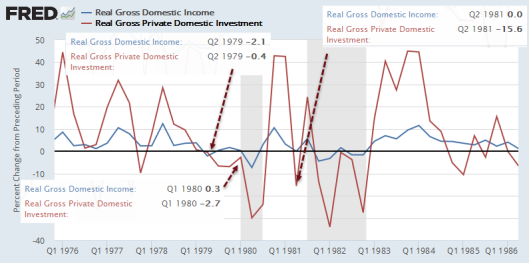

1976-1986

In the period 1976-1986, there were two recessions. The first happened within 9 months of both indicators going negative or zero. The second happened within 1 quarter, albeit with one of the indicators strongly positive.

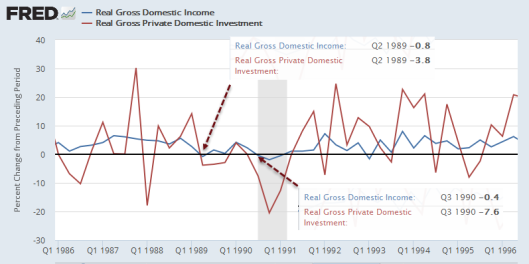

1986-1996

The period 1986-1996 had one recession. It happened the second time both indicators went negative. The first occasion was a false alarm.

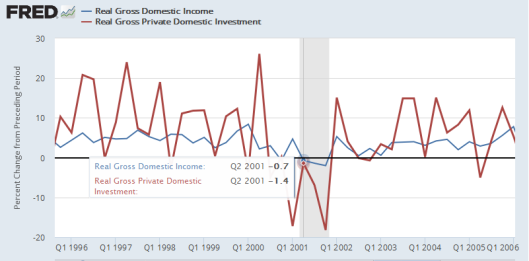

1996-2006

The period 1996-2006 had one recession. It had already started when both indicators went negative.

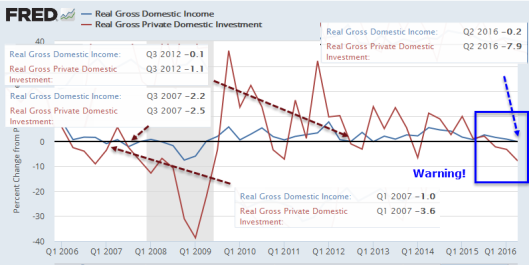

2006-2016

The period 2006-2016 had one recession. It was preceded by a couple of signals. By a tiny margin, there was a second signal in the third quarter of 2012. A recession did not occur.

There is a new signal right now.

Theory

- Real gross private investment normally accounts for only 13-16% or so of GDP. Private investment is a very volatile, but important portion of GDP. In contrast, government spending including transfer payments is typically steady.

- If businesses investment is expanding, that’s a sign of confidence in the economy and portends future hiring.

- Rising real incomes means consumers have increasing purchasing power. When consumers have more money, they are highly likely to spend.

- The combination of falling real incomes with falling business investment says businesses aren’t spending, and consumers cannot spend more without going deeper in debt.

Observations

This indicator sometimes seems to lead and sometimes seem to lag. The lags are easy to understand. Data only comes out quarterly.

The combination does provide a nice spot check. If either real GDI or GPDI is positive, the economy is not likely to be in recession.