In an interview with the Washington Post overnight, San Francisco Fed President John Williams gave his point of view on why the Fed should raise interest rates in 2016.

So, just cutting to the chase here, does that gradual path of rate increases include any this year, in your view?

“In my view, it does.”

Now while Williams is actually a non-voter on this years Fed policy setting panel, Yellen was his boss at the San Francisco Fed before she moved into the top job back in 2010. This means that their views are likely to come from a similar line of thought, so are watched more carefully than any other non-voter.

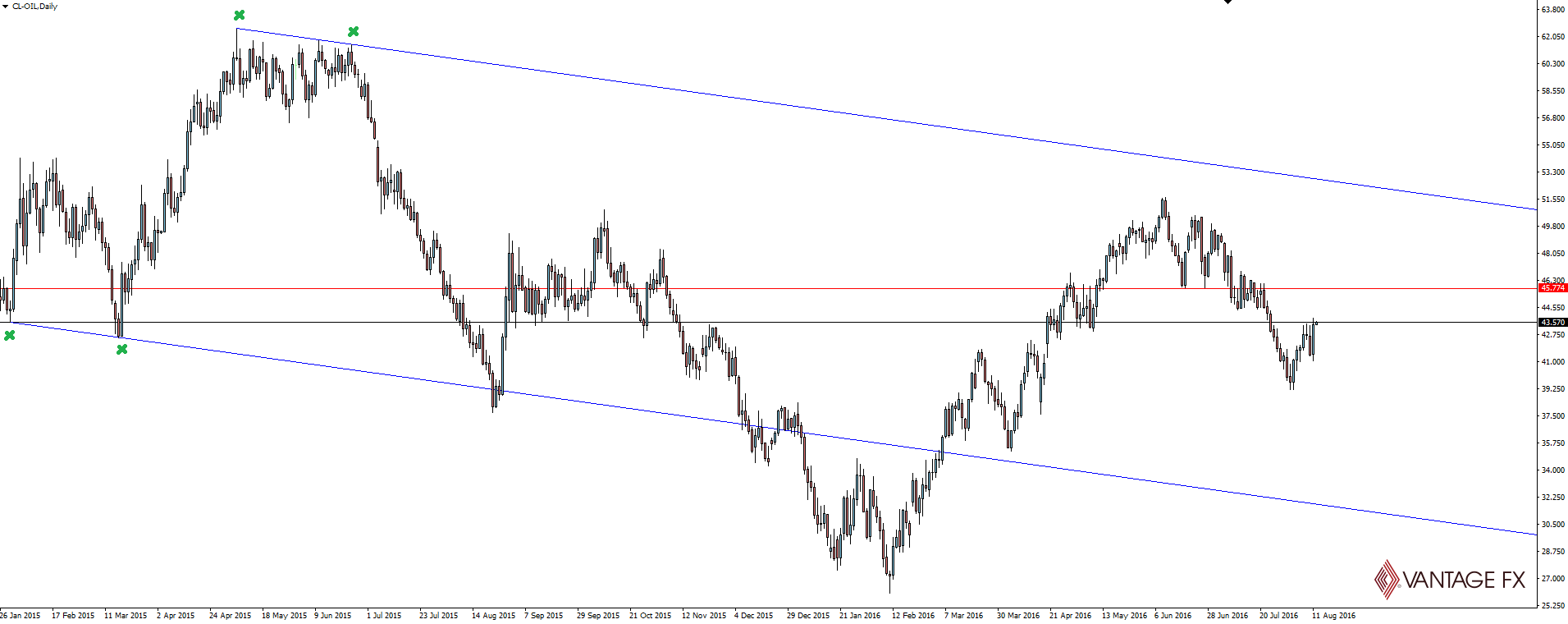

USDX Daily:

But the US dollar has heard these sorts of remarks before and didn’t really react to the headline.

No real trading opportunity developing from this one, but worth noting how certain factions within the Fed are thinking nonetheless.

