ExxonMobil Corporation’s (NYSE:XOM) Papua New Guinea liquefied natural gas (LNG) project or PNG LNG project is looking for multi-year contracts for sales of spot cargoes to utilize surplus production, per co-owner Oil Search.

The aforesaid decision of the LNG industry is a highly unusual one as it is usually dominated by long-term contracts. Also, the move reflects robust output at the LNG project – 12% above nameplate capacity at 7.7 million tonnes per annum (mtpa) two years after coming online.

In the first half of 2016, the project sold eight spot cargoes. This was over and above the 6.6 mtpa locked in long-term contracts to customers in Japan, China and Taiwan.

The project is currently undergoing recertification of the proven reserves in its foundation gas fields. This, Oil Search believes, will create a bigger reserve base to support multi-year contracts for spot cargoes in the future.

Per the project partners, these contracts would cover a significant part of spot volumes and the “strips” could extend to as long as five to seven years. ExxonMobil is responsible for marketing of PNG LNG.

In the first half of 2016, eight spot cargoes were sold, of which six went to Japanese customers. The Japanese customers like PNG LNG for its high heating value or high energy content. Other buyers too have started picking up spot cargoes.

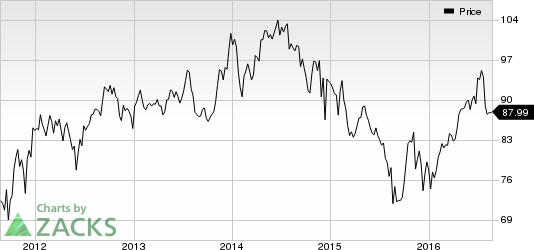

ExxonMobil carries a Zacks Rank #3 (Hold). Some better-ranked players from the energy sector are Devon Energy Corporation (NYSE:DVN) , NGL Energy Partners LP (NYSE:NGL) and Enbridge Energy Partners L.P. (NYSE:EEP) . All these stocks sport a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

ENBRIDGE EGY PT (EEP): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

DEVON ENERGY (DVN): Free Stock Analysis Report

NGL ENERGY PART (NGL): Free Stock Analysis Report

Original post