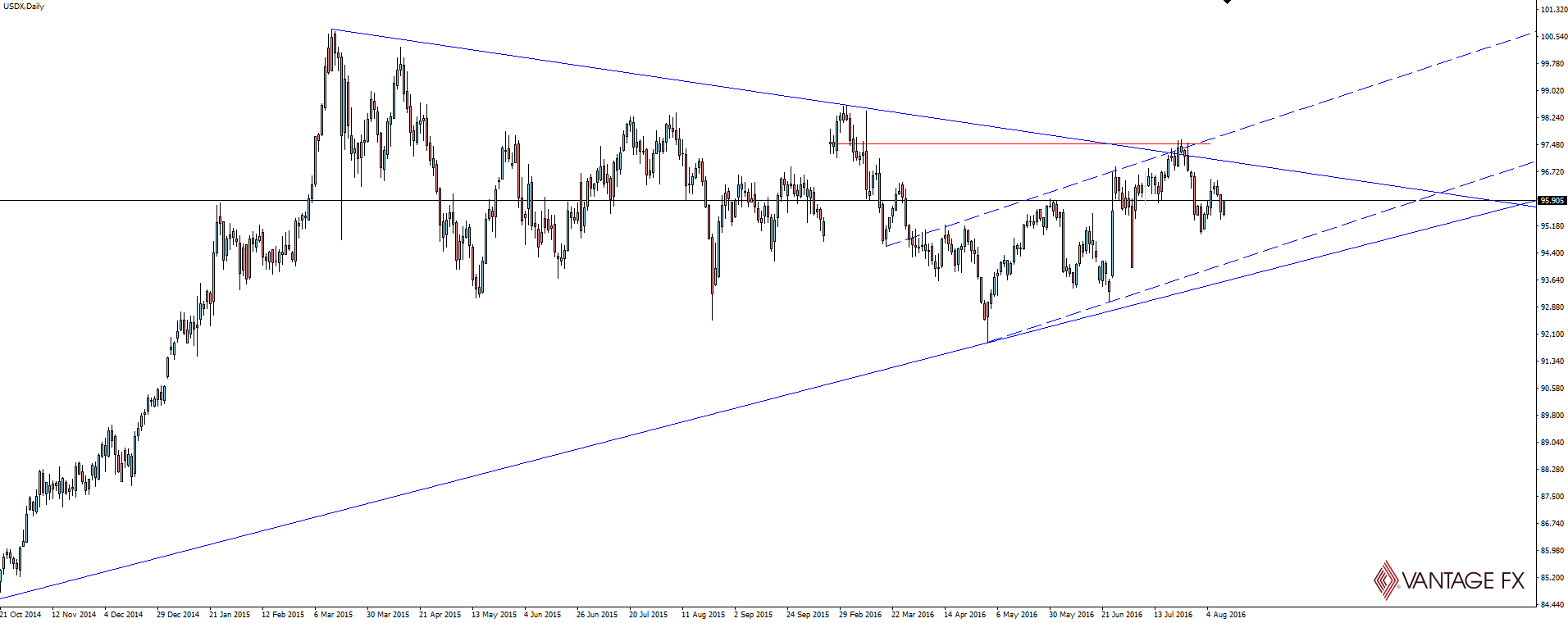

On the other hand, one headline that has moved markets was in oil. The Saudi Arabian Oil Minister said that OPEC members MAY discuss action that may be required to stabilise the price of oil during INFORMAL meetings set down for September.

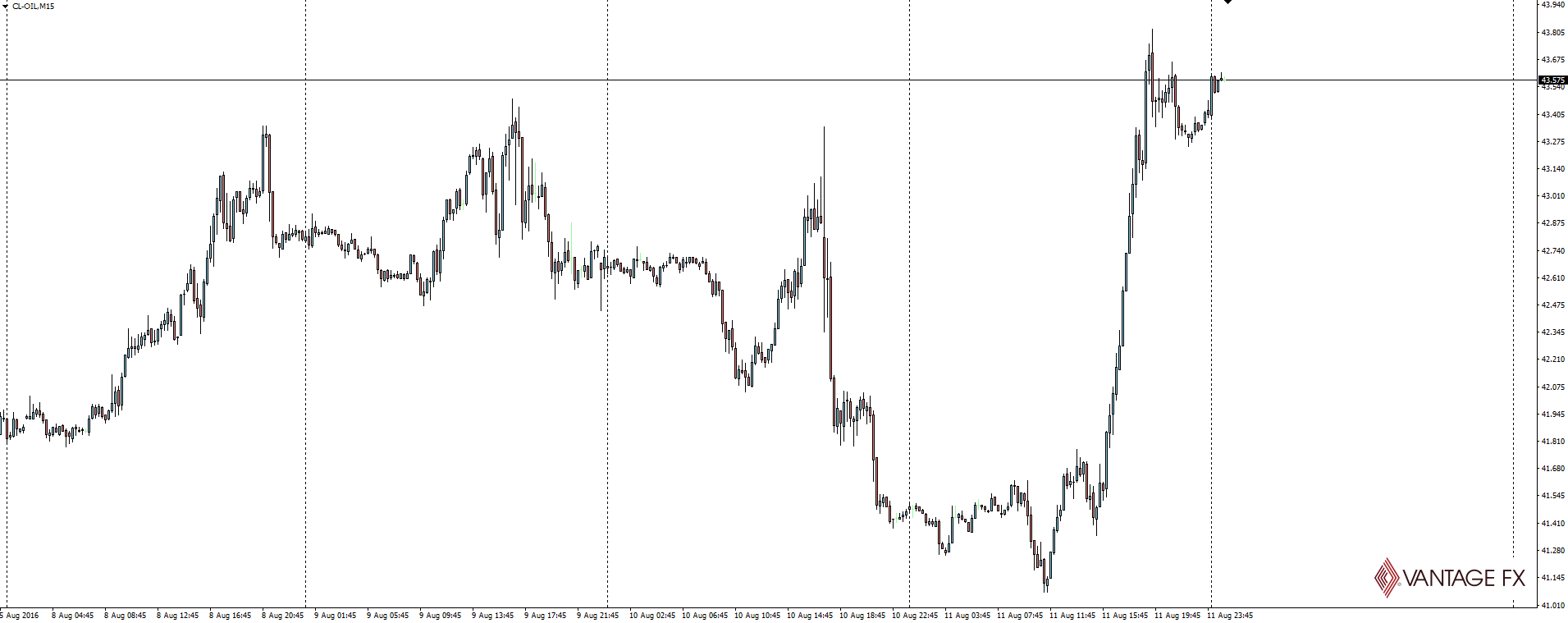

Oil 15 Minute:

Ping! …and oil goes vertical on the day.

I’ll leave it up to you to determine in which direction the biggest chance of disappointing the market lies. The Saudi’s certainly do have a certain history after-all.

The bearish channel here on the daily chart is a little bit subjective due to price breaking out of the bottom, but the marked starting points of the channel are too clean to not take notice.

There’s a bit of market sensitive news on the economic calendar tonight, so make sure you have your News Terminal on the screen next to your charts and protect your account heading into the weekend.

On the Calendar Friday

NZD: Retail Sales q/q

CNY: Industrial Production y/y

USD: Core Retail Sales m/m

USD: PPI m/m

USD: Retail Sales m/m

USD: Prelim UoM Consumer Sentiment

Dane Williams – @VantageFX

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.